imaginima/E+ by way of Getty Pictures

Gogo (NASDAQ:GOGO) shares have been hit arduous, falling 37% over the previous 12 months. The share value decline displays quite a few investor considerations, together with: flat income in 2023, additional delay in plans to deploy 5G connectivity, competitors considerations from Starlink, and a patent lawsuit introduced towards Gogo by SmartSky.

Whereas these considerations mood my enthusiasm, I’ve made a small allocation to Gogo shares as I imagine the market is overlooking its many constructive traits. These embrace: dominant market place, excessive switching prices, potential for fast income and free money stream progress on the again of a 5G improve cycle and elevated WiFi penetration on personal jets. Additional, whereas Gogo shares do not appear low-cost on present numbers, if the corporate is ready to execute its 5G rollout and stave off competitors, Gogo might generate $2/share in FCF looking to 2027 which suggests shares might triple.

Cons/Dangers

-

A number of delays in rolling out 5G service. A 5G rollout is necessary for Gogo as it will assist to stave off competitors from Starlink (mentioned under) and shall be an necessary driver of ARPU will increase going ahead. Initially Gogo anticipated to launch its 5G service in 2H22. This was pushed again to 2023 however after additional delays, Gogo is now guiding to 2H24. Timing has been pushed again as Gogo has encountered problem as a consequence of a design error in chips wanted to offer 5G service. There isn’t a assure that this situation shall be resolved in a well timed trend and it’s honest to imagine we might see additional delays.

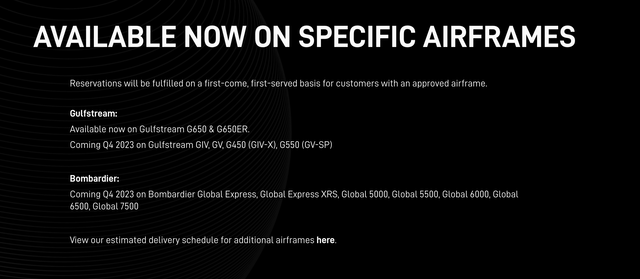

- Starlink has entered the enterprise by way of LEO (low earth orbit) satellites. Up till now, the one competitors to Gogo has come from GEO satellites (slower, rather more costly, solely appropriate for giant jets). Starlink’s low earth orbit satellites have the potential to be a extra formidable competitor providing decrease latency/sooner obtain speeds and probably a extra aggressive value (although nonetheless anticipated to be at a 100-200% premium to the month-to-month value of Gogo’s 5G service). The opposite benefit of Starlink’s LEO mannequin is that it might probably present WiFi service at very low altitudes/for the complete flight length (whereas Gogo’s resolution sometimes requires the aircraft to have reached 3,000+ toes). As proven under, Starlink is now out there for the most important personal jets:

Starlink for Personal Jets (Starlink web site )

Be aware that whereas Gogo has ~85% market share for the US personal jet market total, it has a decrease share amongst giant, long-range personal jets which usually use a tail-mounted GEO satellite tv for pc. Like GEO satellites, Starlink will present world protection. Flexjet, a supplier of fractional jet possession, introduced that it is going to be putting in Starlink on its Gulfstream G650s and expects to put in the service on extra giant jet airframes because the tools receives certification from the FAA.

Whereas it appears probably that Starlink will penetrate the highest finish of the market , at this stage Starlink doesn’t have an answer for smaller jets (as we sit in the present day Starlink’s product can solely serve giant jets that are lower than 20% of the overall market). Gogo’s resolution would not require a tail-mounted resolution (heavy) and as an alternative is positioned on the underbelly of the jet. To be aggressive within the smaller jet phase, Starlink must develop (and installers might want to get certification- described under in ‘Execs’ part) for antennae which match these jets. It’s anticipated that this course of will take a minimal of 18 months which buys Gogo time for its 5G rollout.

- Gogo is being sued by nascent operator SmartSky for patent infringement. SmartSky, which was shaped in 2014, has been attempting to launch a community for the previous decade however has not gained any significant traction within the market. Whereas Gogo has not but rolled out its 5G community, SmartSky has sued the corporate on the expectation that Gogo’s 5G community will infringe on SmartSky’s patents. For its half Gogo has stated that it doesn’t imagine its 5G product will infringe on any legitimate SmartSky patent. In 2023, SmartSky misplaced its movement for a preliminary injunction towards Gogo. The trial is prone to start in 2025. Whereas additional dialogue is past the scope of this piece, readers can discover a extra in-depth dialogue of the potential deserves of SmartSky’s claims right here. In the end if Gogo is discovered to be in violation of SmartSky’s patents, I count on we’ll see some form of royalty paid to SmartSky (these preparations sometimes name for a pair p.c of income).

What I like about Gogo

- Dominant market place with an estimated 85% share of the North American personal jet fleet.

- There must be robust underlying progress out there for connectivity providers for personal jets. Presently lower than 35% of personal jets have in-flight communications out there. It is a operate of jet age (common jet is over 20 years outdated and got here into service earlier than this product was actually out there). Nearly all of new personal jets delivered into service come geared up with Gogo service.

- Excessive switching prices – it prices a complete of roughly $300,000 to put in (30-40% tools w/ the rest being labor/set up value) an antennae and energy system to facilitate in-flight communications. As well as, set up requires 2 weeks to 1 month of downtime whereby the aircraft is out of service. Virtually talking this has meant that jets are solely fitted for in-flight communication when they’re already ‘within the store’ (sometimes for his or her 5-6 12 months upkeep/certification). IF Gogo can get its 5G service up and working forward of Starlink growing the breadth of planes it serves, excessive switching prices imply that Gogo ought to have each alternative to retain its prospects.

- Regulatory boundaries come up from the requirement that the set up for every jet mannequin have an STC (supplemental sort certificates issued by the FAA) which takes about 6-12 months. STC’s are sometimes obtained by installers. Gogo has a relationship with 120 installers all through the US who’ve been putting in & making the most of the corporate for a few years. Starlink must construct these relationships with a purpose to transfer into the market.

- 5G improve cycle will drive significant will increase in ARPU. 5G is predicted to cost at a 20% premium to Gogo’s present 4G providing whereas nonetheless being ~50% inexpensive than Starlink’s product.

- Gogo has partnered with OneWeb to offer a LEO competitor to Starlink which can open up markets past North America.

- Gogo is very worthwhile (~35% working margins), requires restricted capital expenditures and generates ample free money stream.

- Gogo administration expects the corporate to develop its high line at a 17% CAGR for the subsequent a number of years pushed primarily by elevated penetration of in-flight communications on personal jets in addition to larger ARPU from 5G. Whereas there shall be some incremental spend in 2024 related to the 5G rollout, capital expenditures ought to stay under $20 million yearly past 2025. Ought to Gogo obtain its income targets, the corporate might generate in extra of $800 million in 2027 income and practically $2 per share in free money stream per share. Had been Gogo to realize its targets and commerce for 15x 2027 Free money stream, shares might triple. 15x is just not a demanding a number of for an organization with a dominant market place and a recurring income enterprise mannequin.

Conclusion

If Gogo efficiently rolls out its 5G product within the subsequent 12 months, I count on the inventory to soar. In fact, I’ll look again and say ‘I ought to have had a a lot larger place on this inventory’ as I imagine that profitable supply of this community will competitively insulate Gogo from the Starlink risk and place the corporate for income and free money stream progress for years to come back.

Alternatively, Gogo is ~2 years delayed right here and it appears removed from sure that 5G is delivered in 2H24. Failure to carry 5G to market in a well timed trend places Gogo susceptible to shedding out to Starlink (assuming that Starlink is and in a position to configure a product to satisfy the 85% of the market which can’t be served by its tail-mounted resolution).

Given this uncertainty I’ve made a small allocation to Gogo shares and proceed to observe the state of affairs.