Anton Petrus/Second through Getty Photographs

Altria (NYSE:MO) is a “Dividend King” and there are solely about 55 corporations that at present qualify for this title. To make this checklist, an organization must have at the very least 50 years of consecutive dividend will increase. Altria has a 54-year historical past of consecutive dividend will increase. The corporate has been ready to do that despite main laws and despite declines in tobacco utilization, which is spectacular. The tobacco trade has persistently been in a position to make up for lowered volumes by growing costs, and this development seems poised to proceed. Whereas it’s regarding to see an organization that expects lowered volumes sooner or later, it might proceed to boost costs, and I believe there’s a robust probability that smokeless merchandise and hashish (when it’s doubtlessly legalized in all 50 states) will provide Altria new alternatives for progress.

This autumn Outcomes Have been Good Sufficient

The decline in gross sales has been regarding for traders, and as a current Looking for Alpha article factors out, Altria has been lacking income estimates for a lot of quarters now. Due to this, expectations for This autumn weren’t excessive. Luckily, Altria delivered in-line outcomes with non-GAAP earnings per share of $1.18, though revenues got here in at $5.02 billion, which was a miss by $60 million. The corporate additionally stated it anticipated 2024 earnings to return in at $5 to $5.15 per share. The Board of Administrators (having not too long ago accomplished a $1 billion share buyback), additionally introduced a brand new $1 billion share buyback, which is anticipated to be accomplished by the top of 2024. Since Altria was in a position to match analyst estimates for This autumn, and because it earned $1.18 per share, that is adequate, and it permits Altria to comfortably pay a $0.98 quarterly dividend. The steering of $5+ per share in earnings in 2024 can be sufficient to comfortably pay the beneficiant dividend it presents.

Earnings Estimates And The Dividend

With administration anticipating Altria to earn $5 to $5.15 per share for 2024, the dividend is totally lined after which some. With the dividend totaling $3.84 per share for the 12 months, this inventory is now yielding about 9.8%. Moreover, the dividend seems protected, for the reason that payout ratio is round 75%. Continued share buybacks also can assist enhance earnings per share, and subsequently hold the payout ratio at an inexpensive degree and in addition permit the corporate to extend the dividend, simply because it has been doing for therefore a few years.

For example, in 2013, the quarterly dividend was 44 cents per share. Nevertheless, due to annual dividend will increase, the quarterly dividend is now 98 cents per share. Meaning the dividend has greater than doubled in simply round 10 years. If Altria continues to purchase again shares, and if it develops progress potential in associated industries sooner or later, this might permit it to considerably enhance the dividend over the subsequent 10 years, simply because it has for the previous 10 years.

Right here Is How Altria’s Dividend Might Double Your Cash In About 7 Years

Not way back, money balances had been incomes nearly nothing. However today, I like incomes round 5% on my money that is parked in cash market funds. I do not count on a return to a Zero Curiosity Charge Coverage or “ZIRP”; nevertheless, it appears seemingly that rates of interest will hand over at the very least a few of the good points we have now seen, particularly if and when an financial slowdown or recession happens. This implies it is a perfect time to lock the upper yields we’re having fun with now by shopping for choose shares that provide a beneficiant and sustainable dividend. By doing this, traders may very well be poised to lock in excessive yields and in addition place themselves for capital good points that might happen when rates of interest decline.

With this in thoughts, Altria’s beneficiant payout, which is excessive sufficient to roughly double your cash in nearly seven years or so. That is based mostly on the rule of 72, whereby you divide 72 by the yield. For instance, 72 divided by 10 (from a virtually 10% yield), means it should take about 7.2 years to double your cash.

Altria Has A Main Asset It Might Monetize For Extra Dividends In The Future

Altria owns a significant stake in Anheuser-Busch InBev (BUD). In accordance with a Barron’s article the stake is value about $11 billion and it would monetize this asset sometime. If this asset is offered, the money it raises could be used to pay a particular dividend or it may very well be used to purchase again shares. Altria at present has a market capitalization of about $71 billion, so an asset sale of $11 billion may very well be sufficient to purchase again about 15% of the shares excellent, which might enhance earnings per share for the remaining shareholders. Altria has roughly 1.Eight billion shares excellent, so in the event that they offered the stake in Anheuser-Busch InBev for $11 billion, this works out to simply over $6 per share in proceeds that may very well be paid out as a particular dividend. Anheuser-Busch InBev shares at present commerce for about $60 per share, however traded for over $120 per share in 2016 and 2017. Maybe Altria administration is ready and hoping for the inventory to return to those ranges, wherein case the worth of this stake can be about double the present worth and subsequently be doubtlessly value round $22 billion, which might symbolize a really main achieve from present ranges.

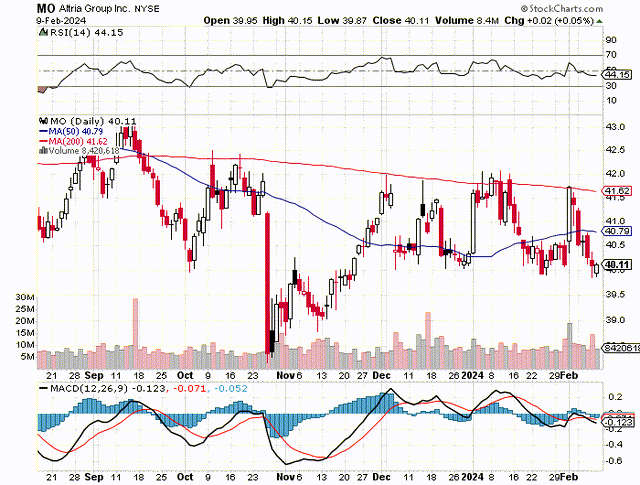

The Chart

Because the chart beneath exhibits, Altria shares dropped from across the $41 degree to simply about $38, after the corporate reported weaker than anticipated Q3 outcomes on October 26, 2023. The inventory has recovered a bit and has since been in a buying and selling vary, roughly between $40 to $42 per share. The 50-day shifting common is $40.79 and the 200-day shifting common is $41.62. Altria continues to be on this buying and selling vary, even after This autumn earnings, and that may be a constructive.

stockcharts.com

Hashish Might Be Altria’s Future Development Driver

It appears clear that the main tobacco corporations within the U.S. have been treading very fastidiously and prevented making the potential misstep of getting straight concerned within the hashish trade. U.S. Federal regulation nonetheless makes marijuana unlawful (together with associated merchandise) and that makes moving into this enterprise straight manner too dangerous for a corporation like Altria proper now. Nevertheless, there are a selection of payments earlier than Congress that might legalize marijuana on a Federal degree. This is able to be a gamechanger and that is once I count on corporations like Altria to behave aggressively to straight enter this trade. Altria has already proven some severe curiosity in hashish by investing within the trade in addition to supporting it. In 2019, Altria acquired a 45% stake in Cronos Group, Inc., which is a Hashish firm situated in Canada. Concerning this funding, Altria states:

“This funding positions Altria to take part within the rising world hashish sector, which we imagine is poised for speedy progress over the subsequent decade. It additionally creates a brand new progress alternative in a class that’s adjoining and complementary to our core tobacco companies.”

I imagine Altria might simply be ready for hashish to be legalized on the Federal degree, and maybe that would be the second that they resolve to promote the Anheuser-Busch InBev stake. This can be a large asset, and the proceeds, or at the very least a few of them, may very well be used to amass a number one hashish firm. This may very well be the expansion driver that Altria must alleviate investor considerations, and broaden the value to earnings a number of. As well as, Altria seems to publicly help the legalization of hashish on a Federal degree, by stating:

“We help a complete federal framework for all hashish merchandise that’s based mostly on science and proof, and we imagine it’s time for a nationwide dialogue about that regulatory framework.”

The Potential Draw back Dangers

The primary potential danger appears to clearly be that fewer persons are smoking today, and laws and bans appear to be growing. If Altria would not remodel itself by shifting into high-growth classes like maybe hashish, the shares might commerce at an excellent lower cost to earnings ratio sooner or later. If administration makes investments or acquisitions which can be ill-conceived, that’s one other potential danger issue.

In Abstract

There are positively some potential draw back dangers when investing in tobacco shares, so I might not take a giant stake by way of positioning in my portfolio. However the dividend yield is so compelling that, in my view, it is smart to personal some shares. I might scale right into a place and see how the inventory does over the subsequent couple of quarters. The dividend may be very beneficiant and will proceed to see small annual will increase due to Altria’s capability to boost costs and since it might monetize the stake it has in Anheuser-Busch InBev. Even when this inventory goes nowhere over the subsequent seven years or so, the dividend alone is sufficient to double your cash in that timeframe.

If rates of interest decline within the subsequent couple of years, traders may very well be prepared to pay extra for this inventory, and that might give traders who purchase now some potential capital good points. I believe the priority over declines in tobacco volumes are greater than offset by the potential positives which embody a decline in rates of interest, continued share buybacks, the potential for Altria to monetize a significant asset, and the potential for the corporate to boost costs and maybe get into greater progress industries comparable to hashish. If declining rates of interest in some unspecified time in the future converge with a brand new progress driver comparable to hashish for Altria, this inventory may very well be re-rated a lot greater. It isn’t simply This autumn outcomes that present Altria can carry on paying the beneficiant dividend, additionally it is the steering it offered for 2024, and naturally the multi-decade historical past it has of paying dividends.

No ensures or representations are made. Hawkinvest is just not a registered funding advisor and doesn’t present particular funding recommendation. The knowledge is for informational functions solely. It is best to all the time seek the advice of a monetary advisor.