Kokkai Ng

Seize: Southeast Asia’s Main Platform Firm

Seize Holdings Restricted (NASDAQ:GRAB) is a Singapore-headquartered platform firm that operates a number one ride-hailing and supply enterprise. It additionally has a nascent fintech enterprise, aiming to turn into Southeast Asia’s main super-app platform. The corporate has managed to enhance its profitability metrics markedly within the mobility section, aligned to its medium-term adjusted EBITDA margin targets. Accordingly, Seize administration underscored its confidence in sustaining the adjusted EBITDA margin of Seize’s mobility section “at round 12% or larger.” Since mobility accounted for almost 80% of Seize’s company adjusted EBITDA within the fourth quarter, it would proceed to be a core earnings driver.

Regardless of that, observant traders needs to be cognizant that the GRAB fell steeply after its earnings launch in late February 2024. Whereas the This autumn efficiency was sturdy, because it demonstrated persevering with working leverage good points, the market was doubtless involved with Seize’s ahead steerage.

Accordingly, Seize articulated income steerage of between $2.7B and $2.75B for FY24. Whereas it represents an estimated 14% to 17% YoY enchancment, it is a steep deceleration from 2023’s 65% development. Because of this, Seize’s development cadence is predicted to normalize to a mid-cycle momentum by way of FY25 earlier than administration expects topline development to reaccelerate. Seize highlighted it initiatives “income acceleration from 2025 onwards as new initiatives achieve traction.” Accordingly, the corporate will execute a number of development initiatives throughout its supply and fintech verticals. Seize believes these alternatives will assist to “diversify its future development” whereas permitting it to seize market share.

Seize’s Profitability Inflection Is Nonetheless Early

There’s little doubt that Seize is the market chief within the area within the mobility section, as seen by its profitability inflection to maintain its core enterprise. Because of this, I imagine Seize stays well-positioned to leverage its core mobility enterprise to take a position extra aggressively within the meals supply and fintech section to develop its moat in opposition to its smaller friends. Accordingly, Seize guided for an adjusted EBITDA of $190M on the midpoint of its outlook vary for 2024, a big enchancment from 2023’s adjusted EBITDA lack of $22M. Analysts believe that Seize’s working leverage ought to profit from its development and scaling initiatives, estimating an adjusted EBITDA CAGR of 95% by way of FY26 from its 2024 base.

Nonetheless, execution dangers abound because the supply section is, in spite of everything, a comparatively low-margin section in comparison with its mobility enterprise. Seize administration expects to ship no less than a 3% supply section adjusted EBITDA margin this 12 months, with a medium-term midpoint goal of about 4.5%. With Seize accounting for 55% of the area’s meals supply market by GMV in 2023, the corporate is well-positioned to scale. Nonetheless, the potential margin upside appears restricted, suggesting Seize could have to rely closely on its fintech section for development. Nonetheless, with the section nonetheless nursing losses because it makes an attempt to safe its foothold in an intensely aggressive digital finance market, I imagine the market is probably going accounting for larger execution dangers as Seize’s topline development normalizes this 12 months.

GRAB’s Valuation Is not Aggressive

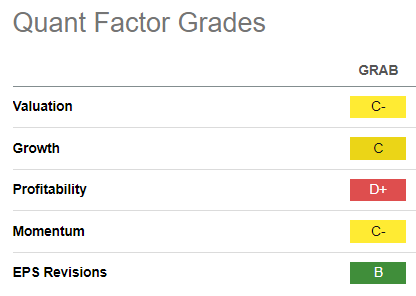

GRAB Quant Grades (In search of Alpha)

In search of Alpha Quant assigns GRAB a “C-” valuation grade, suggesting an inexpensive valuation. Nonetheless, its “D” profitability grade may not present enough confidence to worth traders searching for a basically robust firm.

Regardless of that, traders should take into account that its almost 100% 2Y adjusted EBITDA CAGR affords substantial upside potential if administration executes properly. Its “B” earnings revisions grade suggests Seize administration has doubtless sandbagged its earlier steerage, serving to the corporate to carry out properly relative to the market’s expectations. Because of this, steep pullbacks in GRAB may very well be capitalized as dip-buying alternatives for traders with a speculative portfolio.

Is GRAB Inventory A Purchase, Promote, Or Maintain?

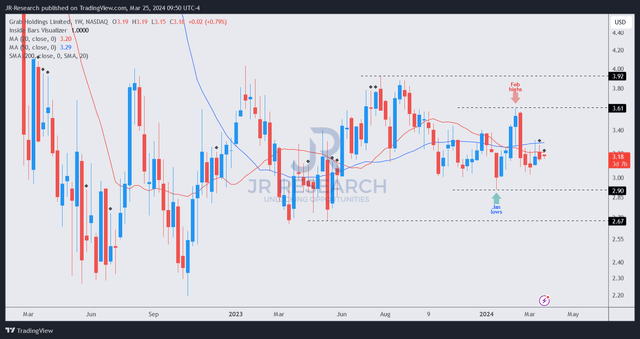

GRAB value chart (weekly, medium-term) (TradingView)

I assessed the market has remained tentative over GRAB’s shopping for sentiments. Because of this, I imagine the market is not satisfied (but) of the corporate’s potential to drive sooner development in its supply and fintech companies amid probably slowing income development projections.

However my warning, GRAB patrons have defended steep pullbacks over the previous 12 months, serving to the inventory consolidate constructively. In different phrases, the worst promoting draw back appears to be over, as patrons loaded up at strong dip-buying alternatives.

Nonetheless, I warning traders to keep away from chasing GRAB at essential resistance zones between the $3.6 and $Four ranges. Patrons ought to take into account shopping for nearer to the $Three assist stage, leveraging GRAB’s accumulation zone.

Ranking: Provoke Speculative Purchase.

Speculative/Cautious Ranking:

See the extra disclosure part beneath for essential notes accompanying the Speculative/Cautious Purchase score introduced.

I Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a essential hole in our view? Noticed one thing essential that we did not? Agree or disagree? Remark beneath with the goal of serving to everybody locally to study higher!

Editor’s Be aware: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.