cemagraphics

In my final three posts, I appeared on the macro (fairness danger premiums, default spreads, danger free charges) and micro (firm danger measures) that feed into the anticipated returns we demand on investments, and argued that these anticipated returns develop into hurdle charges for companies, within the kind of prices of fairness and capital. Since companies make investments that capital of their operations, usually, and in particular person initiatives (or belongings), particularly, the large query is whether or not they generate sufficient in earnings to fulfill these hurdle charge necessities. On this publish, I begin by wanting on the finish sport for companies, and the way that selection performs out in funding guidelines for these companies, after which study how a lot companies generated in earnings in 2023, scaled to each revenues and invested capital.

The Finish Sport in Enterprise

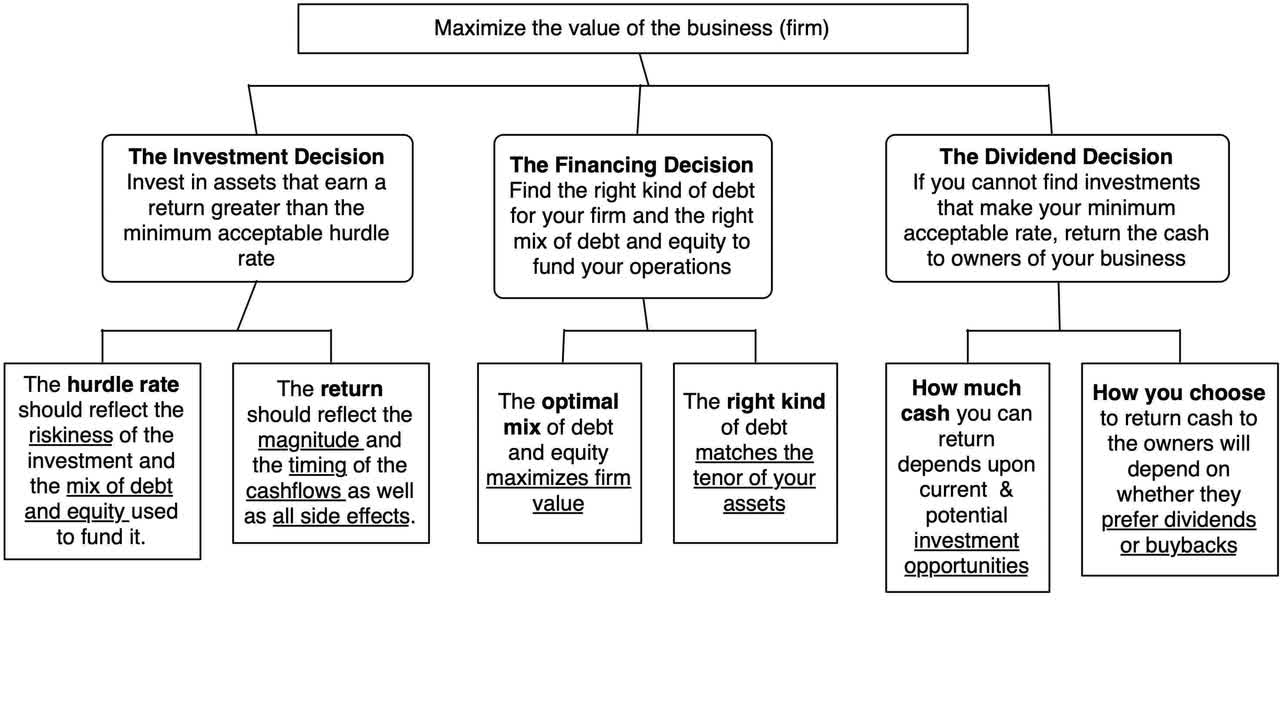

If you happen to begin a enterprise, what is your finish sport? Your reply to that query will decide not simply the way you strategy operating the enterprise, but additionally the small print of the way you choose investments, select a financing combine and determine how a lot to return to shareholders, as dividend or buybacks. Whereas non-public companies are sometimes described as revenue maximizers, the reality is that if they need to be worth maximizers. In actual fact, that goal of worth maximization drives each facet of the enterprise, as will be seen on this massive image perspective in company finance:

For some firms, particularly mature ones, worth and revenue maximization might converge, however for many, they won’t. Thus, an organization with progress potential could also be keen to generate much less in earnings now, and even make losses, to advance its progress prospects. In actual fact, the largest critique of the businesses which have emerged on this century, many in social media, tech and inexperienced vitality, is that they’ve prioritized scaling up and progress a lot that they’ve didn’t pay sufficient consideration to their enterprise fashions and profitability.

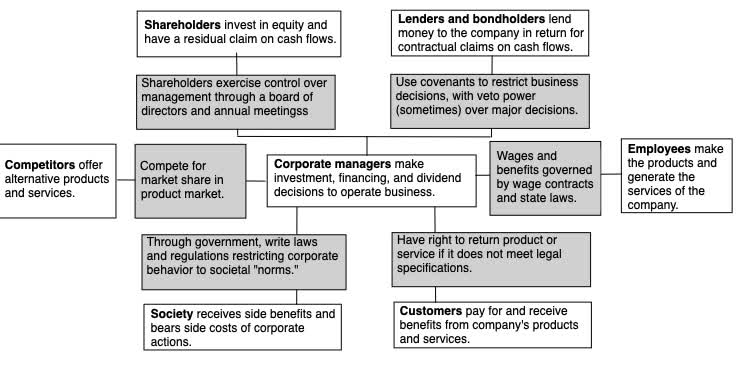

For many years, the notion of maximizing worth has been central to company finance, although there have been disagreements about whether or not maximizing inventory costs would get you an identical final result, since that latter requires assumptions about market effectivity. Within the final twenty years, although, there are numerous who’ve argued that maximizing worth and stockholder wealth is way too slim an goal, for companies, as a result of it places shareholders forward of the opposite stakeholders in enterprises:

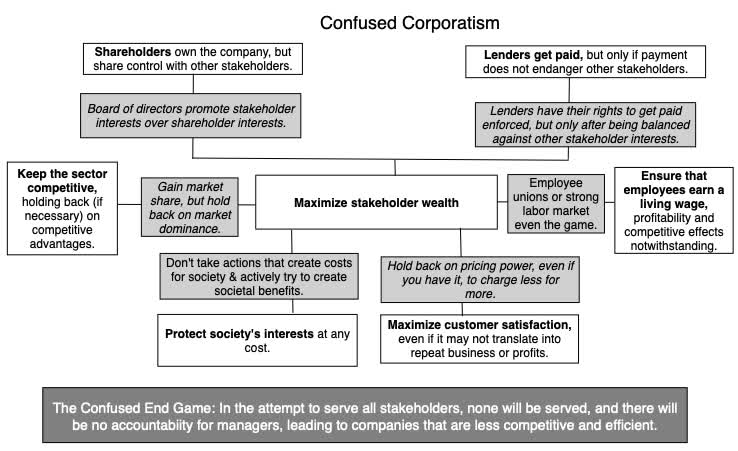

It’s the perception that stockholder wealth maximization shortchanges different stakeholders that has given rise to stakeholder wealth maximization, a misguided idea the place the top sport for companies is redefined to maximise the pursuits of all stakeholders. Along with being impractical, it misses the truth that shareholders are given primacy in companies as a result of they’re the one declare holders that don’t have any contractual claims in opposition to the enterprise, accepting residual money flows, If stakeholder wealth maximization is allowed to play out, it should lead to confused corporatism, good for prime managers who use stakeholder pursuits to develop into accountable to not one of the stakeholders:

As you may see, I’m not a fan of confused corporatism, arguing that giving a enterprise a number of targets will mangle determination making, leaving companies wanting like authorities firms and universities, wasteful entities not sure about their missions. In actual fact, it’s that skepticism that has made me a critic of ESG and sustainability, offshoots of stakeholder wealth maximization, affected by all of its faults, with greed and messy scoring making them worse.

It might appear odd to you that I’m spending a lot time defending the centrality of profitability to a enterprise, however it’s a signal of how distorted this dialogue has develop into that it’s even essential. In actual fact, you could discover my full-throated protection of producing earnings and creating worth to be distasteful, however in case you are an advocate for the viewpoint that companies have broader social functions, the truth is that for companies to do good, they must be monetary wholesome and worthwhile. Consequently, you need to be simply as , as I’m, within the profitability of firms world wide, albeit for various causes. My curiosity is in judging them on their capability to generate worth, and yours can be to see if they’re producing sufficient as surplus in order that they’ll do good for the world.

Profitability: Measures and Scalars

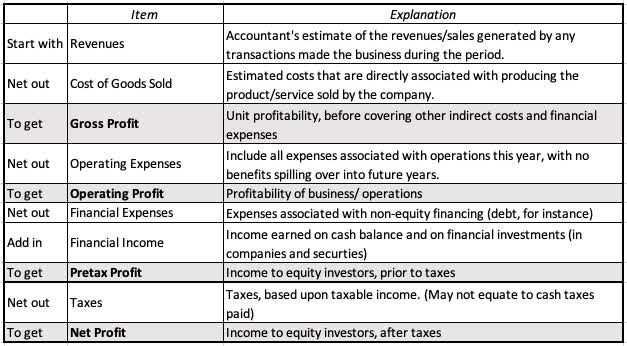

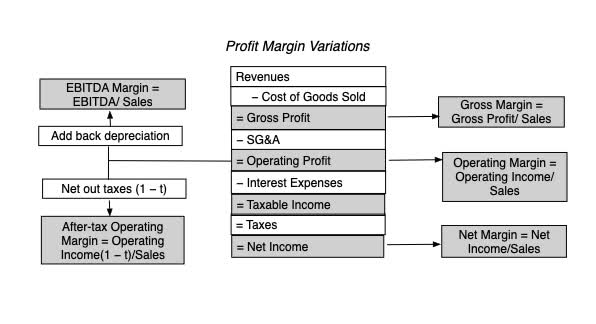

Measuring profitability at a enterprise is messier than you could assume, since it isn’t simply sufficient for a enterprise to generate income, however it has to make sufficient cash to justify the capital invested in it. Step one is knowing profitability is recognizing that there are a number of measures of revenue, and that every measure they captures a unique facet of a enterprise:

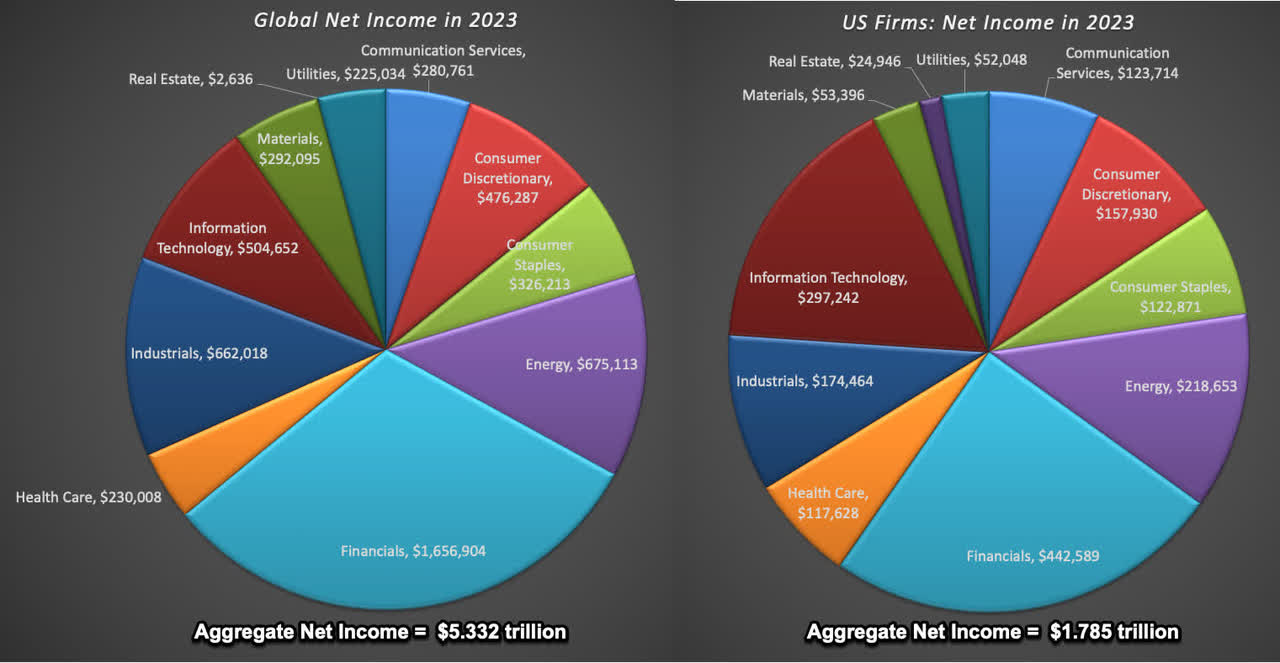

It’s value emphasizing that these revenue numbers mirror two influences, each of which may skew the numbers. The primary is the specific function of accountants in measuring earnings implies that inconsistent accounting guidelines will result in earnings being systematically mis-measured, a degree I’ve made in my posts on how R&D is routinely mis-categorized by accountants. The opposite is the implicit impact of tax legal guidelines, since taxes are based mostly upon earnings, creating an incentive to understate earnings and even report losses, on the a part of some companies. That mentioned, world (US) firms collectively generated $5.three trillion ($1.eight trillion) in web earnings in 2023, and the pie charts beneath present the sector breakdowns for world and US firms:

However their trials and tribulations since 2008, monetary service corporations (banks, insurance coverage firms, funding banks and brokerage corporations) account for the biggest slice of the earnings pie, for each US and world firms, with vitality and expertise subsequent on the listing.

Revenue Margins

Whereas mixture earnings earned is a vital quantity, it’s an insufficient measure of profitability, particularly when comparisons throughout corporations, when it isn’t scaled to one thing that firms share. As as a primary scalar, I have a look at earnings, relative to revenues, which yields margins, with a number of measures, relying upon the revenue measure used:

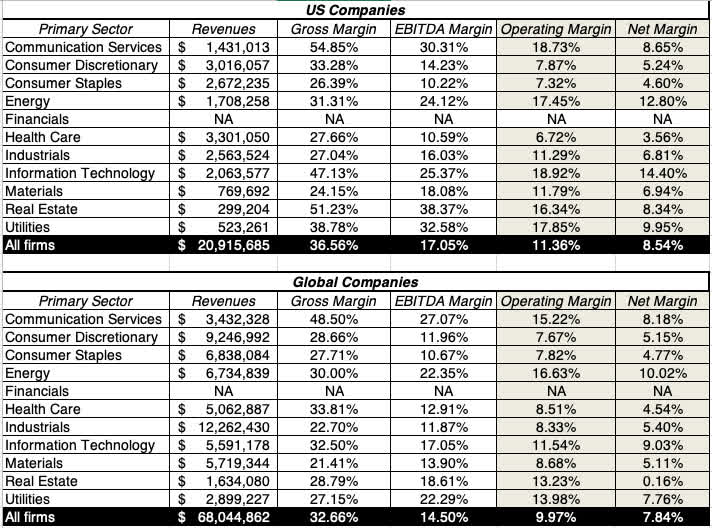

Trying throughout US and world firms, damaged down by sector, I have a look at revenue margins in 2023:

Word that monetary service firms are conspicuously absent from the margin listing, for a easy purpose. Most monetary service corporations don’t have any revenues, although they’ve their analogs – loans for banks, insurance coverage premiums for insurance coverage firms and many others. Among the many sectors, vitality stands out, producing the best margins globally, and the second highest, after expertise corporations in america. Earlier than the sector will get focused as being excessively worthwhile, additionally it is one that’s topic to volatility, brought on by swings in oil costs; in 2020, the sector was the worst acting on profitability, as oil costs plummeted that 12 months.

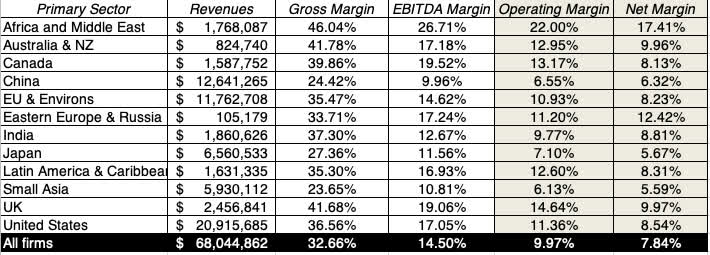

Does profitability fluctuate throughout the globe? To reply that query, I have a look at variations in margins throughout sub-regions of the world:

You could be shocked to see Jap European and Russian firms with the best margins on the planet, however that may be defined by two phenomena. The primary is the preponderance of pure useful resource firms on this area, and vitality firms had a worthwhile 12 months in 2023. The second is that the sanctions imposed after 2021 on doing enterprise in Russia drove overseas rivals out of the market, leaving the market nearly totally to home firms. On the different finish of the spectrum, Chinese language and Southeast Asian firms have the bottom web margins, highlighting the truth that massive markets aren’t at all times worthwhile ones.

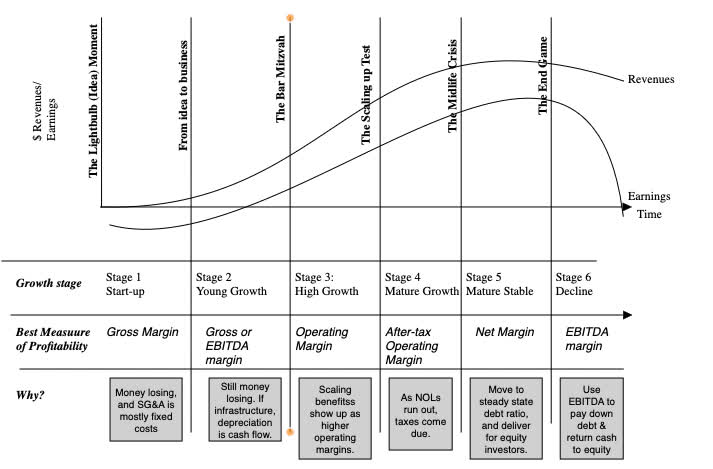

Lastly, there’s a relationship between company age and profitability, with youthful firms usually struggling extra to ship earnings, with enterprise fashions nonetheless in flux and no economies of scale. Within the truth, the pathway of an organization by the life cycle will be seen by the lens of revenue margins:

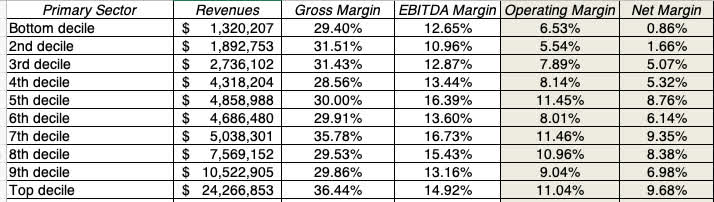

Early within the life cycle, the main target can be on gross margins, partly as a result of there are losses on nearly each different earnings measure. As firms enter progress, the main target will shift to working margins, albeit earlier than taxes, as firms nonetheless are sheltered from paying taxes by previous losses. In maturity, with debt coming into the financing combine, web margins develop into good measures of profitability, and in decline, as earnings decline and capital expenditures ease, EBITDA margins dominate. Within the desk beneath, I have a look at world firms, damaged down into decals, based mostly upon company age, and compute revenue margins throughout the deciles:

The youngest firms maintain their very own on gross and EBITDA margins, however they drop off as you progress to working nnd web margins.

In abstract, revenue margins are a helpful measure of profitability, however they fluctuate throughout sectors for a lot of causes, and you may have nice firms with low margins and below-average firms which have greater margins. Costco has sub-par working margins, barely hitting 5%, however makes up for it with excessive gross sales quantity, whereas there are luxurious retailers with two or thrice greater margins that wrestle to create worth.

Return on Funding

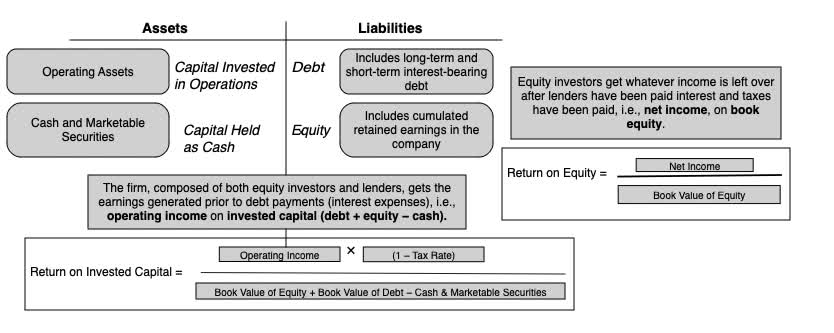

The second scalar for earnings is the capital invested within the belongings that generate these earnings. Right here once more, there are two paths to measuring returns on funding, and one of the simplest ways to distinguish them is to consider them within the context of a monetary steadiness sheet:

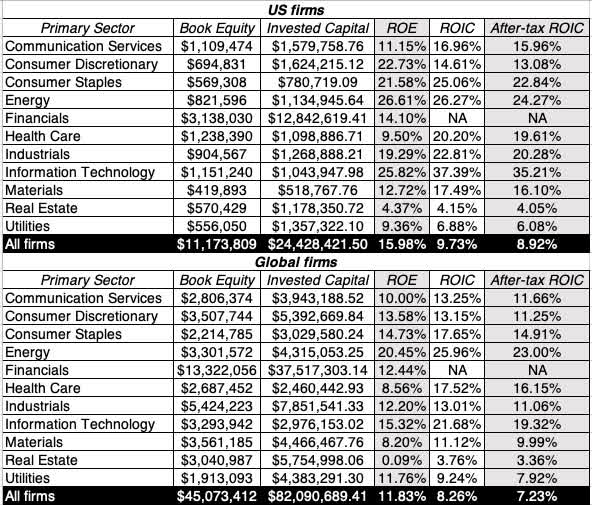

The accounting return on fairness is computed by dividing the web earnings, the fairness investor’s earnings measure, by the e book worth of fairness and the return on invested capital is computed, relative to the e book worth of invested capital, the cumulative values of e book values of fairness and debt, with money netted out. Taking a look at accounting returns, damaged down by sector, for US and world firms, here’s what 2023 delivered:

In each the US and globally, expertise firms ship the best accounting returns, however these returns are skewed by the accounting inconsistencies in capitalizing R&D bills. Whereas I partially right for this by capitalizing R&D bills, it’s only a partial correction, and the returns are nonetheless overstated. The worst accounting returns are delivered by actual property firms, although they too are skewed by tax issues, with expensing to scale back taxes paid, relatively than getting earnings proper.

Extra Returns

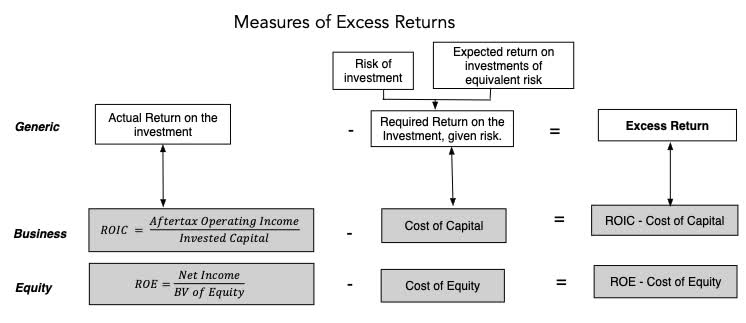

Within the ultimate evaluation, I deliver collectively the prices of fairness and capital estimated within the final publish and the accounting returns on this one, to reply a important query that each enterprise faces, i.e,, whether or not the returns earned on its funding exceed its hurdle charge. As with the measurement of returns, extra returns require constant comparisons, with accounting returns on fairness in comparison with prices of fairness, and returns on capital to prices of capital:

These extra returns aren’t excellent or exact, by any stretch of the creativeness, with errors made in assessing danger parameters (betas and scores) inflicting errors in the price of capital and accounting decisions and inconsistencies affecting accounting returns. That mentioned, they continue to be noisy estimates of an organization’s aggressive benefits and moats, with robust moats going with constructive extra returns, no moats translating into extra returns near zero and unhealthy companies producing destructive extra returns.

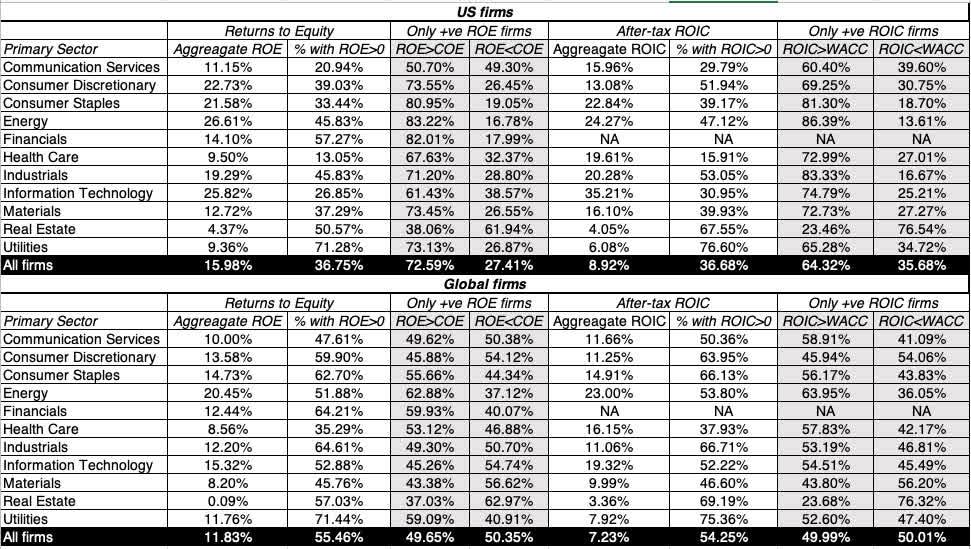

I begin once more by wanting on the sector breakdown, each US and world, of extra returns in 2023, within the desk beneath:

In computing extra returns, I did add a qualifier, which is that I’d do the comparability solely amongst cash making firms; in spite of everything, cash dropping firms may have accounting returns which are destructive and fewer than hurdle charges. With every sector, to evaluate profitability, you need to have a look at the proportion of firms that generate income after which on the p.c of those cash making corporations that earn greater than the hurdle charge. With monetary service corporations, the place solely the return on fairness is significant, 57% (64%) of US (world) corporations have constructive web earnings, and of those corporations, 82% (60%) generated returns on fairness that exceeded their price of fairness. In distinction, with well being care corporations, solely 13% (35%) of US (world) corporations have constructive web earnings, and about 68% (53%) of those corporations earn returns on fairness that exceed the price of fairness.

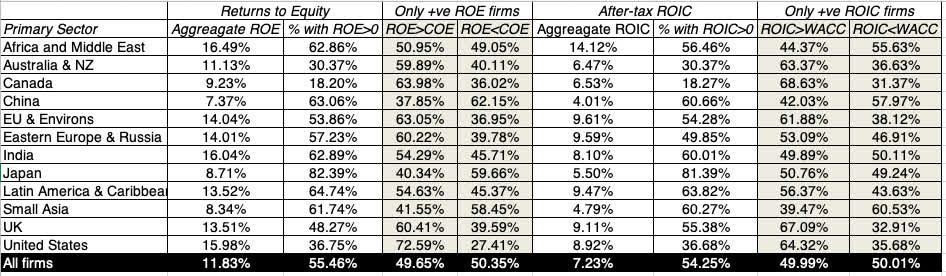

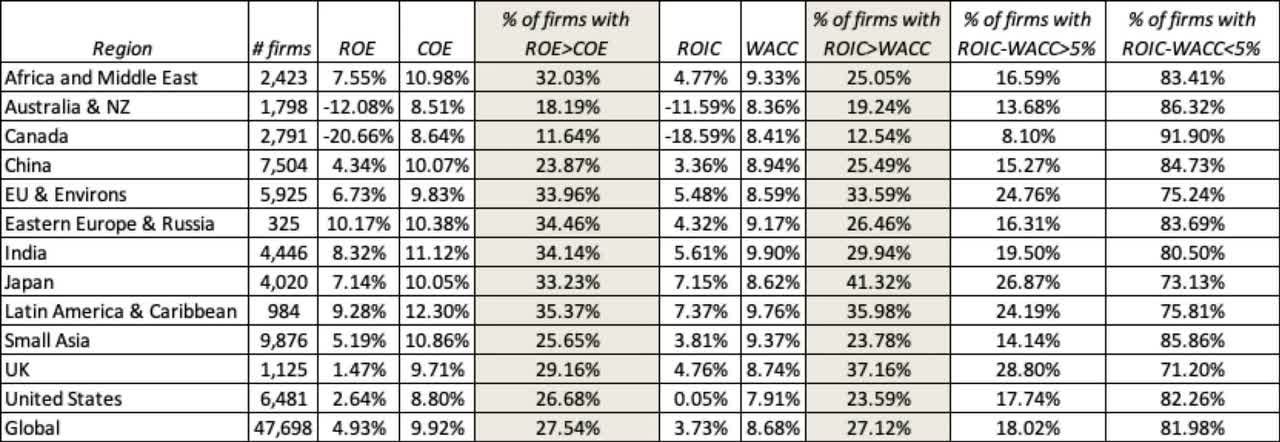

In a ultimate lower, I checked out extra returns by area of the world, once more solely money-making firms in every area:

To evaluate the profitability of firms in every area, I once more have a look at t the p.c of firms which are money-making, after which on the p.c of those money-making firms that generate accounting returns that exceed the price of capital. To offer an instance, 82% of Japanese firms generate income, the best share of money-makers on the planet, however solely 40% of those money-making firms earn returns that exceed the hurdle charge, second solely to China on that statistic. The US has the best share (73%) of money-making firms that generate returns on fairness that exceed their hurdle charges, however solely 37% of US firms have constructive web earnings. Australian and Canadian firms stand out once more, by way of percentages of firms which are cash losers, and out of curiosity, I did take a more in-depth have a look at the person firms in these markets. It seems that the money-losing is endemic amongst smaller publicly traded firms in these markets, with many working in supplies and mining, and the losses mirror each firm well being and life cycle, in addition to the tax code (which permits beneficiant depreciation of belongings). In actual fact, the biggest firms in Australia and Canada ship sufficient earnings to hold the aggregated accounting returns (estimated by dividing the whole earnings throughout all firms by the whole invested capital) to respectable ranges.

In essentially the most sobering statistic, if you happen to mixture money-losers with the businesses that earn lower than their hurdle charges, as it is best to, there’s not a single sector or area of the world, the place a majority of corporations earn greater than their hurdle charges.

In 2023, near 80% of all corporations globally earned returns on capital that lagged their prices of capital. Creating worth is clearly far tougher in apply than on paper or in case research!

A Wrap!

I began this publish by speaking concerning the finish sport in enterprise, arguing for profitability as a place to begin and worth as the top aim. The critics of that view, who wish to develop the top sport to incorporate extra stakeholders and a broader mission (ESG, Sustainability) appear to be working on the presumption that shareholders are getting a a lot bigger slice of the pie than they deserve. That could be true, if you happen to have a look at the largest winners within the financial system and markets, however within the mixture, the sport of enterprise has solely develop into tougher to play over time, as globalization has left firms scrabbling to earn their prices of capital. In actual fact, a decade of low rates of interest and inflation have solely made issues worse, by making danger capital accessible to younger firms, desperate to disrupt the established order.

Datasets

- Revenue Margins, by Trade (US, World)

- Accounting Returns and Extra Returns, by Trade (US, World)

Authentic Put up

Editor’s Word: The abstract bullets for this text have been chosen by Searching for Alpha editors.