PM Pictures

If you end up in an analogous scenario as I’m, with over 30 years to go earlier than retirement, prioritizing dividend compounders may show to be a superior technique, than chasing high-yield shares.

The important thing standards for my investing type is to profit from each capital appreciation and dividends (reinvesting again within the portfolio) as this could yield considerably higher leads to the long-term, in spite of everything my purpose is to beat the market.

In any other case, I may simply dollar-average the index and sleep effectively at evening, however as a substitute I’m a born stock-picker, having fun with the fun of beating the group.

Simply take into account that investing in an organization with a beginning dividend yield of solely 2%, with a DGR of 12% yearly over the course of 20 years will end in a yield-on-cost of 17.2%.

Conversely, a high-yield inventory yielding 5% at the moment with a DGR of 5% after 20 years would yield solely 12.6% alongside considerably decrease capital appreciation, given the enterprise has little or no money left to reinvest and develop.

Naturally, anticipating 12% DGR over the course of 20 years is optimistic, however let me present you two companies at the moment that are market leaders of superior high quality, their shares have been below stress approaching the “cut price territory”, and will show to be compounders with double-digit DGR at the very least for the rest of the last decade.

UnitedHealth Group Integrated (UNH)

UnitedHealth, with $371B in income as of 2023, is the most important healthcare firm on the earth, headquartered in Minnesota.

The enterprise is well-diversified, working by means of two foremost divisions.

UnitedHealthcare operates as a medical insurance division, amassing premiums from corporations and people in trade for healthcare protection. This division serves over 147 million individuals worldwide, and amassing premiums stays the most important income stream of UNH, contributing 77% to the general income.

Optum is the second division, contributing round 21% to the overall income, which focuses as a substitute on:

- Offering pharmacy administration providers

- Sells information analytics and tech options to different healthcare suppliers

- Promoting house care gear and medical gadgets to deal with persistent circumstances

As one would count on with an insurance coverage enterprise, UNH is investing its money reserves to earn extra yield on their cash, which makes up lower than 2% of the overall income.

With UNH’s shares up 4.5x during the last 10 years, buyers have been rewarded handsomely.

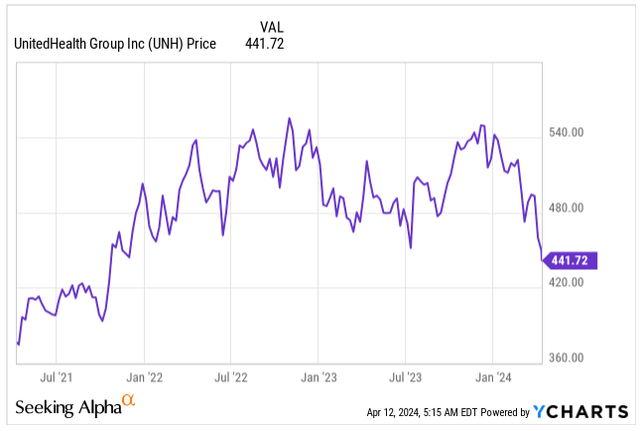

UNH is a superb instance of a top quality enterprise not often being on sale, however current challenges have pressured the inventory, at present buying and selling 20% under its ATH, giving long-term buyers an excellent probability to build up the shares at a less expensive valuation.

UNH worth (Looking for Alpha)

Elevated medical care utilization and bigger than anticipated medical advantages ratio in H2 2024 and 2025, are among the price pressures, which can be impacting the profitability of the enterprise. Medicare Benefit funds are anticipated to rise by 3.7% in 2025, above the preliminary estimates, sending chills by means of the business and impacting fellow Medicare and Medicaid suppliers, Humana (HUM) and CVS Well being (CVS).

If one situation isn’t sufficient, UNH was hit with an antitrust investigation. Interviews had been carried out with business representatives by the U.S. Division of Justice to find out the potential affect on the sector following among the acquisitions made by its well being service arm, Optum. Whereas no lawsuit has been stuffed but, the main dimension of UNH’s enterprise could also be seen as a monopoly-like risk, which may spur additional investigations into the corporate’s practices.

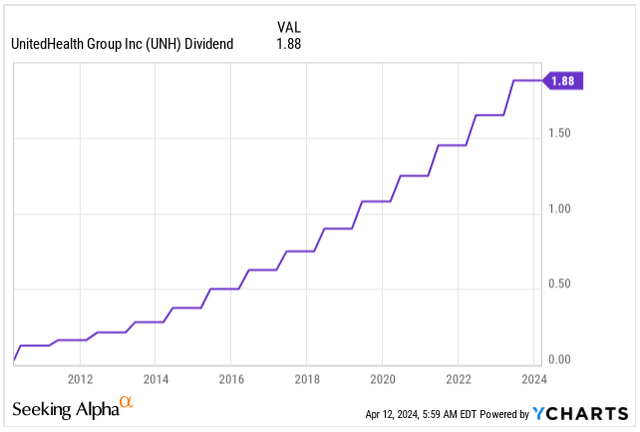

UNH stays top-of-the-line dividend progress shares cash can purchase at the moment, rising its dividend by 61x since 2010. The dividend at present stands at $1.88 per share or 1.7% dividend yield.

The dividend yield is low, however you shouldn’t be shopping for UNH for its fast yield, as a substitute you should purchase it for its DGR which has not slowed down even within the final couple of years, with the final enhance of 14% again in June 2023.

I’m anticipating the dividend progress will proceed within the mid-teens for the rest of the 2020s. In the event you purchased the inventory 10 years in the past, at the moment your yield-on-cost can be a horny 9.92%.

UNH Dividend (Looking for Alpha)

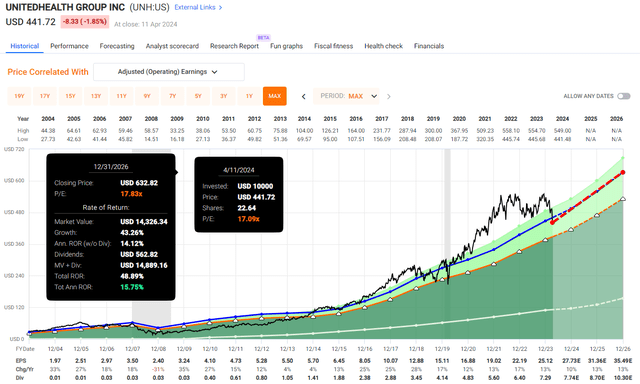

Within the face of current challenges, the inventory has pulled again from a stretched valuation stage of +20 P/E, that we now have gotten accustomed to since 2020.

Immediately, the inventory is buying and selling at a blended P/E of “solely” 17.09x, barely under its 20-year common of 17.83x.

The historic EPS progress has averaged at 14.81% since 2003 and analysts polled by S&P World are forecasting the expansion to proceed, albeit at a barely slower tempo:

- 2024: EPS of $27.73E, YoY progress 10%

- 2025: EPS of $31.36E, YoY progress 13%

- 2026: EPS of $35.49E, YoY progress 13%

Although the valuation has an opportunity to contract additional with the unhealthy press taking its toll on the inventory, shopping for the inventory anyplace under $450 per share presents an excellent long-term alternative.

I’ve already doubled-down on my current place at round $445, and I’m planning on doing the identical if the inventory drops under the $420 mark.

Needless to say UNH is a high-quality enterprise benefiting from an growing old inhabitants within the western-world which tends to make use of extra healthcare providers, creating pure demand for the corporate’s providers and merchandise.

For my part, the inventory’s honest valuation is round 17x its earnings and with the forecasted EPS progress, I’m in search of annual 15%+ whole returns over the subsequent three years.

UNH Valuation (Quick Graphs)

Prologis, Inc. (PLD)

Prologis operates as a world logistics behemoth and with the market cap of $113B it is the most important REIT on the earth, adopted by American Tower (AMT).

Although you may not be acquainted with PLD being largely a B2B-oriented firm, there’s a good probability the products to procure from Amazon (AMZN) or House Depot (HD) had been dealt with in one among PLD’s warehouses as the corporate shops, fulfills shoppers’ orders and manages returns for lots of the world’s largest retailers.

Again in 2022, it was estimated that roughly 3% of the world’s $95 trillion GDP has been processed by means of PLD’s distribution facilities, that are largely discovered close to main cities.

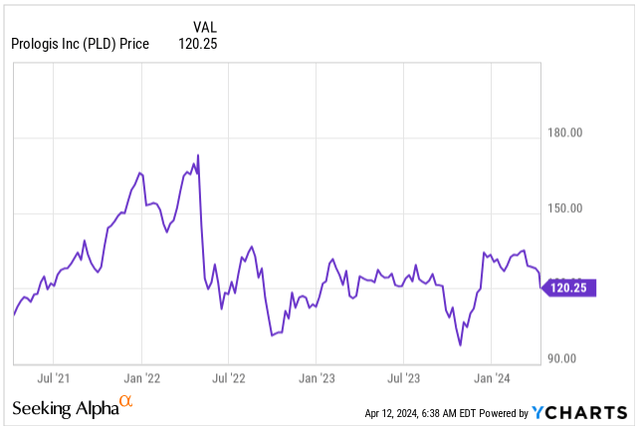

On the finish of 2023, I made PLD one among my largest REIT holdings, through the time of peak pessimism pushed by excessive rates of interest in U.S. and Europe and referred to as the corporate a “High REIT choose for 2024”, given its strategic place benefiting from tailwinds of ever-increasing demand for e-commerce and low cost valuation in relation to its ahead progress.

Now, as client costs rose 3.5% from a 12 months in the past in March, greater than anticipated, the fears of delayed charge cuts had been awoken once more.

Expectations had been for the Fed to start out chopping charges in June, however now these expectations are being pushed again to Q3-This fall 2024, sparking fears that REITs must refinance their loans at increased charges, which may harm their backside line.

PLD Value (Looking for Alpha)

Increased refinancing prices are an actual risk for a lot of REIT’s, together with PLD, but it is occasions like these when buyers have the power to purchase prime quality corporations at extra cheap valuations.

PLD, with a credit standing of “A” by S&P World, has a lower than 5% probability of going bankrupt within the subsequent 30 years.

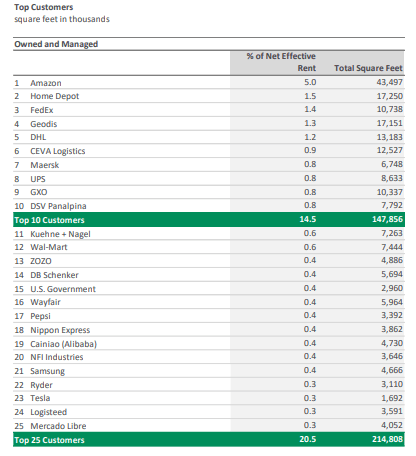

The corporate is well-diversified, with no single tenant exceeding 5% of its internet efficient hire and high 25 clients making up solely 20.5% of the hire collected.

Whilst some retail companies in its portfolio are vulnerable to cyclical weak spot if the economic system slows or enters a recession, the listing is dominated by well-renowned companies and long-term companions.

PLD High Prospects (PLD IR)

PLD’s present dividend of $0.96 or dividend yield of three.2% isn’t the very best, particularly in comparison with different high quality REITs equivalent to Realty Earnings (O) with a 5.9% yield or STAG Industrial (STAG) paying a 4% yield.

If the fast yield is simply too low to your liking take into account that PLD’s administration is dedicated to rewarding shareholders with nice DGR, rising the dividend by 243% since 2010, with the final enhance of 10% again in February 2024, regardless of the headwinds the business is dealing with.

Remember, through the Nice Monetary Disaster, PLD reduce its dividend to retain money and restructure the enterprise. With the overall consensus amongst buyers being that corporations chopping their dividends typically underperform the market, PLD has managed to outperform the S&P 500 (SP500) in whole return by greater than 120% since 2010, proving the naysayers unsuitable.

Going ahead, I’m anticipating PLD to continue to grow its dividend within the low double-digits, rewarding shareholders, so long as rates of interest don’t spike up even additional.

Within the face of those challenges, the valuation of PLD has taken a success, however the firm isn’t buying and selling at a dust low cost valuation, like another REITs.

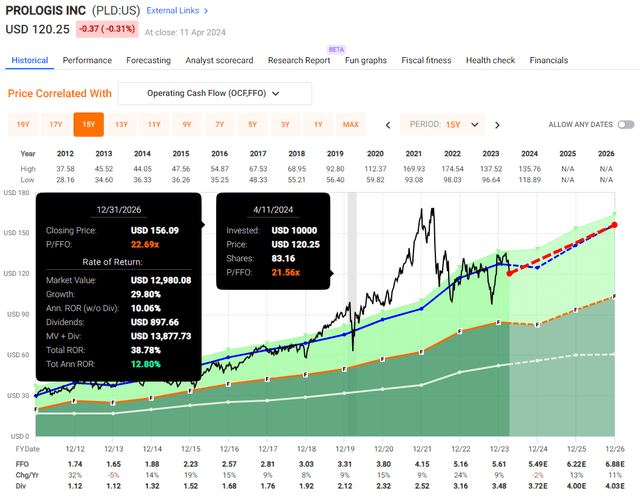

The REIT is at present priced at a blended P/FFO of 21.56x, barely under its 15-year common of 22.69x, implying a small low cost.

PLD has managed to develop its FFO by 11.63% yearly since 2010 and whereas 2024 is anticipated to be a 12 months of detrimental progress given the challenges, the FFO progress ought to resume in 2025 at an analogous stage as we had been traditionally accustomed to:

- 2024: FFO of $5.49E, YoY progress -2%

- 2025: FFO of $6.22E, YoY progress 13%

- 2026: FFO of $6.88E, YoY progress 11%

I’ve doubled-down on the inventory already again in October 2023, when the value dropped under $100 per share, nonetheless, at the moment presents an excellent alternative for long-term buyers as effectively.

After all, there’s a threat the inventory could pull again even additional, particularly if the subsequent CPI report is available in above expectations, doubtlessly prompting the Fed to take care of the elevated charges for longer, however any drop under $100 per share ought to be seen as an incredible alternative to build up much more shares on this dividend compounder.

For my part, it is honest to count on the inventory to be buying and selling at round its historic valuation of 22.69x its earnings for the rest of the last decade because the enterprise panorama improves, doubtlessly delivering 12.8% whole annual returns for buyers shopping for the inventory at at the moment’s worth of $120.

PLD Valuation (Looking for Alpha)

Takeaway

Figuring out companies which is able to compound wealth over an extended time frame is not any straightforward process.

One ought to concentrate on prime quality market leaders, robust moat corporations with little threat of their core income streams being disrupted by new expertise or new entrants, and keep away from overpaying for nice companies.

In at the moment’s market, the place valuations are stretched by standard considering, it is troublesome to be a cut price hunter.

But, I’ve discovered two companies, UnitedHealth and Prologis, which got here below stress on account of business headwinds and market circumstances, providing buyers doubtlessly enticing entry ranges with dividend yields moderately on the decrease finish, however robust DGR which may compound to excessive yield-on-cost over an extended period of time.