JHVEPhoto/iStock Editorial through Getty Photographs

I’m updating my earlier evaluation on Rogers Communications Inc. (NYSE: NYSE:RCI) in gentle of Q1 2024 earnings, which have been launched pre-market on Wednesday, April 24th.

Beforehand, I rated this inventory a purchase for the next causes:

- The long-awaited merger with Shaw was anticipated to drive advantages from each synergy and scale

- Earnings steerage was spectacular and better than my expectations, even earlier than synergy profit

- Valuation multiples have been depressed and did not transfer on excellent news

Since then, Rogers Communications has been down 12% whereas the S&P 500 has been up greater than 20%.

RCI Worth Pattern (In search of Alpha)

With the downward development since my final evaluation, I see much more upside potential on this inventory. Q1 earnings have been very sturdy with larger than anticipated outcomes and nice information on synergy advantages. Rogers can be on the cusp of development from 5G House Web and has been in a position to speed up deleveraging which is able to drive curiosity expense down. With a worth goal of $51.80 and mitigated dangers, I elevate my score from purchase to sturdy purchase.

Q1 Earnings Recap

Q1 earnings have been very sturdy, coming in forward of my (and analysts’) expectations. Adjusted EPS of $0.73 beat consensus by $0.01, and income grew 28% year-over-year to $3.64 billion, beating consensus by $0.06 billion.

These sturdy earnings place Rogers nicely in step with 2024 steerage, which administration reaffirmed.

RCI 2024 Steering (RCI Investor Relations)

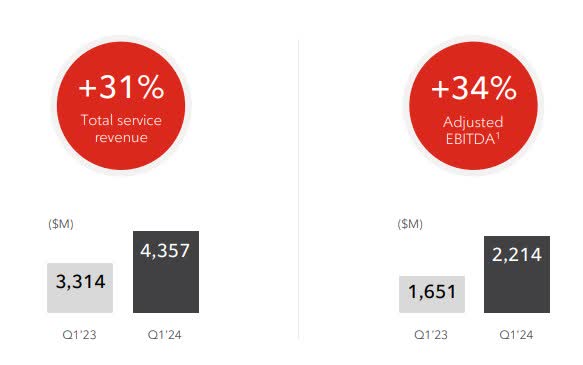

The largest standout for me is that Rogers introduced the completion of $1 billion of synergy actions inside the quarter, one yr forward of the beforehand introduced schedule. This actually reveals within the outcomes, with Adjusted EBITDA outpacing service income development.

Q1 Abstract (RCI Investor Relations)

Valuation

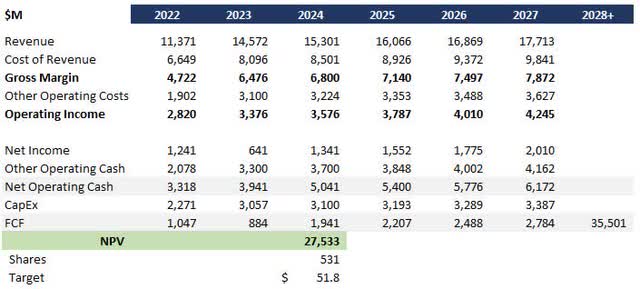

To set a worth goal, I ran a Discounted Money Circulation evaluation utilizing the next assumptions:

- 2024 delivered on the mid-point of administration steerage

- Close to time period income development of 5% and price development of 4% primarily based on growth technique

- Lengthy-run development price of two% primarily based on Canadian telecom CAGR

- 10% low cost price as a longtime, excessive money circulate telco

This mannequin yields a worth goal of $51.80, 35% upside from in the present day’s pricing.

RCI DCF (Knowledge: SA; Evaluation: Mike Dion)

Wall Road analysts are equally bullish at a worth goal of $54.25, 42% upside from in the present day’s pricing.

RCI Wall Road Score (In search of Alpha)

5G House Web Has Nice Potential

Past delivering strong efficiency of their core wi-fi and wireline enterprise, Shaw is pursuing development through 5G Wi-fi Web. I consider it is a larger alternative than the market is pricing in.

An analyst requested an excellent query on sizing the market throughout the Q1 earnings name. In response to the administration response, Rogers’ current wireline footprint covers 2/Three of Canada, which means House Web can compete within the different 1/3. As well as, they’ve been efficiently packaging wi-fi companies with dwelling web, driving a lot larger spend per buyer. In comparison with rivals, the economics are distinctive as they don’t want fiber installations.

A number of the development is even incremental to the trade as a complete. A latest examine by CTIA discovered that 20% of 5G dwelling subscribers are literally new to broadband web total.

Value Reductions Drive Earlier Stability Sheet Enchancment

As with many telcos, Rogers carries a excessive debt load at a 4.7x debt leverage ratio. This has in fact been a drag on internet earnings and free money circulate as curiosity expense grew from $500 million in 2019 to $1.Four billion final yr.

The excellent news is that delivering synergy advantages a yr early has additionally accelerated the flexibility to pay down debt whereas sustaining shareholder returns. Per the newest submitting, they’re on observe to realize a 4.2x ratio by the top of the yr. This acceleration not solely instantly will increase money circulate, but in addition compounds via decrease curiosity into improved outcomes throughout the yr.

Draw back Threat

The first draw back danger to Rogers is sustaining the core companies. Media was down in Q1 as anticipated, however offset by sturdy wireline outcomes. Rogers must proceed to take care of development via each price and quantity within the core companies to ship the present worth goal. That mentioned, the chance is mitigated by new companies like 5G House in addition to investments into the enterprise and authorities house.

The secondary draw back danger to Rogers is worth wars impacting ARPU. Once more, the chance is mitigated with a robust aggressive moat in addition to the flexibility to ship wi-fi web, however I shall be protecting a detailed eye on price shifting ahead.

Verdict

Throughout the enterprise, administration is delivering and shareholders stand to learn. I used to be very impressed by Q1 earnings, particularly with the early supply of synergy advantages. 5G House Web has the potential to not solely increase Rogers’ market share, however to increase the market. And early deleveraging will compound the enhancements in money circulate throughout the yr.

With a worth goal of $51.80 and dangers nicely mitigated, I consider it is a sturdy purchase with a strong margin of security.