mammuth/iStock Unreleased through Getty Pictures

Tesco PLC (OTCPK:TSCDF) continues to keep up the steerage of a flat revenue improvement into subsequent 12 months, that means that their technique of funneling gross sales into Best, which has a optimistic combine impact as mentioned in our earlier protection, is working. It additionally implies that they anticipate income acceleration within the coming quarters due to the Euros and the Olympics. These positives are wanted as a result of there was a serious minimal wage impact of 9%. The companies beneath stress in Booker usually are not main revenue contributors. In all, we predict that the steerage is affordable and achievable. Nonetheless, Tesco trades according to friends, and we do not see them having any particular edge at this level in a relative sense. In an absolute sense, we predict that higher and extra obscure companies will be purchased at decrease multiples on broader markets, and Tesco will at all times need to battle with fierce competitors and stress from wages.

Q1 Buying and selling Replace

As traditional, Tesco doesn’t present revenue knowledge in its Q1 and Q3 buying and selling updates, with extra important disclosures solely taking place on the H1 and FY marks. Nonetheless, the buying and selling replace is a helpful second for analysts to ask questions and for qualitative disclosure to be made.

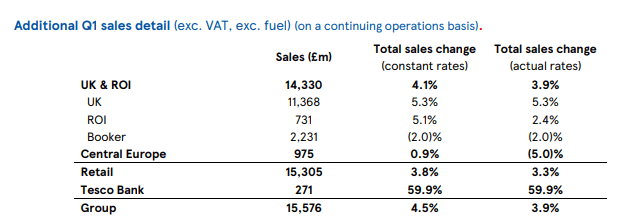

The very first thing we be aware are the present gross sales adjustments. They’re strong at round 3.4% progress in revenues, and the inflation affect is now fairly minimal at no more than 2%. Volumes are robust in a number of of the segments, and the concentrate on maintaining price will increase minimal has meant important market share features by Tesco in a unbroken pattern. Their coverage is an Aldi value match.

Our progress is clearly demonstrated by our progress in market share. With the newest Kantar learn exhibiting the best features for the final two years. This has been supported by 15 consecutive durations of switching features…

Ken Murphy, CEO of Tesco

Gross sales Highlights (Q1 TU)

The UK is seeing robust progress in volumes, and one of many components at play is that they’re commanding the mid-market inside their outlets with grocery store label Best, which is an up-trade from their different Tesco labeled merchandise however nonetheless extra aggressive in pricing than the branded merchandise on their cabinets. In our final protection we famous that branded sellers have been getting extra aggressive with promotional pricing in an effort to compete with Tesco merchandise, which is sweet for the nationwide inflation scenario and, after all, for Tesco clients, reflecting the extremely aggressive nature of the enterprise.

Best is being expanded with pub classics now on supply in an effort to capitalise on what ought to be a strong couple of quarters for sports activities occasions. The Euros is the present consideration, with England persevering with to get deeper within the event, and Tesco hopes it should get some biannual profit from clients treating themselves when consuming in to observe the video games. The Olympics comes after and will supply some related profit.

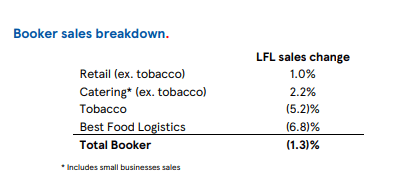

The weak section has been Bookers. Greatest Meals Logistics was acquired at a nominal value and offers distribution providers to clients like Burger King and Pret within the UK. They’re downsizing their attain to attempt to enhance earnings, because the profitability is marginal within the enterprise.

Look, I imply, in your first query on Greatest Meals Logistics and profitability. Look, it is not a cloth piece of the revenue, so it is lower than a handful of million.

Imran Nawaz, CFO of Tesco

Tobacco is in secular decline. Taking a comp of Logista (OTCPK:CDNIF) which additionally does tobacco distribution, we see that tobacco distribution is likely to be extra of a revenue detractor. The tobacco distribution enterprise ought to have related working margins to the Tesco common based mostly on this comp. However it’s only round 3% of revenues nonetheless, and even annualising the 5% decline, we’re solely speaking about 4-5 million GBP misplaced.

Booker Breakdown (Q1 TU)

Additionally they made a brand new acquisition inside Booker of a spirits and drinks enterprise that they will combine and supply wholesale.

Valuation and Dangers

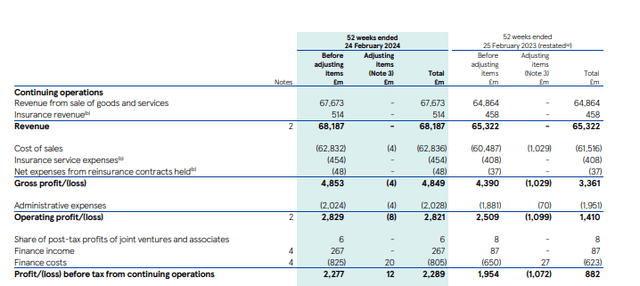

The wage improve of workers goes to price Tesco round 300 million GBP. Sainsbury (OTCQX:JSNSF) may even be investing round 200 million GBP. Labour prices are sampled at round 9-12% of gross sales for grocers. The figures supplied by Sainsbury and Tesco suggest a decrease price at their shops, round 6% for Sainsbury and round 5% for Tesco, figuring out that each are doing round 10% wage will increase at their shops.

Nonetheless, by one other calculation, 220,000 workers affected are getting a 2,000 GBP annual pay improve, which quantities to a rise in prices of round 440 million GBP for Tesco or rather less than 10% of gross revenue.

Regardless, to hit revenue targets, we predict a complete 5% gross sales progress will must be achieved based mostly on final 12 months’s annual figures earlier than wage hikes. This estimation is predicated on the belief that some commodities have deflated, and it ought to be attainable to develop revenues whereas maintaining incremental COGS progress outdoors of the wage will increase flat. A extra conservative guess can be to imagine that Tesco manages to regulate gross margins at present ranges of round 7% as of the FY, which might require an 8% gross sales improve to offset round 400 million GBP in elevated wage prices, a midpoint of the given determine and our again of the envelope calculation.

IS Snapshot (FY 2023 PR)

With combine results, not all of that 5% must be volumes. Importantly, the Euros and the Olympics ought to have the ability to speed up revenues past the present 3.9% mark to have the ability to hit 5% for the 12 months. Extra combine and fewer quantity results usually tend to accrete the gross margin, since quantity is extra operationally intensive.

We expect these numbers are doable, though the 8% gross sales progress would possibly be a stretch. However extra importantly, we aren’t that pleased with Tesco’s valuation. Its PE is sort of precisely according to one other grocery store and grocer inventory within the UK, Sainsbury. There isn’t a relative valuation case at round 12.5x PE, and there is not an excellent absolute case both. The reciprocal of the PE is the earnings yield, and it’s lower than 8%.

Companies like Tesco aren’t with out dangers. There are important aggressive challenges always, mirrored in the truth that a serious operational coverage is to ensure that all costs are matched to Aldi, which is low price, and there may be significant stress from labour costs as properly, mirrored within the substantial wage will increase they’ve needed to undertake and the depth of protection of the price of residing disaster within the UK. We really feel that there are many companies at that PE or decrease which might be beneath much less stress and face fewer potential points in additional obscure markets, avoiding the grocery store and grocery enterprise altogether, which has a difficult business construction.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.