JHVEPhoto

Superior Micro Gadgets, Inc. (NASDAQ:AMD) barely surpassed consensus expectations with its earnings launch for the first-quarter interval, posting per-share earnings figures of $0.62 (in opposition to market estimates of $0.61) on revenues of $5.47 billion (in opposition to market estimates of $5.46 billion).

AMD additionally generated $123 million in internet earnings ($0.07 per share), marking a big turnaround from the -$139 million loss (equal to -$0.09 per share) throughout the identical interval final 12 months. Different areas of word may be present in AMD’s knowledge middle figures, as the corporate’s MI300 AI chip helped the phase submit substantial annualized progress of 80% throughout the interval.

Moreover, the corporate now anticipates 2024 AI chip gross sales figures to succeed in $four billion, which additionally marks a large enhance from the January steerage (calling for 2024 AI chip gross sales of $3.5 billion). On the adverse facet, AMD’s gaming phase posted annualized declines of 48% (at $922 million) as a result of important gross sales weak spot in {hardware} designed for gaming PCs and gaming consoles, such because the PlayStation 5 from Sony (SONY). Nevertheless, regardless of this space of weak spot, the corporate continued to point out power in its desktop CPU phase with annualized positive aspects of 85% (at $1.four billion in gross sales) for the first-quarter interval.

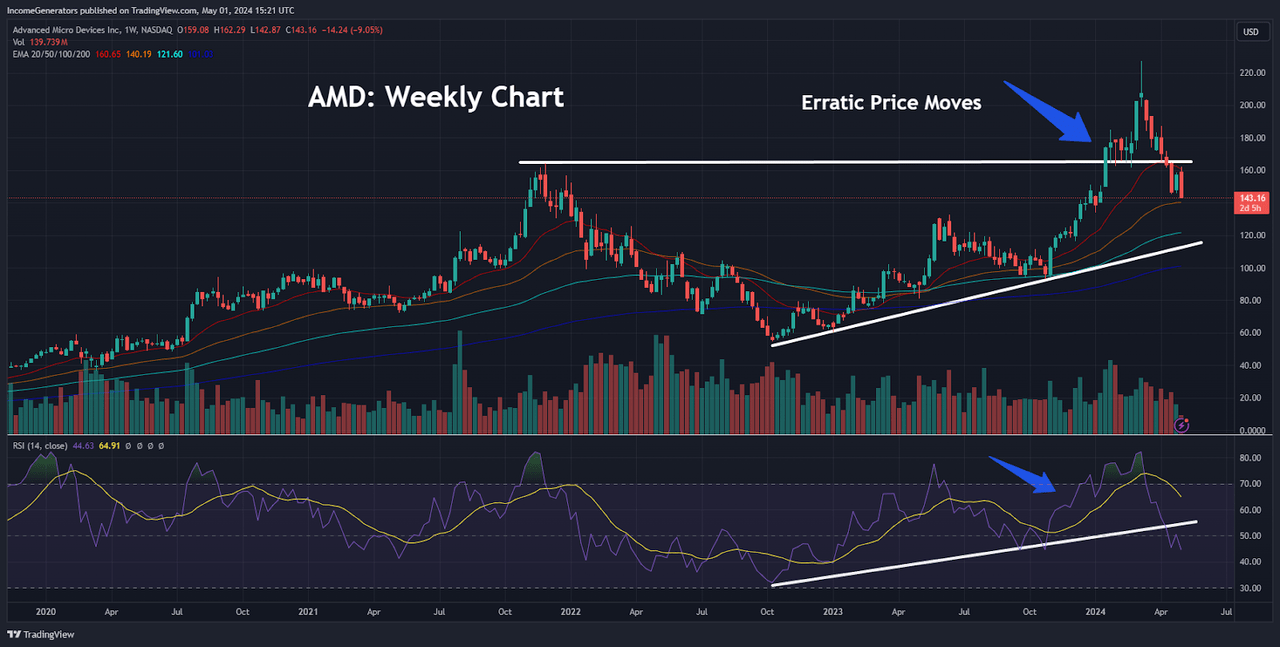

AMD: Erratic Worth Strikes (Revenue Generator by way of TradingView)

Sadly, reasonably optimistic surprises don’t appear to be receiving favorable responses within the inventory market in the mean time – and AMD is wanting like the newest instance of promoting strain. Maybe, the perfect instance of this adverse development may be discovered within the post-earnings response that was seen with Meta Platforms (META) and our prior protection of those occasions may be discovered right here.

In AMD’s case, share value exercise is perhaps in an much more susceptible place (when issues from a longer-term perspective), given the erratic development strikes which have already taken place on the weekly charts. Particularly, we will see that vital resistance ranges from November 2021 (at $164.46) had been damaged to the topside within the bullish impulse value transfer that occurred in January 2024.

In most situations, the sort of value can be thought-about to be a extremely optimistic occasion, with an expectation for important follow-through to the upside. Given the eventual spike excessive that was recorded in early March 2024 (at $227.30), we will make the argument that this assertion would have been true. Nevertheless, the inventory’s incapacity to keep up these highs – and the final word decline again via this vital value zone – calls that preliminary rally into query, and makes the long-term uptrend look like far more susceptible in its foundations.

Additional proof supporting this bearish outlook may be discovered within the weekly indicator readings from the Relative Energy Index (RSI), which started recording bullish tendencies in October 2022. In fact, this optimistic indicator studying was capable of preserve itself (and look fairly wholesome) till this most up-to-date downturn decrease, and the chart above exhibits the eventual draw back break of this technical occasion.

In the end, after we mix all of those elements (spike highs from $227.30 making a Doji sample and failing, violation of resistance-turned-support ranges at $164.46, damaged uptrend in weekly RSI indicator readings), it turns into very tough to make a reputable bullish argument for AMD share costs from the longer-term perspective.

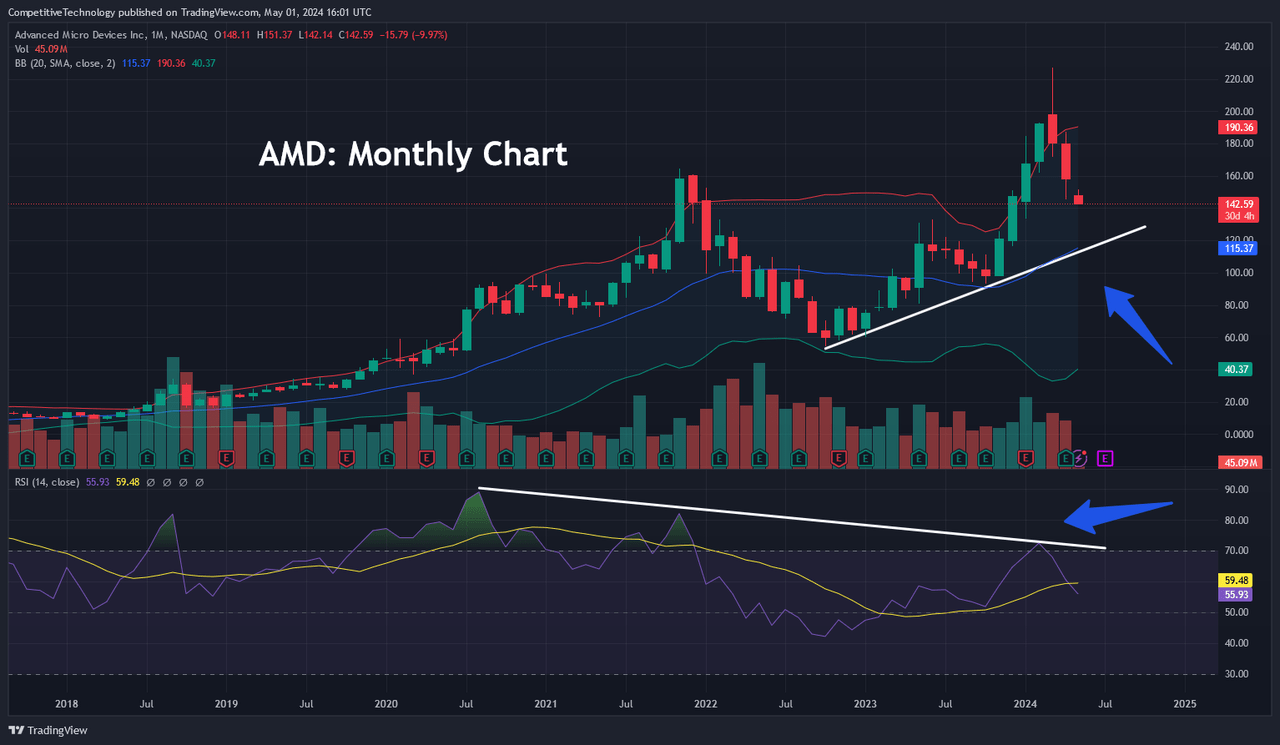

AMD: Month-to-month Chart (Revenue Generator by way of TradingView)

With this outlook in thoughts, it is crucial for merchants to begin searching for potential help zones that may include draw back exercise going ahead. If we take a look at the month-to-month charts, we will see {that a} minor uptrend started to kind in October 2022. If this construction can handle to carry, potential help zones may be discovered close to the $120 deal with. Right here, you will need to word that month-to-month indicator readings within the RSI stay bearish and are fairly removed from falling into oversold territory. On stability, this means that the latest downturn in share costs nonetheless has extra room to increase to the draw back.

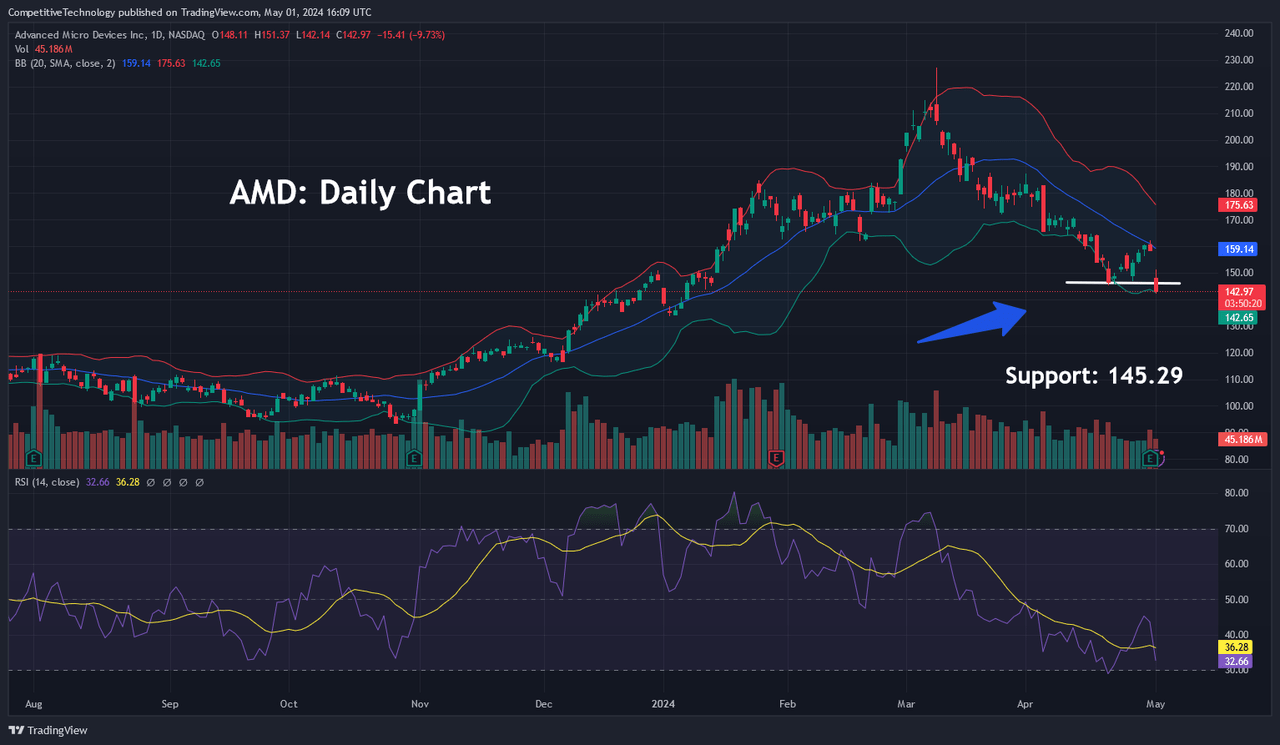

AMD: Every day Chart (Revenue Generator by way of TradingView)

On the every day charts, we will see that short-term help ranges are breaking in a comparatively constant trend. Most lately, the inventory’s value lows from April 19th, 2024 have now been invalidated, and this bear transfer has really despatched AMD shares via the decrease Bollinger Band.

We will pair this occasion with the truth that every day RSI readings are approaching oversold territory – and this does recommend that promoting strain might begin to abate quickly. The one downside with this outlook is the truth that we do not need a lot accessible in the best way of historic help ranges, and this means that there will likely be no clear “line within the sand” for merchants to begin inserting purchase orders in anticipation of an upside reversal.

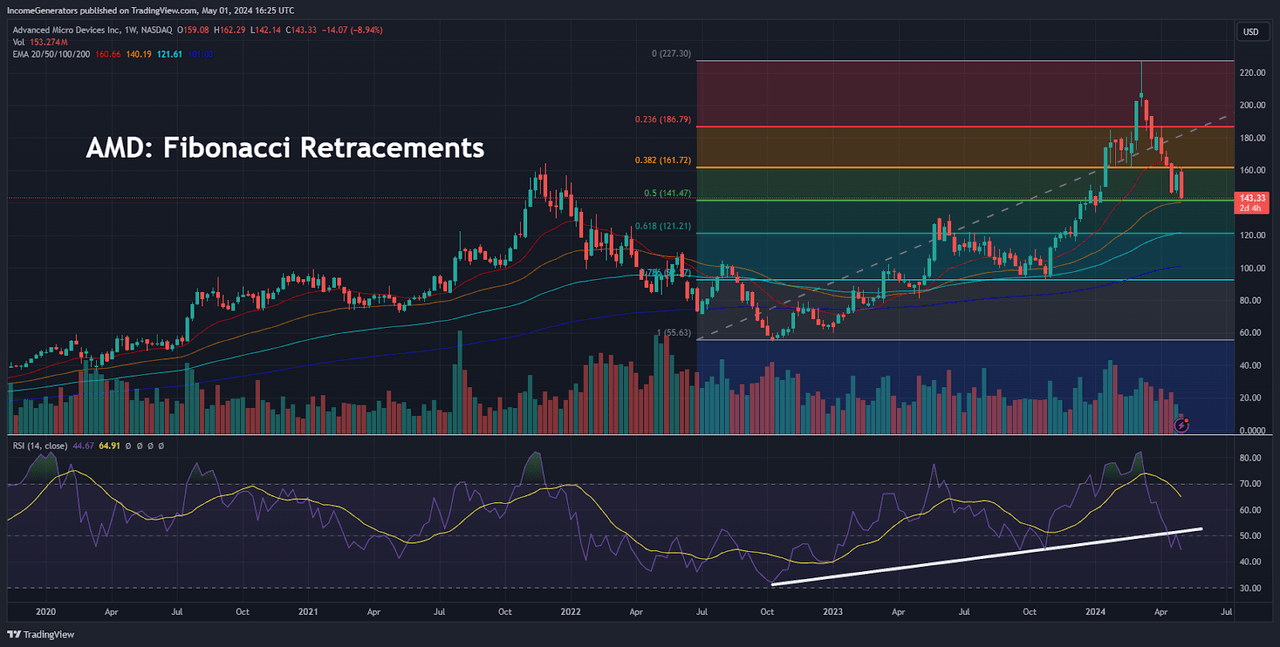

AMD: Fibonacci Retracements (Revenue Generator by way of TradingView)

Lack of historic help ranges will depart Fibonacci retracement as the first technique of figuring out draw back help zones, and right here we will see that AMD is presently contesting with 50% retracement of the dominant bull wave which prolonged from October 2022 to March 2024. Apparently, this degree additionally comes inside shut proximity to the inventory’s 50-week exponential shifting common – and this might assist include promoting strain going ahead. Nevertheless, it seems that we’re going to be forming a Bearish Engulfing candle this week – and we do have the damaged uptrend within the weekly RSI indicator, so it appears unlikely that this will likely be sufficient to supply a lot aid for AMD bulls.

From right here, the subsequent Fibonacci help zone may be discovered with the 61.8% of this aforementioned value transfer, which is positioned close to $121.20. Surprisingly, this Fibonacci degree is one other space that falls inside shut proximity to exponential shifting averages (on this case, we’re wanting on the 100-week exponential shifting common). If costs handle to fall to those ranges, will probably be vital for merchants to reassess the weekly RSI indicator readings as a result of at that stage it’s fairly potential that we are going to have fallen into oversold territory – and this may current new shopping for alternatives at the moment.

Conversely, if costs fall via the 61.8% Fibonacci retracement zone, we won’t have one other historic help degree till we attain the lows from October 2023 (at $93.12), that are positioned lower than $1 away from the 78.6% Fibonacci retracement of the inventory’s dominant value transfer. Total, the market doesn’t look like displaying a lot curiosity within the slight earnings beats that AMD was capable of report throughout the first-quarter interval. Given the latest promoting strain seen in share costs, we consider that it’s time for AMD bulls to begin taking a extra defensive stance and determine help zones to the draw back earlier than establishing countertrend positions in anticipation of a bullish reversal.