coddy/iStock through Getty Photos

The above picture exhibits a nuclear gasoline bundle with gasoline pellets proven within the foreground. Just below one centimeter in diameter and just a little multiple centimeter lengthy, a single pellet in a typical reactor yields about the identical quantity of power as one tonne of steaming coal.

Centrus Power: Funding Thesis

Most of my articles for Looking for Alpha are primarily based on basic evaluation. On the identical time, I recognize different types of evaluation addressing behavioral facets of traders and the psychology of the market. However one of many lesser mentioned approaches on Looking for Alpha is strategic evaluation. I see a strategic alternative arising from the necessity for elevated manufacturing of enriched uranium for the anticipated big enhance in emissions-free base load nuclear energy reactors to help the roll-out of variable renewals.

A December 13, 2023 report by the Worldwide Atomic Power Company, known as for accelerating the deployment of low-emission applied sciences together with nuclear power to assist obtain deep and speedy decarbonization. This adopted a declaration made at COP28 by greater than 22 nations to advance the aspirational purpose of tripling nuclear energy capability by 2050. Statements by the IAEA mentioned how views have modified, demonstrating there’s now a worldwide consensus on the necessity to scale up this clear and dependable expertise to attain important objectives on local weather change and sustainable improvement.

From Centrus Power Corp. (NYSE:LEU) Q1 2024 earnings name transcript supplied by SA Premium,

Between HALEU and LEU, we see an amazing alternative to deal with a big and demanding market as the one publicly traded enrichment firm, and the one firm in the USA to carry needed licenses to supply each HALEU and LEU.

Different issues are the U.S., authorities’s need to finish reliance on Russia for enriched uranium provides for fueling U.S. nuclear energy stations, and the funding help the U.S. DOE is providing to U.S. firms to attain that goal.

Based mostly purely on strategic issues, I charge Centrus Power a Purchase.

However any funding carries dangers together with alternatives. Accordingly, I set out under a extra complete evaluation of the nuclear gasoline alternative and Centrus Power, together with its funds, its expertise, authorities help, the markets it operates in, and its potential opponents.

About Centrus Power, Nuclear Gasoline and Nuclear Energy Era

Centrus Power Corp. is effectively positioned to learn from the present renaissance of nuclear energy technology. The corporate already has a big nuclear reactor buyer base to which it provides Low Enriched Uranium (“LEU”) gasoline, sourced largely from Russia beneath long-term contracts. On the identical time, with help from the U.S. DOE, the corporate has been creating its personal LEU and HALEU (Excessive Assay Low Enriched Uranium) manufacturing functionality. Manufacturing has now commenced, albeit in small portions, and the corporate is poised to drastically broaden manufacturing. The world is more and more recognizing the necessity for some type of clear baseload energy to help variable technology renewables. In lots of jurisdictions, gasoline fired turbine “peakers” are seen as a method of sustaining electrical energy provides in durations the place, resulting from its variability, renewable power is unable to satisfy demand. Attributable to their emissions, these gasoline peakers are supposed to function solely when needed, with an expectation of lower than 5% capability utilization. Working a big and capital intensive gasoline technology enterprise at <5% capability is prima facie a really costly and uneconomic technique of offering firming capability for renewables, and there are nonetheless emissions. Enter Nuclear energy technology. Sure, the upfront capital prices are excessive. However flora is lengthy, availability is excessive, and nuclear is emissions-free baseload energy in a position to function 24/7 12 months spherical. The U.S. Nuclear fleet averages over 92% capability utilization, with the primary downtime being for changing spent gasoline rods, typically at intervals of 12 months to 2 years. Attributable to its excessive availability, nuclear technology within the U.S. offers ~18 to 19% of generated energy, regardless of having solely ~8% of technology capability.

Nuclear Gasoline Provide and Demand

Historic Uranium Manufacturing and Demand

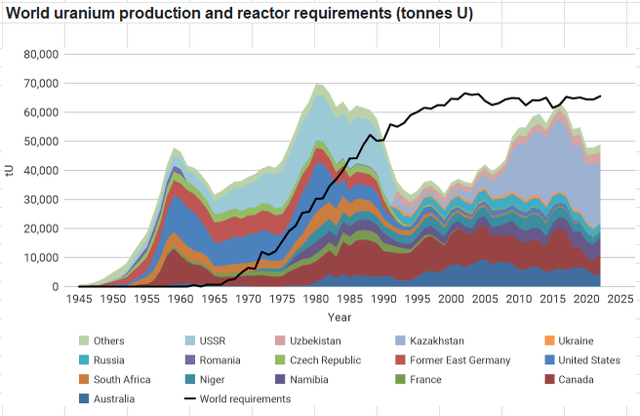

Determine 2 under from a publication by the World Nuclear Affiliation compares world uranium manufacturing to reactor necessities, over the interval 1945 to 2020.

Determine 2

World Nuclear Affiliation

Determine 2 exhibits there was a big extra of manufacturing adopted by shortfalls between manufacturing versus reactor necessities for a major interval. That is defined firstly by the nuclear arms race, requiring massive portions of uranium extremely enriched to 90%. This was adopted by nuclear disarmament treaties, leading to conversion of bomb grade uranium with as much as 25 occasions the enrichment to low enrichment gasoline for reactor use. Worldwide, till 2013, the conversion of army high-enriched uranium was offering about 15% of the world’s reactor necessities. Different sources of reactor gasoline embody recycled uranium and plutonium and re-enrichment of depleted uranium. A extra complete dialogue of nuclear gasoline provide could be discovered at World Nuclear Affiliation, linked above.

Outlook for World Uranium Manufacturing and Demand

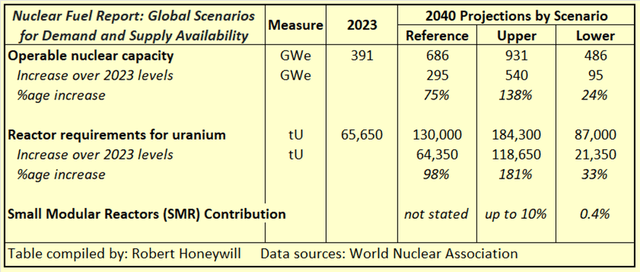

World Nuclear affiliation offers a report, International Situations for Demand and Provide Availability 2023-2040, final up to date 21 Might 2024. Excerpted from that report,

The report considers three eventualities, the Reference State of affairs, knowledgeable by authorities and utility targets and goals, the Decrease State of affairs, which assumes delays in implementing these plans, and the Higher State of affairs, which is underpinned by extra favorable circumstances, largely reflecting the targets introduced in lots of nations to attain net-zero carbon emissions, and the acceptance that nuclear energy will play an indispensable position in reaching this purpose.

I’ve summarized the report’s projections out to 2040 in Desk 1 under.

Desk 1

World Nuclear Affiliation

The report additionally notes,

Geopolitical instability, notably ensuing from the Russia-Ukraine battle has additionally led to elevated curiosity in nuclear energy for power safety and sovereignty.

Outlook for U.S. Uranium Manufacturing and Demand

Between 2009 and 2023, U.S. Uranium mines produced over Four million kilos per 12 months of U3O8, adopted by a decline to 50,00Zero kilos by 2023. The variety of working mines declined from 20 in 2009 to five in 2023. With will increase in uranium costs and the prospect of a nuclear renaissance, some outdated shut down mines are reopening and there’s elevated curiosity in new mine improvement. However the U.S. has solely ~1% of the world’s uranium sources, so most uranium necessities for a nuclear enlargement will likely be imported. At current, the U.S. imports a big portion of its necessities for nuclear gasoline within the type of Low Enriched Uranium (“LEU”) with the U235 content material elevated from the pure 0.7% stage to as much as 5%. The same old association is for no matter amount of LEU is bought (at LEU value), the customer offers the vendor with an equal quantity of pure uranium (earlier than enrichment) that will be required to supply the quantity of LEU acquired. In essence, the customer purchases solely the quantity of labor required to counterpoint the uranium, and replaces the uranium utilized by the vendor to create the LEU with a like amount of uranium. So if LEU is provided to a U.S. nuclear reactor from Russia, the equal amount of pure grade uranium can be provided again to Russia from uranium mined within the U.S. or from anyplace else on the planet. In actual fact, due to low reserves and mine manufacturing within the U.S. the alternative uranium would principally come from nations outdoors the US, corresponding to Australia, with the most important uranium reserves of any nation at ~28% of the world complete. This October 2022 World Nuclear Affiliation publication offers a extra in depth dialogue of the uranium enrichment course of.

World Nuclear Reactor Gasoline – Manufacturing & Provide Sources, and Necessities

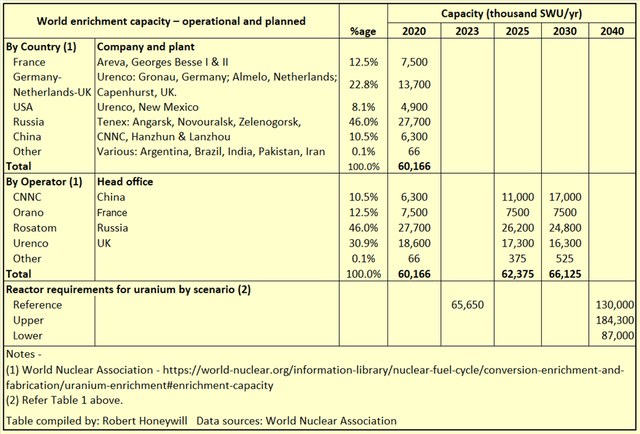

Desk 2 summarizes World Nuclear Affiliation knowledge on present and projected world nuclear gasoline manufacturing capability and necessities.

Desk 2

World Nuclear Affiliation

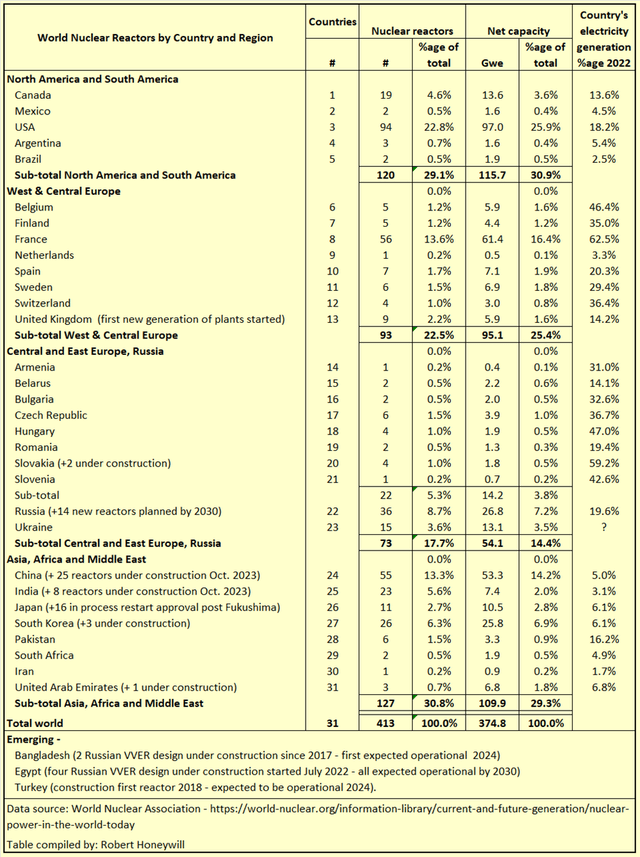

Desk 2 exhibits on the date the statistics had been compiled, there was no US owned operator producing enriched uranium. That is regardless of the U.S. having ~23% of the world’s nuclear reactors and a internet ~26% of nuclear energy producing capability. Desk Three under summarizes World Nuclear Affiliation statistics for nuclear reactors by nation world wide.

Desk 3

World Nuclear Affiliation

Desk Three exhibits the U.S. depends on nuclear energy technology for ~18% of its complete electrical energy technology, whereas Desk 2 exhibits no U.S. enterprise is among the many handful of homeowners of current uranium enrichment operators. That is in distinction to Russia, the place the state-owned firm Rosatom, by way of Tenex, controls 46% of the world’s present uranium enrichment capability. To make issues worse, U.S. nuclear reactors depend on Russia for a lot of their enriched uranium gasoline provides.

The U.S. is rightly involved at this example and as per a U.S. Division of State press assertion dated Might 14, 2024, suggested the import of Russian uranium merchandise into the USA is prohibited as of August 12, 2024, topic to a waiver course of by way of January 1, 2028 throughout a interval of firm of home provide. On the identical time, $2.72 billion in appropriated funds was launched to the Division of Power to spend money on home uranium enrichment, additional advancing a safe and resilient world nuclear power gasoline provide.

US Nuclear Growth, Reactor Gasoline Manufacturing and Provide Sources, and Necessities

Incentivizing Competitors for Construct of New technology Nuclear Reactors – the Advance Act

Excerpted from DOE press launch dated July 10, 2024,

… Nuclear will likely be a part of that answer, which is why the USA has already dedicated to tripling our nuclear capability and is making strikes to assist safe our clear power future…

The ADVANCE Act directs the U.S. Nuclear Regulatory Fee (NRC) to scale back sure licensing utility charges and authorizes elevated staffing for NRC critiques to expedite the method. It additionally introduces prize competitions that the U.S. Division of Power (DOE) can award to incentivize deployment.

Growth of Uranium Enrichment Capability in the USA

In help of the elimination of reliance on Russian imports of nuclear gasoline referred to above, on June 27, 2024, U.S. Division of Power (“DOE”) issued a request for proposals (“RFP”) to buy low-enriched uranium from home sources to,

… assist spur the protected and accountable build-out of uranium enrichment capability in the USA, promote range available in the market, and supply a dependable provide of business nuclear gasoline to help the power safety and resilience of the American individuals and home industries, free from Russian affect. This RFP is supported by $2.7 billion from the President’s Investing in America agenda…. Via this RFP, DOE will purchase LEU generated by new sources of home uranium enrichment capability. Proposals are due by 5:00 p.m. EDT on August 26, 2024.

Centrus Power: Recognized Potential Opponents

Seemingly and attainable candidates for the DOE contracts embody – Centrus Power, Urenco USA, International Laser Enrichment LLC, and BWX Applied sciences, Inc.

Centrus Power

The next is a synopsis of knowledge supplied in Centrus Power’s Q1 2024 SEC 10-Q and transcript of the earnings name (out there on SA Premium),

-

Excessive Assay Low Enriched Uranium (“HALEU”) – achieved new milestones in manufacturing… utilized for a whole lot of hundreds of thousands of {dollars} in funding to advance these efforts…. In November, we introduced the supply of our first 20 kilograms of HALEU beneath Section 1 of our competitively awarded contract with the U.S. Division of Power… now reached about 135 kilograms of cumulative manufacturing… we have now transitioned to Section 2 of the HALEU operation contract and, with that, transitioned to a cost-plus-incentive-fee mannequin, which has improved the profitability of that section… .. On July 13, 2023, the Firm and TerraPower, LLC (“TerraPower”) entered right into a memorandum of understanding (“MOU”) to broaden their collaboration geared toward establishing commercial-scale, home manufacturing capabilities for HALEU to gasoline the Natrium TM reactor that TerraPower is constructing in Wyoming…. On August 28, 2023, the Firm and Oklo Inc. (“Oklo”) introduced a brand new MOU to help the deployment of Oklo’s superior fission powerhouses and superior nuclear gasoline manufacturing in Southern Ohio …together with provide of HALEU produced by Centrus on the Piketon, Ohio facility. ….. the Firm believes demand for HALEU will emerge over the subsequent a number of years, there are not any ensures about whether or not or when authorities or business demand for HALEU will materialize, and there are a selection of technical, regulatory, and financial hurdles that have to be overcome for these fuels and the reactors that may use these fuels to return to market.

-

Low Enriched Uranium (“LEU”) Buying and selling – Centrus acquires uranium and the SWU element of LEU beneath medium and long-term contracts with fastened commitments of roughly $1.Zero billion at March 31, 2024… continued provide of LEU from Russia beneath the Tenex Provide Contract is weak to refusal or incapability of TENEX to ship LEU to us due U.S. or international authorities sanctions are imposed on LEU from Russia, or on TENEX, or some other motive that might trigger a cessation of provide….SWU element of LEU sometimes is bought beneath contracts with deliveries over a number of years…SWU and uranium income is acknowledged when the shopper obtains management of the SWU or uranium.

-

Low Enriched Uranium (“LEU”) Personal Manufacturing – persevering with to advance our U.S. centrifuge expertise that has advanced from DOE innovations at specialised amenities in Oak Ridge with a view to deploying a business enrichment facility over the long run…ours is considered one of simply two websites in the USA that’s licensed to supply low-enriched uranium for current reactors, and the one a kind of websites that’s American-owned…Now we have barely scratched the floor of what’s attainable in Piketon. Our facility is as massive because the Pentagon with room for hundreds of centrifuges…The LEU market could be very massive in the present day. The enrichment element in the USA is price about $2.Four billion yearly at in the present day’s costs. The accessible market internationally is at present about $1.9 billion per 12 months.

-

Funding required – new laws… an extra $2.7 billion to jumpstart home manufacturing of each LEU and HALEU… scaling up manufacturing of both HALEU or LEU would require a sturdy public-private partnership. It can take a major federal funding alongside personal capital and business off-day contracts. Each different enrichment plant on the planet is state-owned and has been constructed on the backs of comparable partnerships from their supporting authorities… the personal sector is stepping up….over the previous couple of months, Centrus has secured roughly $900 million in conditional gross sales commitments to help our effort to return to manufacturing of LEU. Topic to signing definitive contracts, these commitments are contingent upon Centrus securing enough private and non-private funding to construct the LEU enrichment capability.

Urenco USA

The biggest producer and provider, and presently the one business scale producer within the U.S. of LEU gasoline for U.S. nuclear reactors, is Urenco USA, Inc. (UUSA), operated by Louisiana Power Companies LLC, each firms being subsidiaries of the UK headquartered Urenco Restricted. Per Desk 2 above, Urenco USA at present has capability to supply 4,900 SWU per 12 months of LEU. On 6 July 2023, UUSA introduced a 700 SWU enlargement at its New Mexico plant for,

New commitments from US clients for non-Russian gasoline underpin this funding, which can present an extra capability of round 700 tonnes of SWU per 12 months, a 15 per cent enhance at UUSA, with the primary new cascades on-line in 2025.

UUSA are undoubtedly in search of additional alternatives to broaden manufacturing and gross sales and are within the means of receive licensing to permit manufacturing of LEU+ as per excerpt from 16 march 2024 press launch,

On March 8, 2024, the Nuclear Regulatory Fee (NRC) accepted Urenco USA’s License Modification Request (LAR) to extend enrichment ranges from 5.5% to 10% (Low Enriched Uranium+ or LEU+). The NRC has agreed to evaluation our request and expects to make a ultimate determination by the top of 2024….

International Laser Enrichment LLC

From this October 2023 article by fellow SA contributor Henry Miles,

International Laser Enrichment LLC (“GLE”) is one other outlier. A non-public entity, its three way partnership companions are public. Cameco, Canadian, owns inventory and choices that might doubtlessly give it 75% management of GLE; Silex Methods (OTCQX:SILXF) (OTCQX:SILXY), Australian, – who developed the SILEX expertise licensed to the JV – at present owns 51% of GLE. Their mental property is in laser expertise used to separate uranium isotopes (I’m not a nuclear physicist). It presents the potential for the next diploma of enrichment in a single step over conventional processes. Nevertheless, engineering and scale-up have proved tough, and NO business laser separation amenities are at present working.

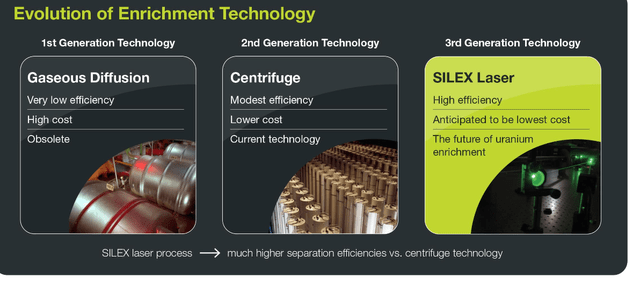

Determine Three under, from the Silex web site, compares Silex Methods expertise to current enrichment expertise.

Determine 3

Silex Methods web site

With the incentives being provided by the US DOE, GLE and Silex Methods have accelerated their business enrichment plans as set out in a July 1, 2024 Silex Methods press launch and accompanying presentation. GLE and Silex Methods seem not as able to deploy their enrichment expertise as Centrus Power and Urenco USA, however are more likely to be a critical participant sooner or later. That is significantly so if their expertise has the claimed larger effectivity and decrease value of manufacturing LEU and HALEU. One other benefit is the expertise’s claimed skill to economically course of spent uranium gasoline with round 0.Three to 0.4% of U235 and produce the share again as much as the ~0.7% stage of pure uranium. This has the advantages of lowering stockpiles of spent uranium, and related prices, and offering an extra supply of “pure” uranium from inside U.S. borders.

BWX Applied sciences, Inc.

BWX Applied sciences, Inc. (BWXT) is concerned in lots of facets of nuclear, together with, Naval Nuclear Propulsion, Business Nuclear Parts, Business Nuclear Gasoline, Strategic Nuclear Supplies, and Nuclear Companies.

The actually fascinating improvement, so far as nuclear gasoline manufacturing goes, is per excerpts under from this 30 August, 2023, press launch, “BWXT to Manufacture HALEU Feedstock for Superior Reactors”,

BWX Applied sciences, Inc. (NYSE: BWXT) in the present day introduced a contract to course of hundreds of kilograms of government-owned scrap materials containing enriched uranium that’s unusable in its current type with the intention to produce greater than two metric tons of feedstock that can be utilized for gasoline to exhibit superior reactors and assist decarbonize the U.S. energy grid…. The ultimate type of the processed materials will likely be Excessive Assay Low Enriched Uranium, extra generally often called HALEU… One in all BWXT’s key roles in transferring the nuclear trade ahead is leveraging its specialty supplies capabilities to help home HALEU wants for the subsequent technology of nuclear reactors…This contract provides to BWXT’s ongoing work with the NNSA to construct the corporate’s HALEU manufacturing capabilities in help of changing excessive efficiency analysis reactors from extremely enriched uranium to HALEU…. BWXT will produce over two metric tons of HALEU over the subsequent 5 years, with a number of hundred kilograms anticipated to be out there as early as 2024….

The foregoing seems to contradict Centrus Power’s declare their Ohio plant is the one place within the Western world licensed for HALEU manufacturing, however that is perhaps appropriate if BWX Applied sciences doesn’t require a license as a result of it’s producing for the federal government and never by itself account. I imagine BWX Applied sciences might definitely be a really robust competitor to Centrus Power if it does take part within the DOE’s RFP processes for HALEU and LEU manufacturing.

Centrus Power: Monetary Evaluation

Centrus Power Internet Revenue

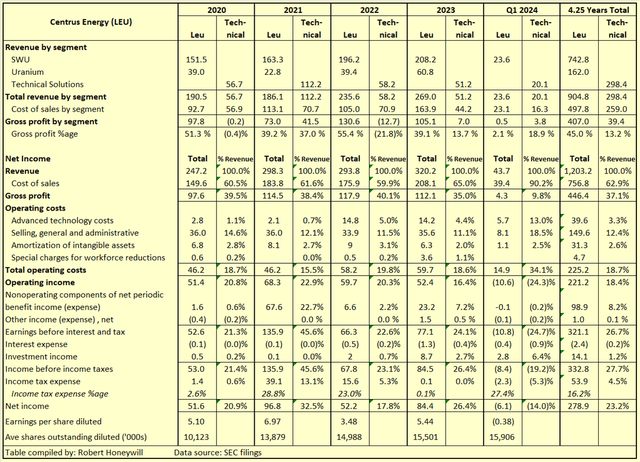

Desk Four under summarizes Centrus Power internet revenue, together with by section, over the past 4.25 years from FY 2020 to Q1 2024.

Desk 4

SEC filings

Feedback on Desk 4 –

LEU section –

The LEU (low enriched uranium) section displays Centrus Power’s buying and selling in LEU, shopping for primarily from Russia (TENEX), and the French firm Orano beneath long-term contracts. The corporate additionally makes spot purchases. Excerpted from 2023 10-Okay submitting with the SEC,

Our world Order Guide consists of long-term gross sales contracts with main utilities by way of 2030. Now we have secured cost-competitive provides of SWU beneath long-term contracts by way of the top of this decade designed to permit us to fill our current buyer orders and make new gross sales. A market-related value reset provision within the TENEX Provide Contract, which is our largest provide contract, occurred in 2018 and took impact initially of 2019 – when market costs for SWU had been close to historic lows – which has considerably lowered our value of gross sales and contributed to improved margins since 2019.

The 2019 value reset had a huge effect on the corporate’s gross revenue margin. Nonetheless, profitability is variable between years, and this seems primarily associated to, (1) lumpiness in income due nuclear reactor clients refueling as soon as each 12 to 24 months, and (2) costs payable by nuclear reactor clients various by buyer relying on when contracts commenced. In Desk Four I’ve proven the common gross margin over the 4.25 years to Q1 2024, and this exhibits a wholesome 45% on common. I imagine that is more likely to proceed for the interval of the Russian contracts by way of 2028, with lumpiness between particular person quarters and years.

Technical section –

From the 2023 10-Okay,

Below a contract with the DOE, our Technical Options section is deploying uranium enrichment and different capabilities needed for manufacturing of superior nuclear gasoline to satisfy the evolving wants of the worldwide nuclear trade and the U.S. authorities. We are also leveraging our distinctive technical experience, operational expertise, and specialised amenities to broaden and diversify our enterprise past uranium enrichment, providing new companies to current and new clients in complementary markets.

Technical Options’ income is derived from companies supplied to the U.S. authorities and its contractors. Via the Technical Phase, the corporate is contributing to its LEU and HALEU R&D prices by way of a value sharing association with the DOE, however has nonetheless achieved an total common gross margin of 13.2% over the 4.25 years to Q1 2024. That could be a good place to be in. As for the LEU section, lumpiness between particular person years seems largely resulting from timing of reserving of revenues and authorities contributions.

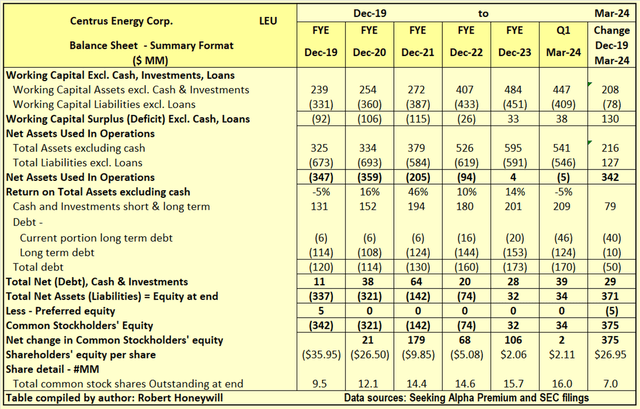

Centrus Power Steadiness Sheet

Desk 5 under summarizes Centrus Power’s steadiness sheet, together with modifications, over the past 4.25 years from FY 2020 to Q1 2024.

Desk 5

Looking for Alpha Premium and SEC filings

With profitability underpinned by favorably priced long-term LEU buy contracts, Centrus Power improved shareholders’ funds from a deficit of $342 million on the finish of 2019 to $34 million in funds on the finish of Q1, 2024. The development over the 4.25-year interval could be attributed to the next,

- GAAP internet revenue $360mm

- Different complete revenue (loss) $ (2)mm

- Concern of Class A shares $118mm

- Repurchase of Collection B shares $(101)mm

- Internet enhance in fairness $375mm

Liabilities excluding loans of $546 million at finish of Q1 2024 consists of Deferred income and advances from clients of $315.Eight million, of which $283.Zero million is present. These balances symbolize advance funds made by clients towards future deliveries. That is offset to some extent by deferred prices related to deferred income of $117.6 million included in complete property of $541 million.

On the finish of Q1 2024, Centrus Power loans payable of $170 million are greater than offset by money of $209 million, leading to nil internet debt.

Centrus Power: Abstract and Conclusions

The corporate’s current LEU enterprise is solidly worthwhile. Its power in having long-term buy and gross sales contracts may also current an look of weak spot, resulting from regular, however not rising earnings. There’s additionally draw back danger from the potential for cessation of provide of LEU from Russia, resulting from motion by both the Russian or U.S. governments. This danger is ameliorated to some extent by possible robust and pressing help from the U.S. authorities to speed up the ramp up of home manufacturing of LEU to switch Russian provide. The expansion alternative for Centrus Power comes from the deliberate tripling of nuclear reactor capability by the U.S. and by many different nations world wide. Plans for SMRs and microreactors additional improve this chance, with the corporate among the many few enterprises at present having the potential to supply HALEU, the popular gasoline for these new design reactors. The prevailing enterprise has a strong steadiness sheet, with no internet debt, is worthwhile, and has common optimistic money flows. On the identical time, not like the current buying and selling enterprise, producing LEU and HALEU would require a capital intensive operation. It will require vital new fairness and debt. This needs to be achievable, at affordable pricing, given current money flows supported by long-term contracts, the brand new contracts already negotiated topic to elevating needed finance, and the potential safety of proposed authorities buy contracts for HALEU and LEU within the billions, if profitable with RFPs.

Based mostly on strategic issues, I imagine Centrus Power is a Purchase.