David Ryder/Getty Photos Information

Introduction

The impartial US refiner and marketer, Ohio-based Marathon Petroleum (NYSE:MPC), launched its fourth-quarter and FY22 outcomes on January 31, 2023.

Word: I’ve adopted MPC quarterly since 2018. This new article is a quarterly replace of my article printed on November 24, 2022.

4Q22 and FY22 outcomes snapshot

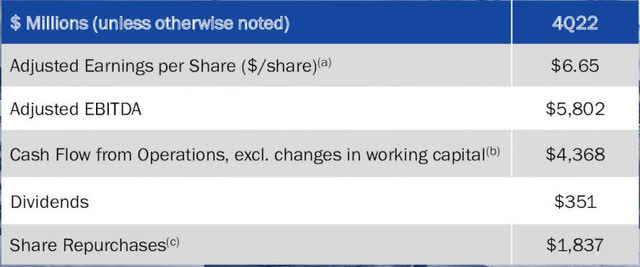

Marathon Petroleum reported a better-than-expected adjusted earnings of $6.65 per share for the fourth quarter in contrast with $1.30 final yr.

Internet earnings was $3,321 million, in comparison with $774 million in 4Q21. Revenues elevated considerably from $35.61 billion final yr to $40.09 billion.

MPC 4Q22 highlights (MPC Presentation)

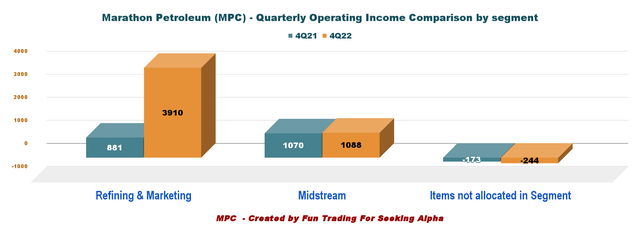

The corporate’s outcomes had been boosted by the stronger-than-expected efficiency of its primary Refining & Advertising phase, with earnings totaling $3,910 million (please see the chart beneath).

MPC Quarterly Working earnings 4Q21 versus 4Q22 (Enjoyable Buying and selling)

Inventory efficiency

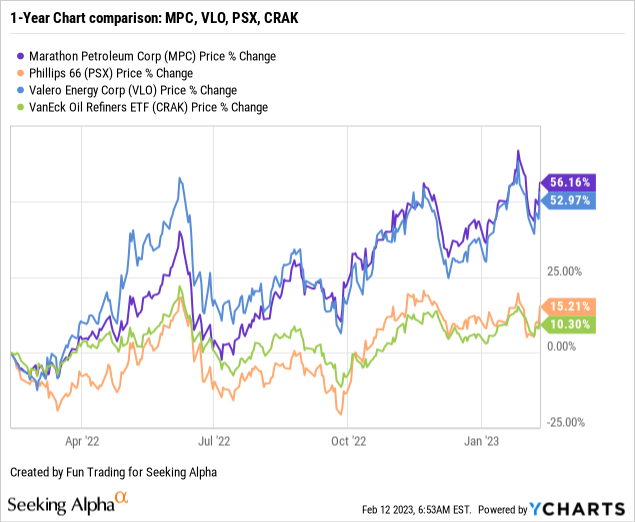

Marathon Petroleum has outperformed Phillips 66 (PSX), Valero Power (VLO) and VanEck Oil Refiners ETF (CRAK), and is up a whopping 56% on a one-year foundation. VLO is an in depth second, however PSX and CRAK lag nicely behind.

Funding thesis

As anticipated, Marathon Petroleum has carried out exceptionally nicely over the previous few months. It continues to be the chief of the refiners’ group, intently adopted by Valero Power, which is my first selection on this trade.

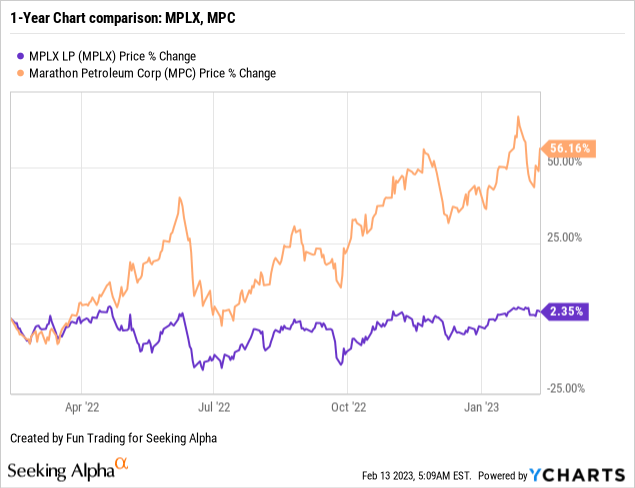

Marathon Petroleum additionally owns a majority stake (64.6%) in a midstream partnership referred to as MPLX LP (MPLX). Most of Marathon’s midstream phase is dealt with by MPLX LP. Subsequently, the Refining & Advertising, or R&M, phase is MPC’s primary operational phase. Nonetheless, MPC has considerably outperformed MPLX on a one-year foundation. MPLX LP is paying a dividend yield of 9%.

The corporate has proven distinctive efficiency in 2022 and is more likely to carry out nicely in 2023, albeit at a decrease degree. Revenue margins went as much as the roof, and vitality demand is predicted to be robust in 2023 and, extra particularly, in 2024. Nonetheless, oil costs are anticipated to go down in 2023 even when oil demand is robust now after China determined to restart its economic system.

The US Power Info Administration expects world consumption of liquid fuels similar to gasoline, diesel, and jet gasoline, to set new document highs in 2024. Based on EIA’s January Brief-Time period Power Outlook, world liquid gasoline consumption will exceed 100 million barrels per day, on common, in 2023 for the primary time since 2019, then common greater than 102 million barrels per day in 2024.

Nonetheless, regardless of a considerably rosy 2023-2024 interval, the revenue margins are anticipated to lower considerably from the document in 2022, and MPC might expertise greater volatility in 2023. Additionally, analysts are predicting a recession within the second half of 2023, affecting demand.

Thus, it’s prudent to commerce LIFO for about 50% of your long-term place in case of a steep retracement if the market will get frightened by an elevated danger of a painful recession.

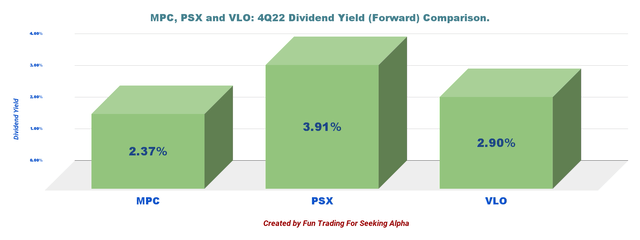

Holding a long-term holding is smart from an investor’s perspective. MPC pays a dividend yield of two.37%, which isn’t negligible however nonetheless a little bit low in comparison with its friends.

Nonetheless, the full efficiency, together with inventory enchancment, is equal to Valero Power and considerably beats Phillips 66.

MPC Dividend comparability: MPC, VLO, PSX (Enjoyable Buying and selling)

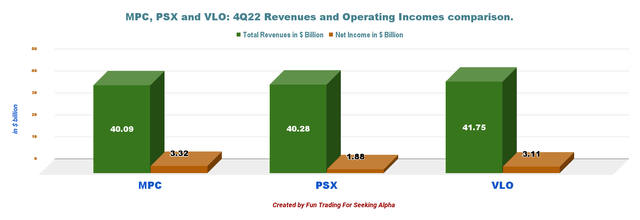

Income and internet earnings in comparison with Valero Power and Phillips 66 in 4Q22.

MPC Chart comparability Income and internet earnings MPC, VLO, PSX (Enjoyable Buying and selling)

MPC repurchased $1.eight billion of shares in 2022 and added $700 million of shares this yr till Jan 27.

The full shares excellent diluted has been decreased by 22.6% YoY. Marathon additionally permitted an extra $5 billion share repurchase and has a remaining authorization of $7.6 billion.

Margins by Area

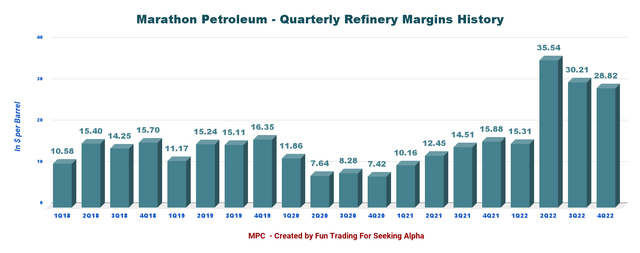

Marathon Petroleum declared a world R&M margin of $28.82 per Bbl primarily based on throughput per area. Margins are nonetheless nicely above common this quarter, regardless of dropping from 3Q22.

Particulars beneath:

| Gulf Coast | Mid Continent | West Coast | Whole |

| $26.86/per Bbl | $29.20/per Bbl | $28.63/per Bbl | $28.82/per Bbl |

Marathon Petroleum – Monetary Historical past: The Uncooked Numbers – Ending Fourth Quarter 2022

Word: The 10-Okay has not been filed but. Therefore, capital expenditure can solely be estimated in the meanwhile. Free money stream and capital bills will probably be adjusted when the corporate information its FY22 10-Okay.

| Marathon Petroleum | 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 |

| Whole Revenues in $ Billion | 35.34 | 38.06 | 53.80 | 45.79 | 39.81 |

| Whole Revenues and others in $ Billion | 35.61 | 38.38 | 54.24 | 47.24 | 40.09 |

| Internet Revenue accessible to widespread shareholders in $ Million |

774 |

845 |

5,873 |

4,477 |

3,321 |

| EBITDA $ Million | 2,463 | 2,546 | 9,134 | 7,543 | 4,564 |

| EPS diluted in $/share | 1.27 | 1.49 | 10.95 | 9.06 | 7.09 |

| Working money stream in $ Million | 3,674 | 2,513 | 6,952 | 2,514 | 4,368 |

| CapEx in $ Million | 481 | 495 | 498 | 701 | 560* |

| Free Money Move in $ Million | 3,193 | 2,018 | 6,454 | 1,813 | 3,808* |

| Whole Money $ Billion | 10.84 | 10.60 | 13.32 | 11.14 | 11.77 |

| Debt Consolidated in $ Billion | 25.54 | 26.71 | 26.77 | 26.70 | 26.70 |

| Dividend per share in $ | 0.58 | 0.58 | 0.58 | 0.75 | 0.75 |

| Shares Excellent (Diluted) in Million | 605 | 568 | 536 | 494 | 468 |

| Working Revenue per Section in $ million | 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 |

| Refining & Advertising | 881 | 768 | 7,134 | 4,625 | 3,910 |

| Midstream | 1,070 | 1,072 | 1,126 | 1,176 | 1,088 |

| Objects not allotted within the Section | -173 | -161 | 68 | -173 | -244 |

Supply: Firm Information

* MPC debt is $6,923 million, and MPLX debt is $19,779 million in 3Q22.

Evaluation: Earnings Particulars

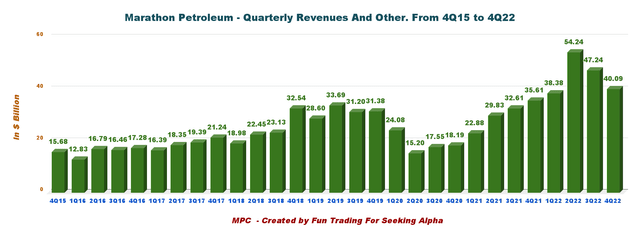

1 – Revenues and different earnings had been $40.09 billion in 4Q22

MPC Quarterly Income Historical past (Enjoyable Buying and selling)

Word: Primary revenues had been $39.813 million.

Marathon Petroleum reported a complete earnings of $40.093 billion within the fourth quarter of 2022, up 12.6% from the identical quarter a yr in the past and down 2.1% sequentially. Internet earnings was $3,321 million or $7.09 per diluted share in comparison with $774 million in 4Q21, and adjusted internet earnings was $6.65 per share, beating analysts’ expectations.

The working earnings from the Refining & Advertising and the Midstream models totaled $3,910 million and $1,088 million, respectively, exceeding expectations. Nonetheless, working earnings is slowly falling from the record-2Q22.

1.1 – Refining & Advertising

The corporate reported an working earnings of $3,910 million in comparison with $881 million in the identical quarter a yr in the past. The numerous enchancment was on account of greater year-over-year margins however partially offset by decrease throughputs and refined product gross sales. The refining margin was $28.82 per barrel in 4Q22, up from $15.88 a yr in the past.

Throughput decreased from 2,936 mbp/d within the year-ago quarter to 2,895 mbp/d, decrease than anticipated. Capability utilization in the course of the quarter was the identical as final yr at 94%. Lastly, working prices per barrel elevated by 4.9% from final yr.

Under is the Refinery margins historical past:

MPC world R&M Margin historical past (Enjoyable Buying and selling)

1.2 – Midstream

Marathon Petroleum’s normal and restricted majority companions are MPLX LP. Section profitability was $1,088 million, up 1.7% from $1,070 in 4Q21. MPLX has largely underperformed MPC on a one-year foundation. Nonetheless, the corporate is now paying a better dividend yield than MPC of 9.00%.

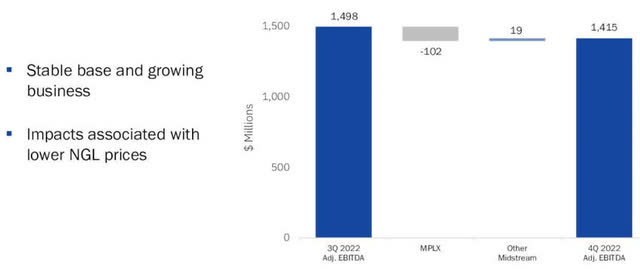

MPC MPLX adjusted EBITDA 3Q22 versus 4Q22 (MPC Presentation)

CFO Maryann Mannen mentioned within the convention name:

This morning MPLX additionally introduced their 2023 capital funding plan of $950 million. Their plan consists of roughly $800 million of development capital and $150 million of upkeep capital. The capital spending plan focuses on including new gasoline processing crops and smaller investments focused at enlargement and debottlenecking. of current belongings to fulfill buyer demand.

MPLX’s decrease EBITDA is primarily on account of impacts related to decrease NGL costs, which can speed up in 1Q23.

2 – 1Q23 Outlook

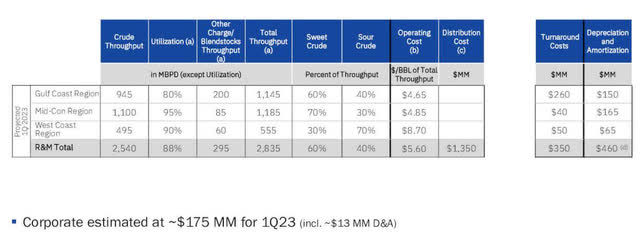

MPC 1Q23 outlook (MPC Presentation)

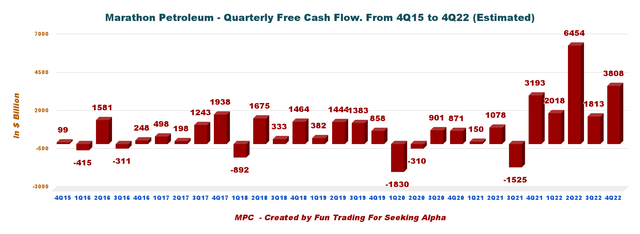

3 – Free money stream was estimated at $3,808 million in 4Q22 (topic to alter after the 10-Okay filings)

MPC Quarterly Free money stream historical past (Enjoyable Buying and selling)

Word: Generic free money stream is the money from operations minus CapEx. The corporate has a distinct manner of calculating it.

The trailing 12-month free money stream was $14,093 million, with roughly $3,808 million in 4Q22. The dividend payout ($3.00 per share) is $1.404 billion yearly, which is roofed by Free money stream.

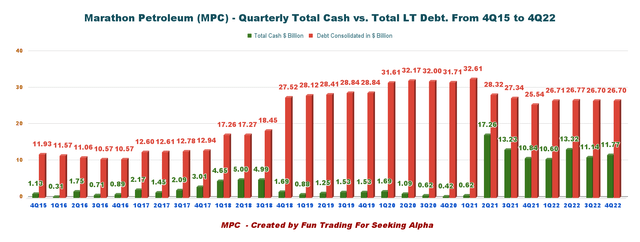

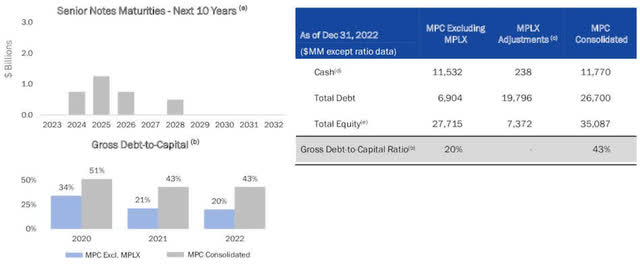

4 – The full debt is $26.7 billion (consolidated) in 4Q22

MPC Quarterly Money versus Debt historical past (Enjoyable Buying and selling)

Word: The graph above signifies the debt on a consolidated foundation.

MPLX’s debt is $6.904 billion. As proven beneath, the debt is $19.80 billion on a standalone foundation, with a debt-to-capital ratio of 20% and 43% on a consolidated foundation. Whole money is $11,770 million (MPC standalone money was $11,532 million).

MPC Stability sheet 4Q22 (MPC Presentation)

Technical Evaluation (Brief Time period) and Commentary

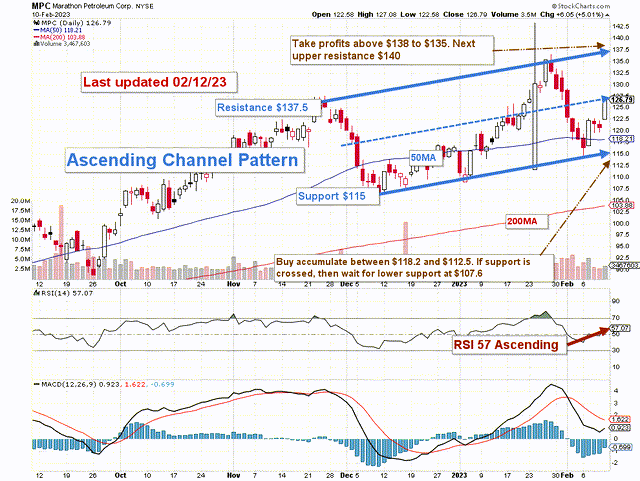

MPC TA Chart short-term (Enjoyable Buying and selling StockCharts)

Word: The chart is adjusted for the dividend.

MPC types an ascending channel sample with resistance at $137.5 and help at $115.

Ascending channel patterns are usually short-term bullish, transferring greater inside an ascending vary, however these patterns normally type inside longer-term downtrends as continuation patterns. Thus, I anticipate a retracement throughout H1 2023, and we should always deal with the 200MA as the primary help.

The general technique that I counsel in my market, “The Gold And Oil Nook,” is to maintain a long-term place and use about 50% to commerce LIFO (see notice beneath) whereas ready for a better last value goal on your core place between $140 and $145.

The buying and selling technique is to promote above $135 and $138 with doable greater resistance at $140. I counsel ready for a retracement between $118.2 and $112.5 to build up once more, with potential decrease help at $108, which is near the 200MA.

Warning: The TA chart should be up to date regularly to be related. It’s what I’m doing in my inventory tracker. The chart above has a doable validity of a few week. Bear in mind, the TA chart is a device solely that will help you undertake the appropriate technique. It isn’t a technique to foresee the long run. Nobody and nothing can.