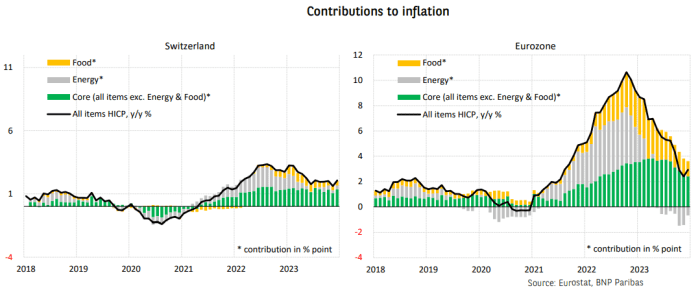

An enormous power shock following Russia’s invasion of Ukraine in 2022 added to inflation pressures that ravaged eurozone economies following the onset of the COVID pandemic. Switzerland, in the meantime, stood aside.

Eurozone inflation peaked at 10.6% in October 2022. Swiss inflation by no means exceeded 3.3%, topping out in July-August 2022. (The U.S. shopper value index peaked at 9.1% 12 months over 12 months in June 2022.)

See: International inhabitants decline will drive up inflation long-term, ECB’s Isabel Schnabel says

Two components labored in Switzerland’s favor, mentioned Lucie Barette, economist at BNP Paribas, in a Wednesday notice.

First, fossil fuels make up solely 2% of Switzerland’s power combine versus 38% for the eurozone. Second, standing outdoors the euro, a robust Swiss franc additionally stored costs in test (see charts under).

Barette broke down how Switzerland’s power combine helped insulate the financial system from surging oil and gasoline costs.

“The burden from hydropower power (68%), nuclear power (19%) and photovoltaic and wind power (11%) has enabled the Swiss financial system to be reasonably impacted by the rise in gasoline costs from Russia and the surge in oil costs,” Barette mentioned.

Power value inflation in Switzerland hit 29% year-over-year at its highest between 2021 and 2022 versus 44% within the euro space over the identical interval. Russia accounted for simply 41% of Swiss gasoline imports, or simply 4% of the nation’s complete power combine.

The economist famous that power additionally accounts for a decrease share of Swiss family shopper spending. Which means the burden assigned to its contribution when calculating inflation is robotically decrease than within the eurozone (5.5% in comparison with 10.2%, respectively).

In consequence, the power element solely contributed 38% to Switzerland’s headline inflation on common, in contrast with 54% within the euro space.

The primary-round results of this shock have then unfold to the opposite elements of the eurozone’s value index. Nevertheless, because the rise in power costs has typically been contained in Switzerland, no important will increase have been seen within the meals and core elements both, Barette wrote.

After which there’s the Swiss franc USDCHF, +0.18% EURCHF, +0.32%.

It’s appreciation additionally helped to include inflation by decreasing the price of imported items and providers and helped the nation get a good firmer grip on costs of imported oil and gasoline, that are largely traded within the euro and greenback, she mentioned.

The restricted rise in costs, in the meantime, allowed the Swiss Nationwide Financial institution to turn out to be of of the final central banks to emerge from interval of damaging rates of interest, Barette mentioned, noting the SNB has hiked charges simply 5 instances, or 250 foundation factors in complete, since mid-2022. It’s nominal rate of interest stands at 1.75%, leaving its actual, or inflation-adjusted, price in damaging territory with inflation standing at round 2% year-over-year on the finish of 2023.