magnetcreative/E+ through Getty Pictures

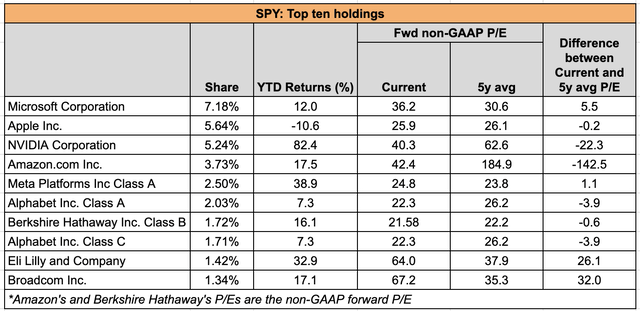

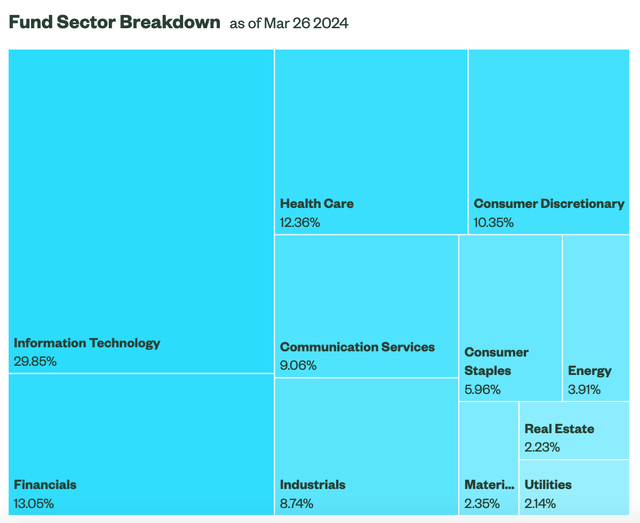

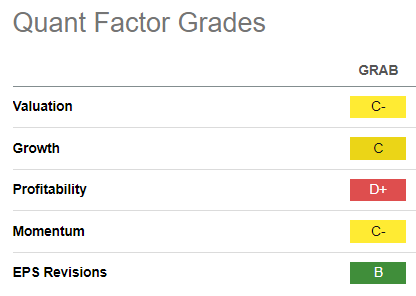

Eli Lilly (LLY) has been an outstanding inventory to personal over the previous couple of years. In early 2022, it was buying and selling for about $230 per share, however at the moment it trades for almost $800. This big run is basically due to the success of its weight problems drug, “Zepbound”. Eli Lilly shares now commerce with a whopping worth to earnings ratio of round 60. Analysts count on Eli Lilly to earn about $12.47 per share, in 2024. For 2025, the earnings estimates are at $18.16, and for 2026 the estimates are at $23.60.

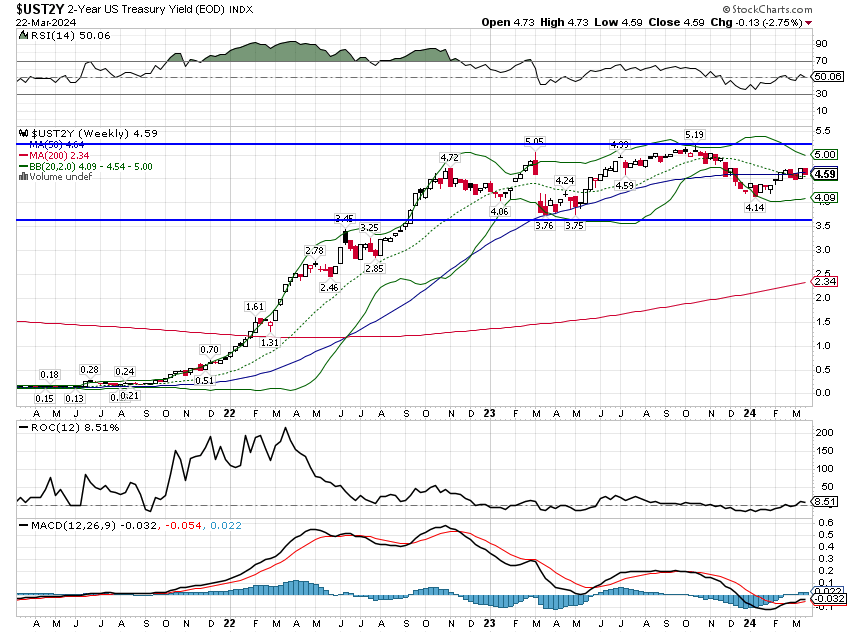

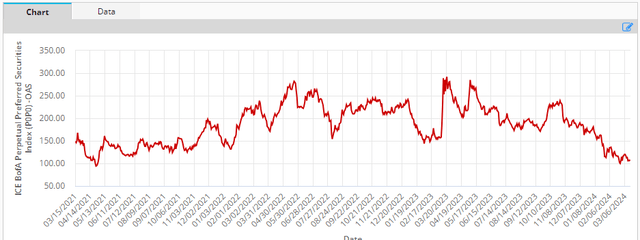

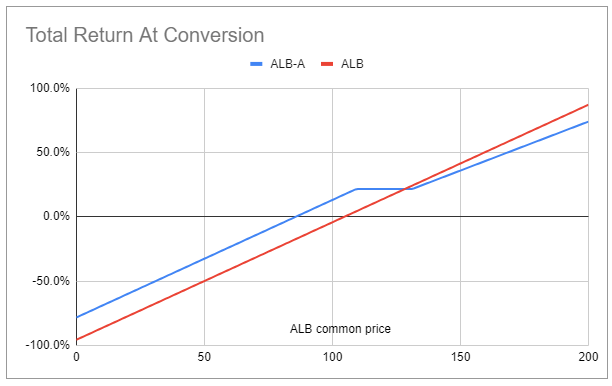

Because the chart under exhibits, and as mentioned above, Eli Lilly shares have had an enormous run over the previous few years:

StockCharts.com

The weight problems market is anticipated to probably develop to round $100 billion by 2030. That is an enormous market and it is easy to see why buyers are so enthusiastic about treating weight problems. Since a drug is taken into account to be a blockbuster when it has $1 billion or extra in annual revenues, the weight problems market is large enough to create many blockbusters inside this class alone. If I owned Eli Lilly shares now, I might be a vendor. The inventory has had an enormous run, it is rather richly valued and competitors is coming. I feel there are higher shares to purchase and one specifically may very well be the subsequent Eli Lilly in a way, as a result of it may also have a blockbuster weight problems therapy coming. That firm is Amgen (NASDAQ:AMGN) and in some methods (akin to by way of earnings energy), Amgen already may very well be thought-about the equal of Eli Lilly proper now and even superior. If Amgen’s weight problems candidate makes it to market, then Amgen may not simply be the subsequent Eli Lilly, it might even be higher. Let’s take a better look.

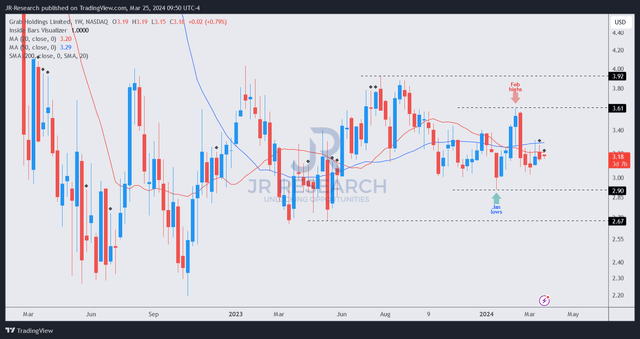

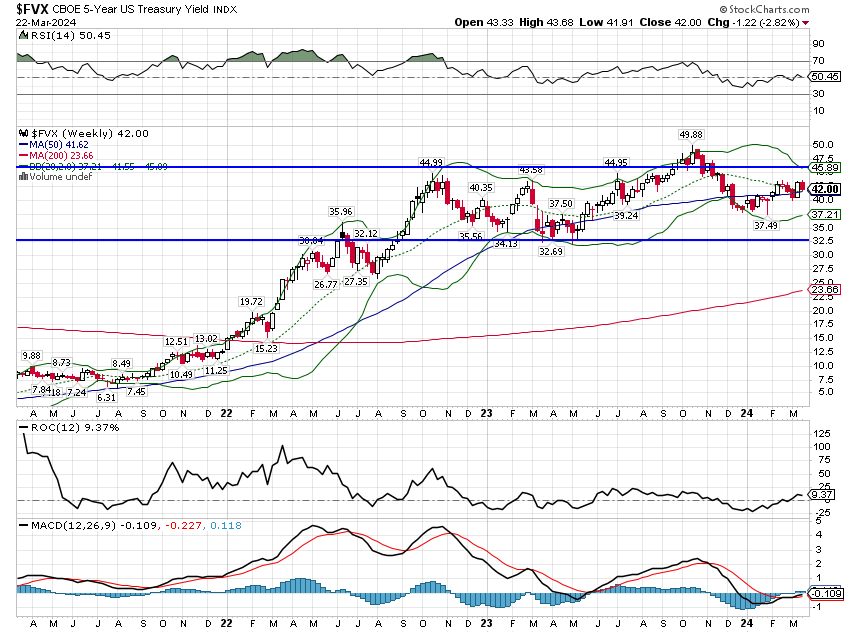

The Chart

Because the chart under exhibits, Amgen shares have been in an uptrend for the previous a number of months. In February, this inventory traded as much as across the $325 stage, however it has since skilled a pullback which I feel is a perfect shopping for alternative. This inventory lately traded all the way down to about $270, which isn’t removed from the 200-day transferring common of about $264 per share. If it will get to that $264 stage, I might turn into a extra aggressive purchaser.

StockCharts.com

Amgen’s Weight problems Candidate And Extra On The Pipeline

Whereas Eli Lilly is perhaps seen because the chief by many in relation to weight problems therapy, this chance has not gone unnoticed and competitors is coming from plenty of firms. Amgen is creating an injectable therapy known as MariTide (previously AMG133) and it may very well be extra useful for sufferers as a result of it seems to assist them hold the load off even after they cease injections. Amgen can be testing this as a as soon as a month injection which might be superior to the weekly injections which are required with different therapy choices which are in the marketplace now. Amgen can be engaged on an oral weight reduction therapy, and this may very well be ideally suited for sufferers that don’t tolerate injections. Amgen is anticipated to launch section 2 scientific trial updates on MariTide in addition to section one outcomes on its weight problems capsule later this yr. These outcomes may very well be a serious upside catalyst for the inventory, if the outcomes proceed to indicate promise.

Amgen’s MariTide has proven promise and security in early-stage trial information and it seems to be more practical in serving to sufferers to maintain the load off when in comparison with different therapies which are in the marketplace. This potential sturdiness issue plus the likelihood for the injection to be as soon as a month, might assist Amgen leapfrog many rivals. If MariTide and/or Amgen’s different weight problems therapies just like the capsule taken orally make it to market, Amgen’s earnings and revenues might surge within the coming years, making it probably even higher than being “the subsequent Eli Lilly”.

Amgen has a really sturdy pipeline and a few of these candidates might additionally turn into blockbusters by way of revenues sooner or later. “AIMOVIG” for pediatric migraines, “AMJEVITA” for irritation, “LUMAKRAS” for colorectal and lung cancers, “OLPASIRAN” for heart problems, “TEZSPIRE” for extreme bronchial asthma, are all in section Three trials, and that is only a partial checklist of the section Three candidates. Along with this, there are quite a few candidates which are in section 2 and earlier stage scientific trials. There are such a lot of candidates in Amgen’s pipeline it’s too lengthy to checklist—have a look right here. As will be seen under, Amgen has plenty of vital potential pipeline milestones which are anticipated for 2024, together with MariTide:

Amgen.com

Let’s Examine “Zepbound” And “MariTide”

Zepbound: This therapy helped overweight sufferers lose as much as about 20.9% of their weight after 72 weeks (when taking the best dosage which is 15 mg). Injections are taken weekly. By way of extra widespread hostile unwanted side effects, sufferers might expertise: nausea, diarrhea, vomiting, stomach ache, constipation, allergic response, injection website reactions, hair loss and heartburn, and there are extra potential unwanted side effects. By way of extra severe however probably much less widespread unwanted side effects, Eli Lilly’s web site says that Zepbound could cause tumors within the thyroid.

MariTide (AMG133): In early stage trials, and in line with a research printed by Nature Metabolism, this therapy noticed sufferers dropping 14.5% of their physique weight in simply 12 weeks. This can be a as soon as a month injection. The most typical treatment-adverse occasions had been nausea and vomiting which had been typically gentle and resolved inside 48 hours. No clinically significant modifications in blood strain had been noticed. Sufferers who obtained a single shot of the best dose (420 milligrams) of MariTide nonetheless misplaced as much as 8.2% of their physique weight after 92 days, which (in line with the authors of the research) suggests a single injection has a chronic weight reduction impact. In one other group that participated within the research, a number of doses of the drug got and sufferers nonetheless retained an 11.2% weight discount, even 5 months after receiving the final dose. Once more, this means that MariTide has extended weight reduction advantages, together with the good thing about a once-a-month injection.

Earnings Estimates And The Steadiness Sheet

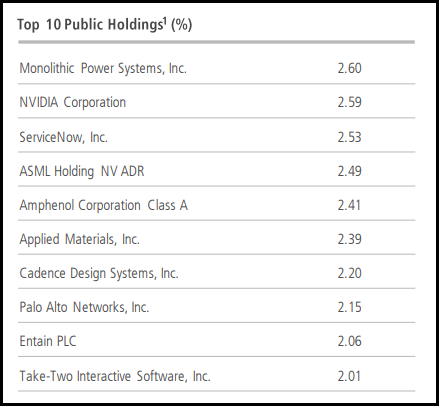

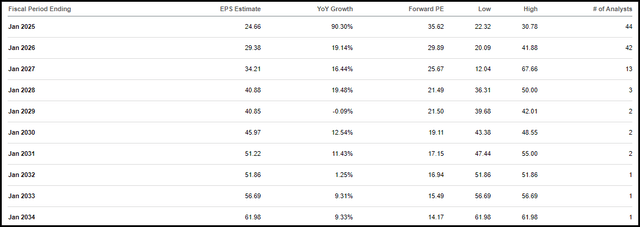

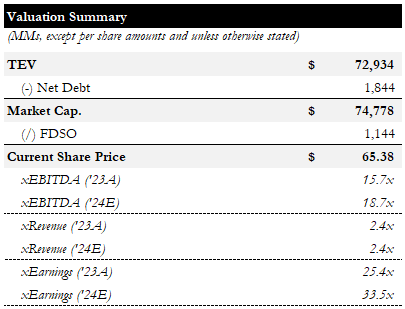

Analysts count on Amgen to earn $19.62 per share on revenues of about $33 billion. For 2025, estimates are at $21.11 on revenues of round $34 billion and earnings are anticipated to rise to $22.23 with revenues coming in at almost $35 billion for 2026. Should you take a look at the earnings estimates for Eli Lilly, you possibly can see that Amgen is anticipated to earn rather more this yr, however by 2026, each firms may very well be incomes round $22 to $23 per share. But, there’s an unbelievable disparity within the share worth with Eli Lilly buying and selling for almost $800, and Amgen buying and selling for somewhat multiple third of that share worth, at nearly $280. I perceive that Eli Lilly is rising sooner proper now, however the truth that it can possible take about two years for Eli Lilly to catch as much as what Amgen is incomes is important. However, I additionally suppose it’s clear that Amgen’s earnings and income estimates don’t appear to incorporate a lot (if any) potential income progress that would come if its weight problems therapy is profitable. Based mostly on this, Amgen’s earnings estimate may very well be too conservative.

As for the stability sheet, Amgen has round $65.42 billion in debt and almost $11 billion in money. I might slightly Amgen had much less debt, however on the similar time I’m not involved with the stability sheet.

The Dividend

Amgen at the moment pays a dividend of $2.25 per share on a quarterly foundation, and this totals $9 per share yearly. The dividend has grown considerably through the years and will proceed to take action. In 2014, the quarterly dividend was simply 61 cents per share, so up to now ten years the dividend has roughly quadrupled. With an earnings estimate of greater than $20 per share, a $9 per share in whole annual dividends is a protected payout ratio and it leaves loads of room for extra dividend will increase. Amgen usually pronounces a dividend improve annually, proper round December.

On March 6, 2024, Amgen introduced a second quarter dividend of $2.25 per share could be paid on June 7, to shareholders of document on Could 17, 2024.

Potential Draw back Dangers

As with every firm that does drug growth, there are main dangers for scientific failures. As well as, there’s the danger of some sort of litigation sooner or later if sufferers develop unexpected well being issues from taking a drug. This sector additionally has main regulatory dangers, and election yr dangers from politicians promising to assault drug costs. Further dangers embrace generic competitors when medication go off-patent.

In Abstract

Amgen’s valuation appears to be like very compelling, particularly when in comparison with Eli Lilly. Amgen presents a dividend yield of about 3.2% and it has a powerful document of accelerating the dividend annually. Buying and selling at nearly 14 occasions earnings, Amgen shares seem undervalued, particularly if it has some success within the weight problems market. I feel Amgen is a purchase at present ranges, and I plan to purchase extra aggressively if it trades all the way down to the $264 stage, which is true across the 200-day transferring common (which is usually a powerful help stage).

AI is another excuse I like Amgen and the biotech and pharma sector proper now. It is too early to yield outcomes, however the usage of AI sooner or later might pace up drug discovery and result in breakthroughs, in addition to cut back the time and expense it takes to deliver a therapy to market. The opposite issue I like is that Amgen has such a powerful portfolio of current merchandise in addition to a promising pipeline. Due to this, Amgen’s inventory is just not going to crash if there’s a scientific failure, and but a major scientific success with a therapy candidate like MariTide might considerably enhance the share worth. For my part this inventory has a wonderful threat to reward ratio.

No ensures or representations are made. Hawkinvest is just not a registered funding advisor and doesn’t present particular funding recommendation. The knowledge is for informational functions solely. It’s best to all the time seek the advice of a monetary advisor.