Matteo Colombo

Funding Abstract

Corporations within the fundamental materials sector have delivered surprisingly good market returns throughout the primary half of 2024. Given our thesis on the fabric sector first introduced again in Q3 2023, this has been pleasing to see.

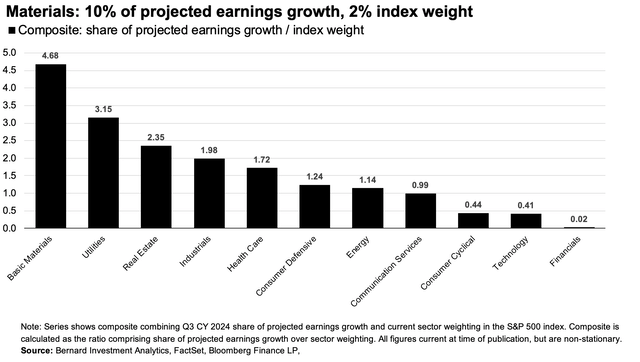

I advocated allocating to the supplies area again then, because it appeared attractively positioned on the worth/worth matrix. On the time, the sector held simply 2% of the notional worth of the market cap-weighted S&P 500 Index and was projected to develop earnings by 10% over the fourth to coming 12 months. This – adopted by the utilities sector – introduced a beautiful composite, as seen in Determine 1.

Determine 1. Observe: Chart is retrieved from earlier evaluation in Q3 2023.

Writer, from earlier evaluation in Q3 2023

It has been pleasing to look at quite a few firms in the sector monitor increased, whilst broad fairness markets have begun to point out indicators of exhaustion at this level of the yr.

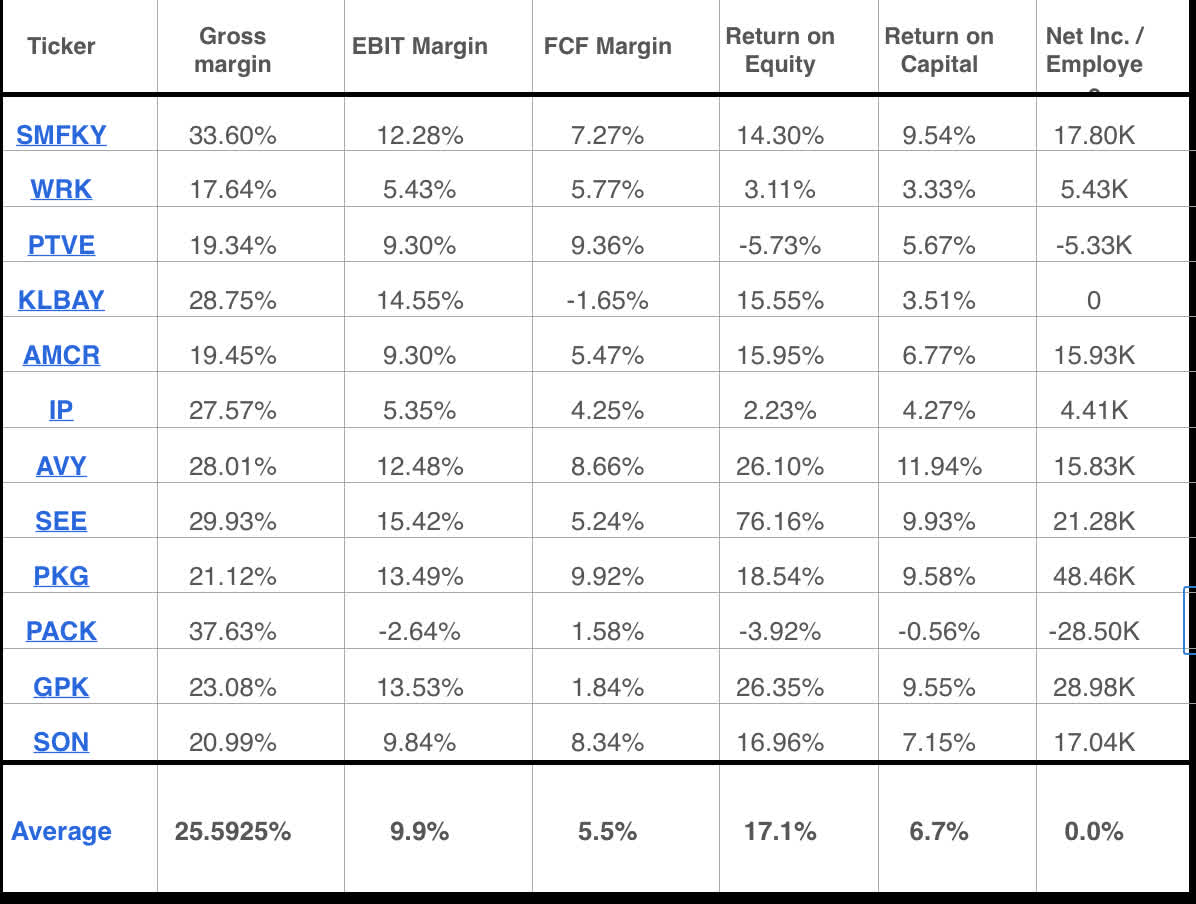

The paper and plastic packaging merchandise business is one undercover pocket inside the supplies area. The comparatively small group operates on common gross margins of 26% and pre-tax margins of about 10% (Determine 2). It produces pretty lackluster returns on capital of 6 to 7%.

Determine 2. Plastic and packaging merchandise business key statistics

Writer, information retrieved from Looking for Alpha

Throughout the business sits WestRock Firm (NYSE:WRK), presently buying and selling at 26x ahead earnings with a ahead dividend yield of two.2%.

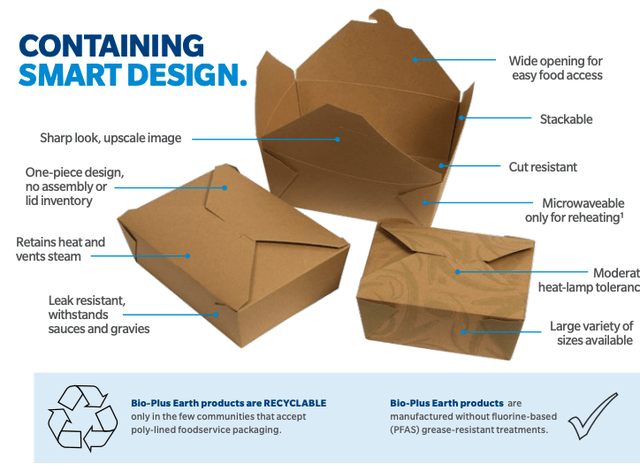

WRK is within the fibre-based paper and packaging enterprise. Its mission is to supply its clients with sustainable paper and packaging. The corporate says that by 2025, all its merchandise might be “recyclable, compostable or reusable.” The photographs under present examples of a few of its merchandise.

The corporate reviews operations throughout Four companies – (i) corrugated packaging, (ii) shopper packaging, (iii) international paper, and (iv) distribution. The 2 divisions I’m most interested by are (i) and (iii). The corrugated packaging section books revenues from the sale of corrugated containers and merchandise. Whereas its shopper packaging operation sells merchandise resembling folding cartons. It is a pretty specialised area. WRK consequently serves quite a few domains, together with the meals + beverage, healthcare, residence + magnificence, processed meals, industrial and e-commerce markets. This breadth of protection means it has >300 manufacturing amenities positioned throughout the globe.

Determine 2a. The “Bio-Plus Earth” meals containers; a part of the folding cartons line in “shopper packaging”.

Supply: Retrieved from WestRock web site. See: “folding cartons”.

Determine 2b. Examples of the “EnduraLiner” product line within the “international paper” division.

Supply: Retrieved from WestRock web site. See: “Paper options”

Within the first half of the corporate’s fiscal 2024, it booked $4.Eight billion in corrugated packaging gross sales and $2.2 billion in shopper packaging revenues (observe: Q2 FY 2024 corresponds with Q1 CY 2024 for WRK). It additionally clipped $1.9 billion in international gross sales, and its distribution section did $561 million value of enterprise through the yr. In complete, it put up $9.48 billion of revenues within the six months ended March 31, 2024, down from $10.36 billion throughout the identical time in 2023.

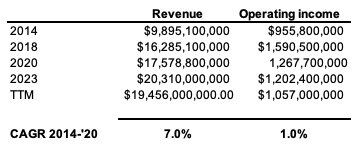

Lengthy-term efficiency has been regular and as anticipated for a corporation of this maturity. In 2014, the corporate put up $9.89 billion in income on $955 million of working earnings. It had grown to $16.2 billion in top-line gross sales on $1.66 billion of working revenue 4 years later. Final yr, this stretched to $20.Three billion on $1.2 billion of working revenue. Within the final 12 months of commerce, it has performed $19.5 billion value of enterprise and $1 billion of working earnings.

On this time-frame, gross sales have grown at a compounding fee of seven% per yr on flat earnings progress of 100 foundation factors (earnings are to be discovered right here as working revenue).

Determine 3.

Writer, information from Bloomberg Finance LP

One of many key issues that stood out to me when analyzing the corporate initially was the part of its reviews titled “strategic portfolio actions. “Check out this, from the Q2 FY 2024 10-Q: “We’re dedicated to bettering our return and invested capital in addition to maximizing the efficiency of our property.”

This instantly jumps out to me because it aligns explicitly with my core funding tenants. I like excessive returns on invested capital, too. And, I like firms that maximize the efficiency of their property. So this was instantly a standout.

Based mostly on my evaluation, WRK presents with compelling enterprise economics that recommend it’s a purchase on medium to long-term worth. Right here I’ll run via my findings underneath our “efficiency, well being, valuation” (“PVH”) framework. This hyperlinks to intrinsic valuation via return and invested capital and progress. Price purchase.

Q2 2024 earnings insights

It was a fairly flat quarter of enterprise for the corporate in Q2 fiscal 2024. WRK put up $4.7 billion of revenues, down from $5.Three billion the yr prior. The decline was underlined by an 8.7% pullback within the corrugated packaging section, compounded by a 13% decline in international division gross sales. Each had been pushed by a mixture of decrease common realized costs and weaker buyer volumes. I recommend that top-line progress was impacted by the corporate’s resolution to divest its inside partition enterprise in 2023. It could take a yr or 2 to digest this consequence totally.

It pulled this to adjusted EBITDA of $170 million, down 22% year-over-year because of the softer high line. It left the quarter with internet debt of $8.Four billion and $Three billion in accessible liquidity. It additionally produced $37 million in working money flows, and while that is down considerably on the prior yr, it’s nonetheless sufficient to fund operations internally. As an illustration, the corporate nonetheless invested $301 million towards capital expenditures and paid $78 million to shareholders by means of dividends through the quarter.

My evaluation of the second quarter outcomes exhibits that they had been largely in step with expectations, and the market had already digested the end result previous to the discharge. That is evidenced by the continued post-earnings drift in its inventory worth. Searching to 2025, consensus tasks 4% to five% top-line growth for the corporate, on 67% bottom-line progress, stretching as much as 17% progress in earnings the yr after. In my view, traders want to this earnings ramp favourably, which might internet $3.50 per share in 2025.

Enterprise economics supporting purchase score

In a commodity-like business the place substantial or extra capability exists, I’m instantly drawn to one in all two elements for every enterprise. These are post-tax margins and capital turnover.

I’ve already demonstrated the tremendously skinny working margins the businesses on this business do enterprise on. That is because of the commodity-like economics – merchandise will not be differentiated in any customized vital manner, such that these with manufacturing benefits (like working efficiencies or extremely proficient human capital) are the standouts.

The second level to contemplate is that due to the surplus capability, progress by way of further market share or greenback volumes just isn’t essentially achievable. What which means is, I am on the lookout for a mixture of excessive returns on legacy capital – that’s, the existing-invested capital – with exceptionally free money move for us to feast on because the investor.

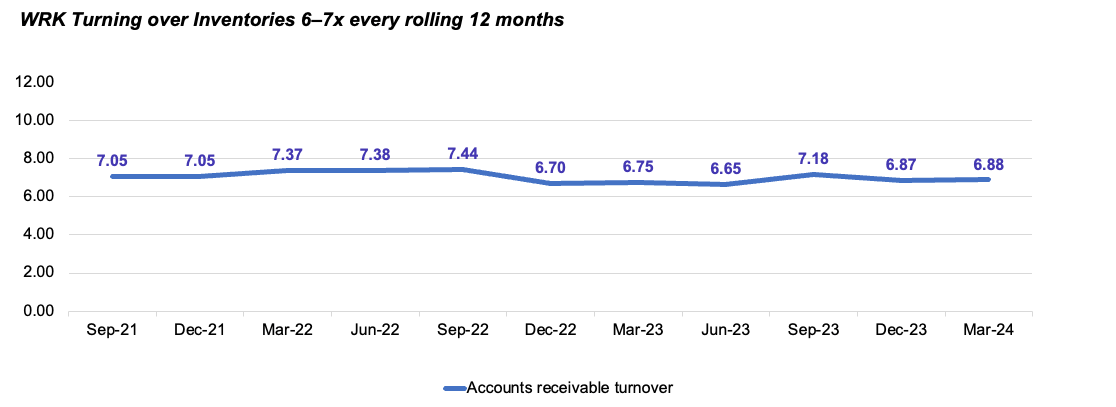

My view is that WRK matches this invoice. It achieves this via quite a few mechanisms. Firstly, it has a tremendously excessive fee of turnover on working capital, significantly stock.

As seen in Determine 4, stock turnover has 6-7x rolling 12-month interval since September 2021. It is a extremely environment friendly use of capital and ensures money is coming within the door rapidly and in giant sums. If the stock turns are 7x each rolling 12 months, it implies the corporate is promoting out its stock 1.7 occasions each month of the yr. This implies a $1 funding within the firm’s stock is recycled again to money in round 17-18 days. That is tremendously enticing for my part, and matches the invoice of what we try to search for – firms which can be rotating capital again to money at a quick tempo.

Determine 4.

Writer, firm filings

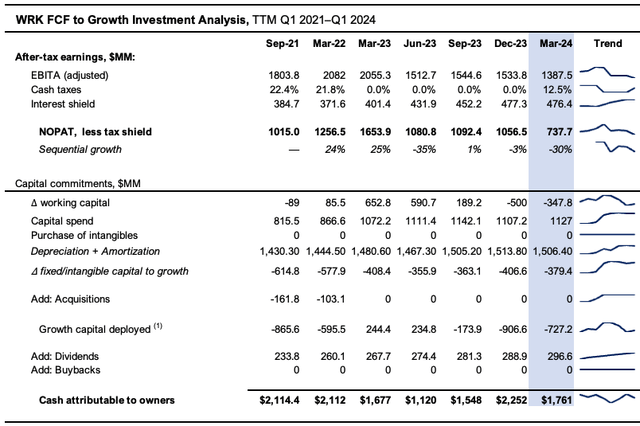

Determine 5 exhibits the impact of this on a rolling 12-month foundation since 2021. Right here, I’ve proven the free money move attributable to shareholders and/or for reinvestment in any case “progress funding”. Progress funding is outlined as all capital invested above the “upkeep capital cost”, together with acquisitions. The upkeep capital cost is approximated as the extent of depreciation and amortization every interval. Dividends are included within the remaining calculation of free money move. Solely that funding above the upkeep capital cost is taken into account right here.

As noticed, the corporate has not deployed substantial quantities of progress capital over this era. I’m not stunned about this, given the shortage of funding runway talked about earlier.

However what I’m tremendously happy to see is the truth that WRK is throwing off wherever from $1.5 billion -$2 billion {dollars} in free money move each interval on this rolling twelve-month foundation.

I discover it laborious to argue in opposition to an organization that may throw off $1-$2 billion in free money move in any case incremental capital required to take care of its aggressive place and develop is taken into account. That is the sort of firm I’m drawn to, and deserves a excessive valuation, for my part, given the excessive “money earnings” of the enterprise. As I’ll exhibit later, that is tremendously conducive to my views on the corporate’s valuation.

Determine 5.

Writer, Firm filings

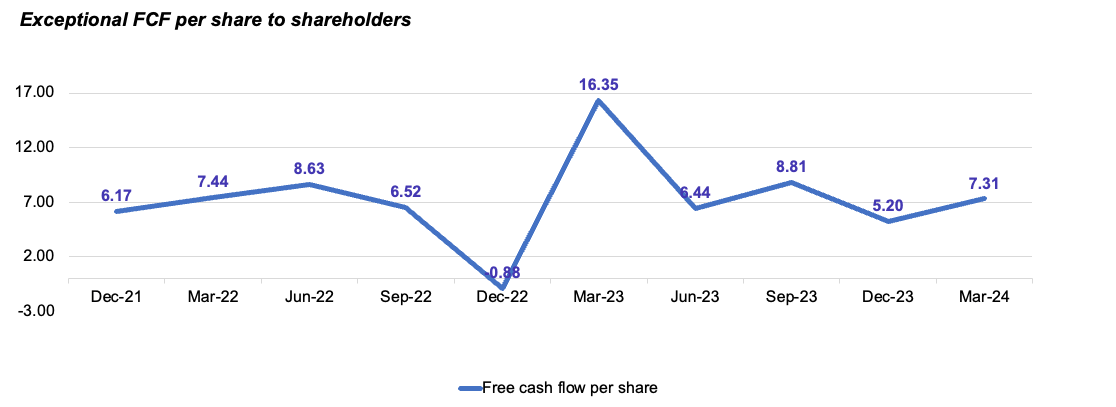

That is demonstrated on a per-share foundation in Determine 6. Solely as soon as within the final 2 to three years has the corporate thrown off lower than $5.00 per share in trailing free money move.

Determine 6. Trailing FCF per share

Firm filings, Writer’s chart

Projections of company worth at regular state

The truth that WRK just isn’t increasing the enterprise at a speedy tempo is actually not a deterrent, for my part. My constructive views on the corporate are constructed on its capacity to throw off distinctive levels of free money move every interval on an ongoing foundation. If the worth of a monetary asset is the current worth of its future money flows – which we firmly consider it’s – that is exactly the sort of firm that matches in nicely to a long-term fairness portfolio in my finest estimation.

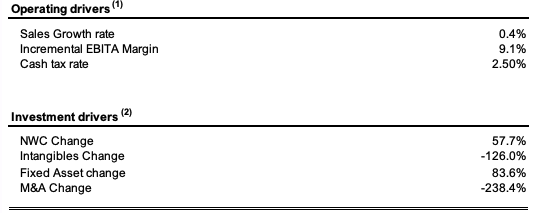

In that respect, I need to get a extremely good understanding of what the corporate can produce at its regular state of operations-that is, if it continues dancing to the identical tune because it has not too long ago. Determine 7 illustrates administration’s allocation choices from 2021 to 2024 on a rolling 12-month foundation. It additionally displays the corporate’s monetary efficiency. As anticipated, gross sales have been flat, increasing simply 40 foundation factors per interval. Pre-tax margins are barely above the business at 9%.

Apparently, there have been main divergencies in the place capital has flown to and from. Following the divestiture of the partition enterprise in 2023, capital allocation to acquisitions and intangibles has dropped considerably. To provide a brand new greenback of income, the corporate has wanted to take a position round $0.57 in working capital (primarily stock and receivables) together with $0.84 in mounted capital. The overall funding of ~ $ $1.40 per greenback of income progress has been methodically rotated into free money move, as I demonstrated earlier.

Determine 7. WRK capital allocation & monetary efficiency, 2021-2024 rolling TTM

Writer, firm filings

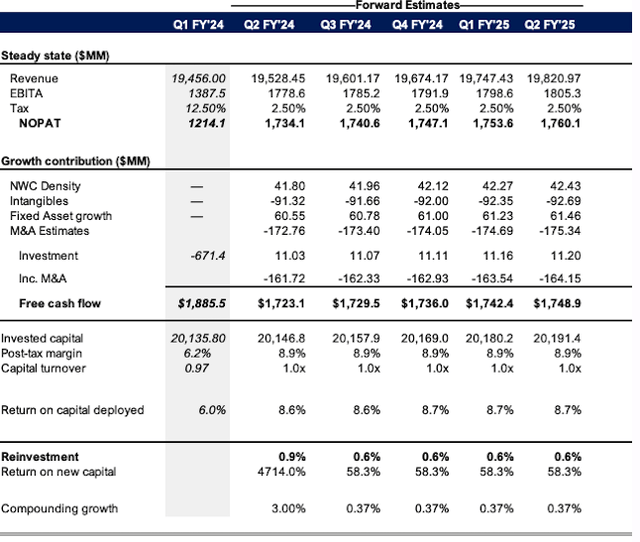

If it continues alongside these strains, my numbers venture the corporate to hit $1.75 billion to $1.Eight billion in pre-tax revenue this yr. Critically, my numbers additionally recommend it might throw off $1.7 billion in free money move after further divestments. I’d additionally venture gross funding of $45 million-$50 million every year out to 2025 to supply these figures, and that it might produce wherever from 8% to 9% return on capital over this era. That is tremendously conducive to valuation, as mentioned under.

Determine 8. Projections at regular state of operations

Writer’s estimates

Valuation

Buyers are paying a premium to purchase the corporate at this time at 22x trailing EBIT and about 24x trailing earnings. WRK additionally sells at simply at market at 1.Four occasions the corporate’s internet property. It is a dislocation in my opinion-on the one hand, it’s priced excessive relative to the earnings, however it’s priced low relative to the enterprise’s property.

That is exactly why linking the evaluation to intrinsic value-that is, taking a look at discounted money flows-is vital, and never simply multiples of guide worth for instance, which have a look at property with none context of money flows.

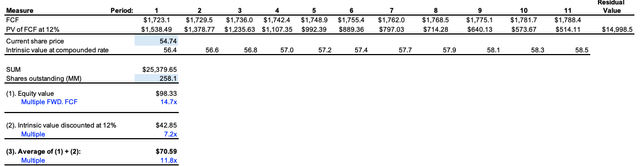

Projecting my estimates of free money move out over the following 10 years utilizing the regular state mannequin from above, and discounting these again at a 12% hurdle fee, the outcomes are proven under. I exploit that 12% fee as a result of it’s the long-term market common and the chance value of not holding the broad indices.

Doing so in discounting again at this fee will get me to a valuation of $98 per share, or $25.Three billion in market worth. Critically, a great chunk of the worth is within the regular state interval, not the persevering with worth interval (after the forecast interval). Combining this with a mannequin that reductions the return on capital and reinvestment charges (ROIC x reinvestment fee), I find yourself with a blended valuation of $70 per share, or 29% upside potential from the time of writing.

Determine 9.

Writer’s estimates

Conclusion

One of many issues I actually like about this valuation is that even at these questionable multiples, there look like comparatively comfortable assumptions baked into the present inventory worth. There are actually no progress assumptions, for instance.

The financial information, nevertheless, help the concept this firm is extremely productive on the free money move facet and helps a long-term valuation above the place it trades at this time. In that vein, I fee WRK a purchase with a $70 per share beginning valuation, seeking to $95 per share as a second goal over the three to 5-year interval. Price purchase.