Morsa Photos

Abstract

Throughout the COVID-19 pandemic, PayPal Holdings Inc. (NASDAQ:PYPL) skilled a big rally, with its share value almost tripling. Nevertheless, the corporate has since witnessed a decline of roughly 80% from its peak, primarily on account of slowing development and elevated aggressive pressures. Presently, the inventory’s valuation doesn’t appear to supply a compelling entry level based mostly on conservative estimates, although it’s not deemed excessively overvalued. An entry level across the low $50s would current a extra interesting risk-reward ratio. Though we keep a impartial stance on PayPal’s shares, we acknowledge the arguments favoring funding. A technique to contemplate may be the sale of barely in-the-money name choices, which might yield a low to mid-double-digit annualized return if the inventory value stays secure or appreciates, providing a doubtlessly engaging efficient foundation.

Firm Overview

PayPal operates a two-sided community with a diversified product providing that allows digital funds and simplifies commerce experiences on behalf of retailers and customers worldwide.

It operates via a portfolio of manufacturers/merchandise, together with PayPal, PayPal Credit score, Braintree, Venmo, Xoom, PayPal Zettle, Hyperwallet, and Paidy. It has two detailed reporting segments:

- Transaction Revenues: Charges charged to retailers and customers on a transaction foundation: Take price (3.49% + $0.49 per transaction), forex conversion, switch of funds to checking account, buy or sale of cryptocurrencies, contractual

- Different Worth-Added Companies (“OVAS”): Partnerships, referral charges, subscription charges, gateway charges, different providers, curiosity and charges earned on loans receivable and belongings underlying buyer balances

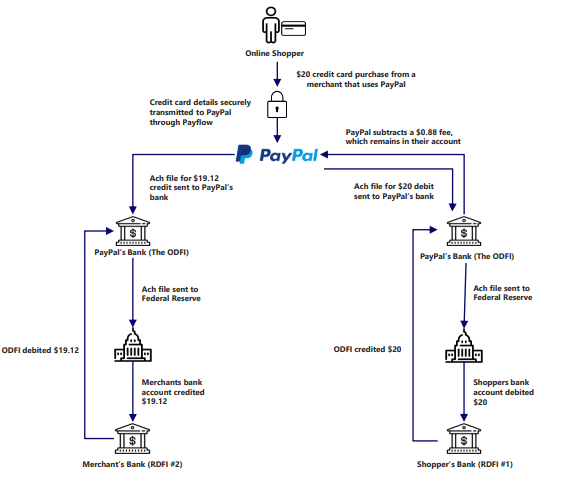

Illustrative Transaction (Empyrean)

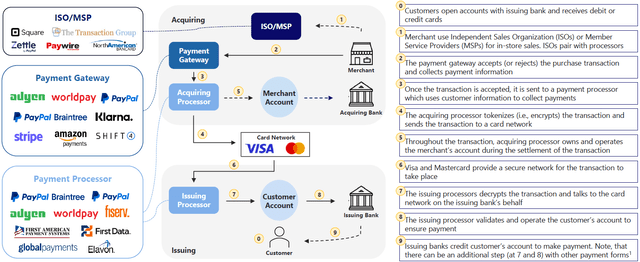

The cost system worth chain entails a number of elements required for retailers and clients to conduct commerce, on-line or in particular person. Though advanced, the varied components of the worth chain work collectively to create a seamless expertise for the client, all accomplished inside seconds.

Funds Worth Chain (Empyrean)

PayPal noticed super success with the outbreak of COVID-19, as e-commerce gross sales surged; nevertheless, latest macro challenges and growing competitors have induced a slowdown in lively accounts, leading to poor share value efficiency.

PYPL 5Yr Share Worth Historical past (CapIQ)

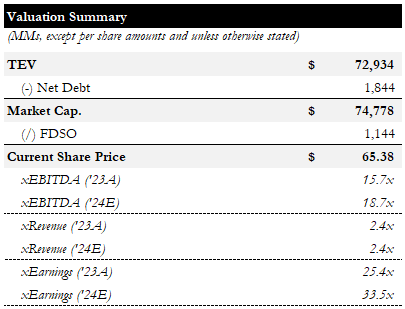

Valuation

Since reaching its nadir within the low-$50s, the shares have rallied almost ~30% to the mid-$60s. The present value implies an EV/EBITDA of ~16x.

Valuation Abstract (Empyrean)

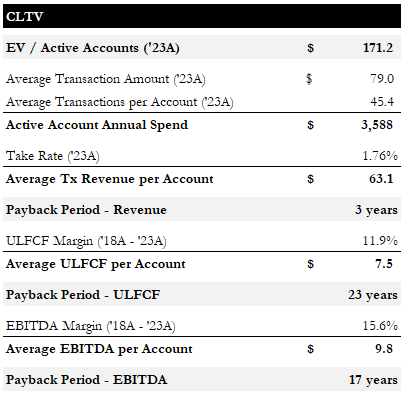

Whereas we’ve a DCF mannequin for PayPal, we rely closely on it on account of our quite a few questions on development and low cost charges, pricing energy, and acceptable low cost charges. As a substitute, we favor to contemplate EV/Energetic Account vs seemingly buyer lifetime values (“CLTV”). The market is presently ascribing a price of ~$171okay to every lively account as of Dec-23. Based mostly on the Dec-23 common transactions per account and common transactions per account, every buyer generates ~$3,600 of cost volumes. Utilizing the most recent take-rate, we calculate ~$63 of transaction income per account and ~$7.5 of ULFCF or ~$10 of EBITDA based mostly on latest common margins. This means payback durations of ~23 and ~17 years for ULFCF and EBITDA, respectively.

CLTV (Empyrean)

Whereas this evaluation assumes no development within the person base, we really feel comfy with this as a conservative assumption given the latest weak spot (n.b., ~2% decline in lively accounts YoY from ’22 to ’23). We current the EV / Energetic Account / [Revenue, ULFCF, EBITDA] as payback durations, although they may also be considered multiples. With the corporate having grown EBITDA and ULFCF at a ~14% and ~19% CAGR from ’18 to ’23, we view these multiples as reasonably excessive.

Given the backdrop of accelerating competitors (mentioned additional under) and pricing strain, we don’t see a big value dislocation or margin of security. Nevertheless, we don’t see the shares as considerably overvalued.

Dangers

1) Intensifying Competitors in Funds

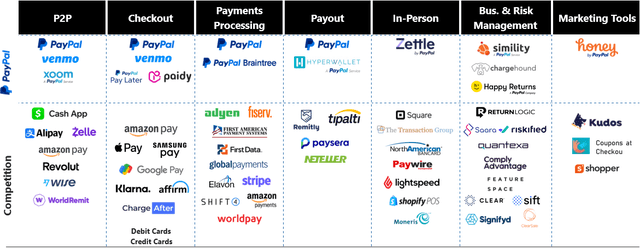

There are extra digital wallets right now than ever, and PayPal shouldn’t be immune from competitors regardless of being the most important supplier. Intensifying business competitors can result in pricing strain or lack of market share.

Aggressive Panorama (Empyrean)

Potential Mitigant: Regardless of going through competitors for each branded checkout and processing, PayPal’s immense scale and double-sided community results will function a resilient financial moat in opposition to opponents.

2) Elevated Buyer Churn Lowering Income Base

PayPal’s internet new lively buyer development slowdown during the last two years has anxious traders. Given the elevated churn price for PayPal’s clients, this may increasingly result in future unfavourable earnings revisions from administration.

Potential Mitigant: The latest problems with elevated churn are associated to the cohorts of consumers PayPal onboarded in the course of the pandemic reasonably than being a structural situation of the enterprise. After these customers are churned off, PayPal ought to be capable to return to its typical tempo of person development, particularly with new product introductions and enhancements.

3) Lack of Exclusivity with Main Retailers

After PayPal’s lack of exclusivity with eBay, the corporate has continued to face levels of market pessimism concerning its capability to take care of agreements with sure giant on-line marketplaces.

Potential Mitigant: PayPal’s lack of exclusivity to eBay shouldn’t be a future threat for the enterprise’s buyer base in any respect, provided that PayPal’s common take price is double its take price for eBay clients. PayPal’s agreements with eBay on the particular person service provider degree have contributed to the decline in PayPal’s take price over time, and this settlement change will solely stabilize its take price

4) World eCommerce Progress Outlook is Restricted

The pull-forward in eCommerce demand on account of COVID enabled PayPal to learn from an uplift in buyer seize, however weaker long-term eCommerce tendencies might function a big headwind for the enterprise.

Potential Mitigant: Though PayPal’s slowdown of complete transaction quantity development could be attributed to the deceleration of eCommerce penetration globally, PayPal’s core phase doesn’t lag business development. Different headwinds, reminiscent of renewed lockdowns in China, have additionally contributed to a lower in cross-border transaction volumes however will finally get well

Conclusion

Following a monster rally via COIVD, which noticed the share value almost triple, PayPal has crashed ~80% as development has slowed and aggressive pressures mounted. The present value doesn’t seem to supply a extremely engaging entry level underneath conservative assumptions, although we don’t see it as considerably overvalued. We’d be extra comfy with shares within the low- $ 50s. Although we aren’t within the shares, we perceive the bull case. A technique we might really feel comfy enjoying PayPal right now can be to promote barely ITM name choices, offering a low/mid-double-digit annualized return if shares stay flat or rally, at a doubtlessly engaging efficient foundation.

t