hakule/iStock through Getty Pictures

Palantir (NYSE:PLTR) reported a serious beat-and-raise of their Q1’24 earnings launch on Might 6, 2024, and was met with a shocking -15% decline of their share value instantly following. Regardless of the near-term value motion, I stay adamant in Palantir’s development story and imagine that with their high-touch AIP boot-camp technique, the agency will understand considerably greater development and margin growth than what Wall Avenue consensus estimates counsel. I reiterate my STRONG BUY suggestion for PLTR shares, with a value goal of $25.95/share at 17.66x eFY25 value/gross sales.

Remember to assessment my earlier reviews overlaying Palantir:

Palantir-Oracle Partnership Brings Each Corporations Super Upside

Palantir: This Is Simply The Starting

Palantir Has The AI Edge

Palantir Operations and Monetary Forecast

Palantir reported a robust Q1’24 with a beat-and-raise to income steering and adjusted working earnings because the agency realizes energy of their AIP boot-camp program. Administration got here into their Q1 earnings name assured of Palantir’s skill to proceed to tackle market share for AI purposes past GenAI, suggesting that the agency’s platform has the flexibility to automate operations past opponents’ capabilities. One instance administration supplied on the decision was that Normal Mills was saving $14mm yearly with a partial deployment of Palantir’s platform. It has change into fairly clear that Palantir’s software program platform isn’t only a chatbot, however a software program package deal that gives corporations the flexibility to avoid wasting materially on opex and enhance enterprise processes. I imagine that with administration’s hands-on strategy, AIP boot camps have confirmed themselves efficient in each showcasing the purposes and constructing a baseline for what corporations can count on from AI purposes. Given the novelty of leveraging LLM knowledge, this stage of contact ought to present Palantir continued development in income technology, whether or not the enterprise purchases the product outright or continues by means of their POC course of. I imagine that this issue alone is a serious contributor to Palantir’s success in rising their industrial buyer base, in addition to drive their skill to cross-sell and increase their TCV throughout enterprises. One other issue that performs an enormous position within the buyer acquisition and growth course of is that Palantir’s engineers work with enterprises in exploring use instances that may in the end save the agency in prices, optimize and automate enterprise processes, and guarantee there aren’t any missed gross sales alternatives.

Administration remained exceptionally optimistic of their platform’s skill to outperform competing platforms, suggesting that Palantir’s software program outpaces different corporations to the purpose that they’re not thought of opponents.

I do not imagine now we have opponents. So, I do not imagine within the US industrial market now we have competitors. I do not imagine within the US authorities market now we have competitors. I do not — I feel that is the explanation Ukraine and Israel purchased our product. We’re differentiated as a result of with a purpose to really make AI work, you want an ontology. Nobody has an ontology.

Alex Karp, CEO

Although it is a very daring assertion to make, it seems to be true to a sure diploma. Whereas nearly all of conversations over AI revolve round GenAI, Palantir’s platform goes past GenAI throughout their platforms and interesting in broader knowledge evaluation and enterprise course of enhancement. AIP shouldn’t be solely a platform for builders to develop on, however supplies prebuilt options that may be utilized to a enterprise’s knowledge. Although C3.ai (AI) supplies a competing platform to Palantir’s AIP, C3.ai’s AI platform is personalized extra on a per-customer, per-industry foundation. I imagine this supplies Palantir an edge through which the agency can extra broadly goal new buyer acquisitions whereas permitting for the platform to be tailor-made to the corporate’s particular {industry} wants, and never the opposite manner round.

Company Studies

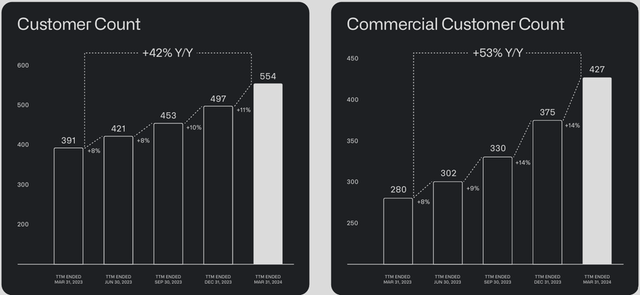

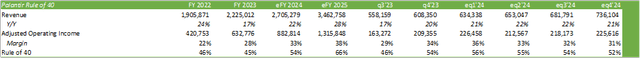

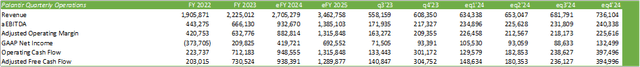

The deal stream throughout Q1’24 was exceptionally sturdy, with 87 offers closing with a worth of at the very least $1mm, 27 over $5mm, and 15 of those offers over $10mm. This efficiency translated to a development fee of 21% year-over-year on the prime line that drove substantial adjusted working earnings margin growth to 36%, up from 24% a 12 months in the past. This excessive stage of development and margin growth drove the agency’s Rule of 40 to 56%, up 2% sequentially, and 15% from the earlier 12 months.

Company Studies

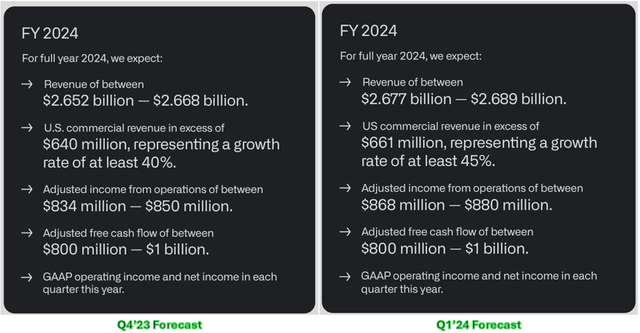

Regardless of the sturdy working efficiency, working capital led to a year-to-year decline in money stream from operations and adjusted free money stream, which seems to solely be a near-term headwind. Administration forecast a serious upswing in adjusted free money stream technology by means of the period of FY24 within the vary $800-$1,000mm, a 10-37% enchancment from FY23 money stream technology.

Trying to Q2’24, administration forecasts income development within the vary of $649-$653mm with an adjusted working margin within the vary of $209-$213mm. Although it is a sequential compression to the working margin, the forecast requires 55-58% development with year-over-year margin growth within the vary of 32-33%, up from 25% a 12 months in the past.

Company Studies

Administration additionally upped their FY24 forecast throughout the working assertion and expects the next industrial engagement fee for the 12 months. Given Palantir’s skill to assist enterprises save on prices whereas optimizing operations, the agency might probably understand continued development regardless of the macro setting. Although AIP is a big capital funding for corporations to tackle throughout occasions of money preservation, AIP might present enterprises the flexibility to avoid wasting in opex properly past the price of utilizing the platform.

Company Studies

Forecasting out by means of FY25, I do anticipate operations to scale with gross sales experiencing modest margin growth. I imagine that Palantir’s know-how supplies corporations with the bandwidth to increase operations with minimal capital investments going ahead. Regardless of administration’s initiative to increase their gross sales and advertising and marketing staff, I do imagine that they’ll stay prudent in scaling with income and never overshoot development. One factor that stands out to me is Palantir’s proactive strategy to gross sales with their hands-on boot camps. Even when this doesn’t drive an instantaneous sale, it would create a baseline for expectations for what an AI-enabled platform ought to be able to. I imagine that it is a long-term technique that may repay in each the near-term and long-term as corporations understand the cost-saving capabilities Palantir’s platform has to supply.

Taking a look at income development, I do anticipate Palantir to develop over consensus estimates given these elements. I imagine that Palantir’s high-touch gross sales strategy will drive stronger development than what Wall Avenue consensus has baked into their estimates. Palantir isn’t simply merely bringing their platform to the AWS market; the gross sales staff is utilizing potential prospects’ stay knowledge to supply actual use instances, not simply hypothetical fashions and purposes. Although I stress this for almost all of my funding thesis on Palantir, I do imagine this issue is a serious differentiator for the agency of their skill to usher in extra prospects.

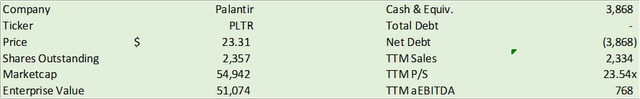

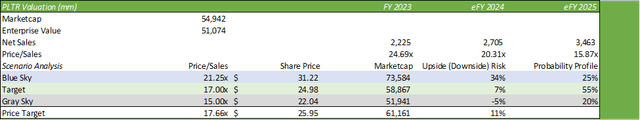

Valuation & Shareholder Worth

Company Studies

PLTR shares took a modest beating after the Q1 earnings launch, with shares declining -15% following the discharge. Shares have recovered because the decline however nonetheless stay beneath their pre-earnings value stage. Regardless of the difficult shareholder help following earnings, I do imagine PLTR shares can supply buyers vital worth going ahead because the agency continues to develop each their top-line and margins past their opponents. I keep my STRONG BUY score for PLTR shares with a value goal of $25.95/share at 17.66x FY25 value/gross sales.

Company Studies