ridham supriyanto/iStock Editorial by way of Getty Photographs

Introduction

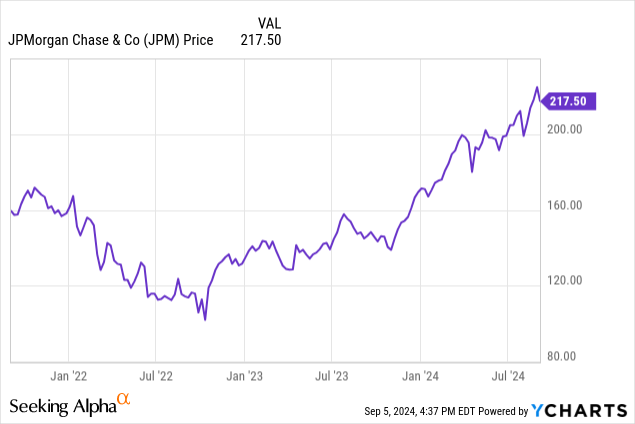

I don’t suppose JPMorgan (NYSE:JPM) must be launched to any investor. As a US-based monetary conglomerate, the monetary establishment is a family title. Whereas I additionally like the corporate from an earnings perspective, its dividend yield is at present fairly low at 2.1%. That’s why I targeted on the financial institution’s most well-liked securities in earlier articles as I nonetheless consider the mixture of proudly owning widespread inventory for capital features and most well-liked inventory for the earnings is one of the simplest ways to be invested in JPMorgan.

No should be fearful about JPMorgan’s potential to generate a revenue – mortgage loss provisions are utterly beneath management

Whereas this text is supposed to be specializing in the popular fairness issued by JPMorgan, a overview of among the most well-liked shares goes hand in hand with how the financial institution is doing as the popular dividends clearly should be lined by the financial institution’s earnings.

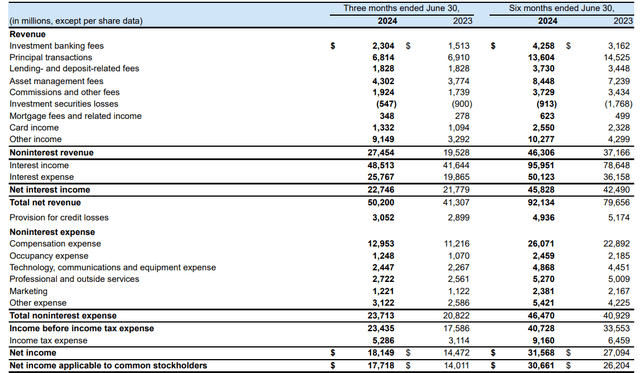

Trying on the Q2 outcomes, JPMorgan as soon as once more noticed a year-over-year enhance in its internet curiosity earnings because the financial institution reported $22.75B internet curiosity earnings, representing a rise of in extra of 4% on a YoY foundation. Moreover, the overall quantity of internet non-interest earnings additionally got here in fairly robust with a complete internet non-interest earnings of virtually $4B.

JPM Investor Relations

Because the earnings assertion above reveals, the availability for credit score losses additionally elevated, from $2.9B to $3.05B on a YoY foundation, and regardless of alarmist articles right here on Searching for Alpha, that is the conventional course of doing enterprise. Some loans merely don’t work out, and so long as the underlying earnings can cowl the anticipated losses, the financial institution is doing effective. And per the earnings assertion, even after together with the in extra of $3B in mortgage loss provisions, JPMorgan nonetheless reported a pre-tax earnings of $23.4B. Because of this even when the financial institution would see its provisions eightfold, it will nonetheless be worthwhile.

However as proven above, the web revenue generated by JPMorgan was roughly $18.15B, of which round $400M was wanted to cowl the popular dividends. For sure I’m fairly pleased with the low proportion of its internet revenue wanted by JPMorgan to cowl the popular dividends.

A glance again on the evolution of the Sequence EE most well-liked inventory

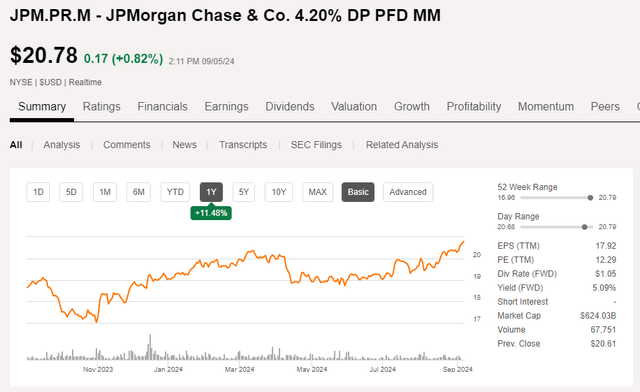

I’ve lined a number of most well-liked securities which have been issued by JPMorgan and I normally tried to search out the center floor between producing a good earnings in addition to conserving the potential for capital features on the desk. The popular shares with a low most well-liked dividend coupon had been clearly hit the toughest through the period of rising rates of interest and the Sequence MM ( NYSE:JPM.PR.M) with a 4.2% most well-liked dividend yield have executed properly, lately. Since my article was revealed in October 2023, the Sequence MM noticed the value enhance by 19% which, together with the popular dividends, resulted in a complete return of in extra of 20%.

Searching for Alpha

I contemplate the “straightforward features” to have materialized by now, and contemplating the present yield of that safety is simply over 5%, I feel it could make sense to begin wanting into swapping the safety out for the next yielding safety.

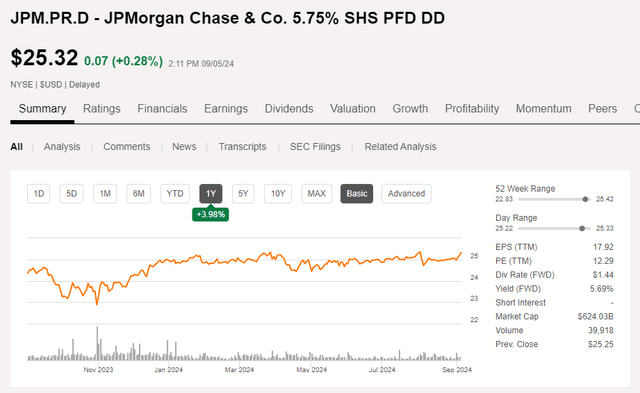

The Sequence DD most well-liked inventory, buying and selling at (NYSE:JPM.PR.D) presents a 5.75% most well-liked dividend yield however because the inventory is buying and selling at a premium to the principal worth of $25 per share, the present yield is slightly below 5.7%. These most well-liked shares will be referred to as at any given time, so you possibly can realistically count on the prefs to proceed to commerce across the $25 mark.

Searching for Alpha

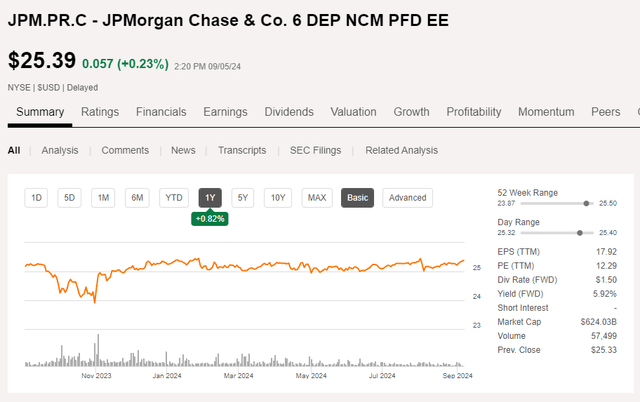

Whereas an fascinating decide, it will make much more sense to have a better take a look at the Sequence EE most well-liked shares (JPM.PR.C), which I lined on this older article. These most well-liked shares have a 6% most well-liked dividend coupon and are at present buying and selling at a slightly greater share worth than the Sequence DD. This implies the present yield is roughly 5.9%.

Searching for Alpha

The Sequence EE will also be referred to as at any second and as that collection is a much less value environment friendly means of funding (learn: the upper coupon means it is costlier capital than its different collection of most well-liked shares), the probability of this collection to be referred to as is greater than the lower-yielding most well-liked fairness.

Funding thesis

This doesn’t imply one “has” to make the change from a decrease yielding safety because the upside potential of the 5.75% and 6% most well-liked shares is fairly restricted: If rates of interest on the monetary markets proceed to drop, JPMorgan might simply name the costlier capital during which case there can be a 1-1.5% capital loss. In the meantime, if/when the rates of interest on the monetary markets proceed to lower, the decrease yielding securities might even see additional share worth will increase.

I at present don’t have any place in any of JPMorgan’s most well-liked securities and I am mulling over if I ought to re-initiate a protracted place in its most well-liked shares. I’ve a small lengthy place within the widespread shares.