Japanese shares had been again within the highlight from high Wall Road corporations, because the benchmark Nikkei 225 crossed the 35,00Zero mark for the primary time in practically 34 years.

The Nikkei 225 ended up 1.8% to 35,049.86, in one more sturdy displaying for the Japanese index. The index has gained 5% this 12 months, versus the nearly flat efficiency for the S&P 500. Over the past 52 weeks, the Nikkei has stormed 33% greater, stunning most everybody besides Warren Buffett, who began making his massive push in Japan in 2020.

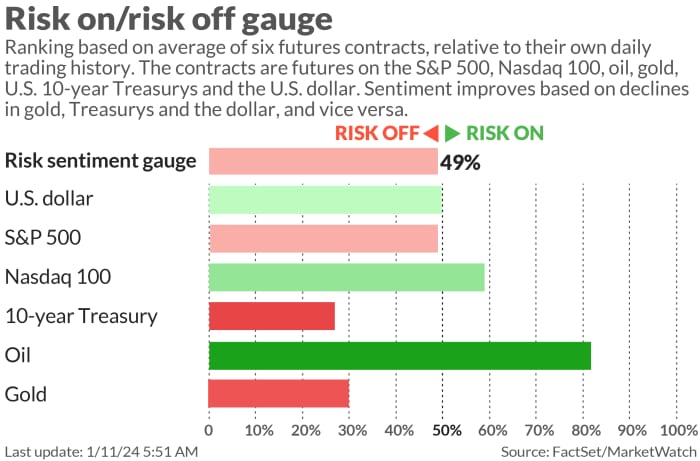

“This owed primarily to the weak yen and a tailwind from risk-on sentiment in world inventory markets after the Fed paused rate of interest hikes,” say strategists at JPMorgan led by Rie Nishihara.

Nishihara factors out that firms are beginning to announce bigger wage will increase than final 12 months, however that the nation has but to flee deflation. However the important thing query is whether or not these wage will increase then present up in promoting costs.

Financial institution of America strategists led by Masashi Akutsu additionally level to development in actual wages as a catalyst in the course of the first half of the 12 months. “Rising actual wages are resulting in a restoration in shopper sentiment, making it simpler for firms to boost their costs and contributing to enhancing margins and ROE,” stated Akutsu.

Each pointed to a Nikkei survey suggesting 5% wage development this 12 months, above the three% rise final 12 months.

JPMorgan’s Nishihara additionally stated firms are turn into extra acutely aware of the price of capital and share costs, together with by managed buyouts and mergers and acquisitions. She additionally flagged a brand new authorities tax-free inventory funding system that fosters expectations for an influx of funds from particular person traders.

The Financial institution of America strategists say Japanese shares will rise within the first half, then transfer sideways from July to September amid a attainable dissolving of the Food plan, after which rise once more after the U.S. presidential election in November.

They are saying it is sensible to carry worth shares with excessive dividend yields, together with Mitsubishi JP:8058, Mitsui JP:8031, Marubeni JP:8002 and Sumitomo JP:8053 — all holdings of Buffett’s Berkshire Hathaway.

The markets

Tech futures NQ00 are main some modest positive aspects on the fairness entrance ES00, with Treasury yields headed decrease. Crude oil CL is up 1.5% and gold GC00 continues its ascent.

| Key asset efficiency | Final | 5d | 1m | YTD | 1y |

| S&P 500 | 4,783.45 | 1.67% | 1.62% | 0.29% | 20.50% |

| Nasdaq Composite | 14,969.65 | 2.59% | 1.60% | -0.28% | 36.94% |

| 10 12 months Treasury | 3.991 | -0.75 | 6.96 | 11.04 | 54.49 |

| Gold | 2,037.60 | -0.65% | -0.67% | -1.65% | 7.23% |

| Oil | 71.74 | -0.91% | 0.13% | 0.57% | -8.33% |

| Knowledge: MarketWatch. Treasury yields change expressed in foundation factors | |||||

The thrill

Shopper value inflation is due at 8:30 a.m. Forecasters count on December headline inflation to rise to 0.2% from 0.1% and to three.2% from 3.1% yearly. Core CPI, minus meals and power, is seen dipping to three.8% from 4% yearly. Weekly jobless claims are due on the identical time.

Cleveland Fed President Loretta Mester will seem on TV at 11:30 a.m. and Richmond Fed President Tom Barkin will communicate at 12:40 p.m.

Observe together with our Stay Weblog protection

Eleven bitcoin exchange-traded funds, together with Grayscale Bitcoin Belief , Blackrock’s iShares Bitcoin Belief and ARK 21Shares Bitcoin ETF will being buying and selling on Thursday after a Securities and Trade Fee inexperienced gentle and a chaotic 24 hours for the company.

Chesapeake Power CHK is shopping for Southwestern Power SWN, at a slight low cost to Wednesday’s shut, because the deal talks had been beforehand reported.

Extra tech job cuts — on the heels of Amazon.com AMZN, Alphabet’s Google GOOGL reportedly plans to axe tons of of employees.

Citigroup C has put aside $1.Three billion to cowl dangers associated to turmoil in Argentina and Russia.

An oil tanker within the Gulf of Oman was boarded early Thursday by “unauthorized males” carrying army uniforms.

Better of the net

Does Apple, Verizon or ‘Fortnite’ owe you cash? Right here’s methods to verify.

Quick-fashion retailer Boohoo put ‘Made in U.Ok’ label on abroad clothes

Rising carbon dioxide within the air? It have to be a China restoration

The chart

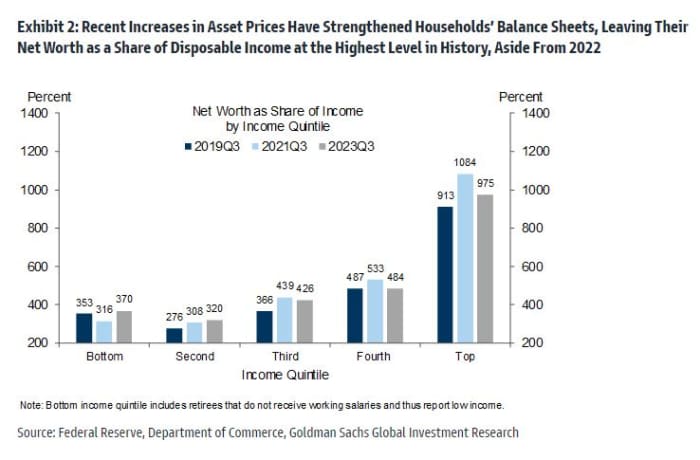

With fairness and home costs rebounding from 2022 declines, family steadiness sheets have firmed up, notes a staff at Goldman Sachs led by chief economist Jan Hatzius. And so they say whole family web value as a share of disposable earnings is now at all-time highs.

Whereas these previous inventory and house-price declines dragged on consumption development in 2023, the turnaround may increase spending this 12 months. “We count on positive aspects in family wealth to spice up quarterly annualized consumption development by a mean of 0.Four pp [percentage points] in 2024,” stated the Goldman staff.

High tickers

These had been the top-searched tickers on MarketWatch as of 6 a.m.:

Random reads

What area actually smells like.

Heiress seeks 50 random individuals to assist her give away $27.Four million.

Must Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e-mail field. The emailed model shall be despatched out at about 7:30 a.m. Jap.