Liudmila Chernetska/iStock by way of Getty Photos

We have now beforehand coated AT&T Inc. (NYSE:T) in April 2023 right here. At the moment, the inventory has been wrongfully sold-off, since its free money circulate technology has all the time been lumpy, relying on the timing of money distributions, capital expenditures, and money paid for vendor financing.

Given the optimistic indicators of working value optimization and improved profitability, we imagine the telecom could probably obtain its bold FCF technology of $16B in 2023. With the inventory already overly offered off because of the Amazon (AMZN) rumor, we’re cautiously rerating the T inventory as a Purchase right here.

The Revenue Funding Thesis Seems Extra Enticing Right here

T and Verizon Communications (VZ) have been lately hammered by the rumors that AMZN could also be getting into the telecom area within the close to future. This growth isn’t a surprise certainly, because the latter has beforehand displayed bottomless ambitions in a number of markets.

This contains being a cloud supplier by means of Amazon Internet Providers since 2000, groceries by means of Amazon Recent since 2007, limitless streaming by means of Prime Instantaneous Video since 2011, major healthcare by means of Amazon Care since 2019, the pharmacy service since 2020, and most lately, the film business by means of the acquisition of MGM in 2021.

Most notably, we suppose this piece of rumor could also be a continuation of these mentioned since 2019, with AMZN supposedly considering shopping for pay as you go cellphone wi-fi service, Increase Cellular, from T-Cellular (TMUS) then. Both approach, with AMZN and TMUS already debunking the rumors, the coast has been all cleared for the rebound of T and VZ’s inventory costs.

Nonetheless, it seems TMUS continues to be affected by the baseless market rumor, with the inventory nonetheless down by -6.1% since June 02, 2023. The pessimism embedded in its inventory costs is stunning certainly, given its outperformance up to now.

Maybe this is because of Mr. Market’s conviction that AMZN could finally enter the telecom market, placing nice competitors towards the present telecom gamers, because of its 148.6M Prime members within the US. Nonetheless, we suppose that speculative occasion could solely happen by the second half of the last decade. That is why.

AMZN has been struggling to trim its working bills and return to profitability, because of the overly aggressive growth in its footprints and headcounts throughout the hyper-pandemic interval. Even within the newest quarter, the e-commerce large solely reported 3.9% in working revenue margins, dramatically impacted in comparison with the hyper-pandemic heights of 5.9% in FY2020 and 5.2% in FY2019.

We suppose there’s minimal chance that AMZN could enter the telecom market now, the place competitors is intense, margins are skinny, and capex is elevated. Nonetheless, in the long run, it isn’t overly speculative to think about the large finally taking up the MVNO technique, shopping for the telecoms’ spare capability at wholesale costs, as soon as the macroeconomic outlook normalizes.

This technique has been employed by smaller telecom gamers as properly, resembling Mint Cellular providing month-to-month cell plans from $15 and Shopper Mobile from $20 onwards. Whereas it’s unsure if the latter two are worthwhile, the enterprise could probably enhance AMZN’s Prime memberships, because of the extremely aggressive costs of $10.

It’s already well-known that the e-commerce enterprise operates at razor-thin margins, with the pure revenue play embedded in its Prime memberships, considerably aided by the AWS phase. It is a comparable technique that we’ve got noticed with Costco (COST).

We suppose a part of the pessimism can also be attributed to T’s lumpy free money circulate at $1B (-83.6% QoQ/ +42.8% YoY) and elevated long-term money owed of $137.5B (+1.1% QoQ and -33.7% YoY), regardless of the strong annualized adj. EBITDA of $42.32B (+3.8% YoY).

In the meantime, VZ is not any higher with a free money circulate of $2.33B (+37% QoQ/ +133% YoY) and long-term money owed of $140.77B (inline QoQ/ +0.5% YoY), with stagnant FY2023 adj EBITDA steering of $47.75B on the midpoint (inline YoY).

A lot of the impacted money circulate is attributed to T’s elevated capital expenditure of $19.39B (+17.7% sequentially) and sustained dividend payout of $15.05B (-46.04% sequentially) during the last twelve months, leaving little for debt reimbursement.

The identical has been reported by VZ at capital expenditures of $23.22B (+7.5% sequentially) and a dividend payout of $10.89B (+4% sequentially) during the last twelve months. Whereas TMUS doesn’t pay out dividends, it’s obvious that the telecom enterprise is capex intensive, with the latter equally reporting $13.59B (+8.6% sequentially) of capital expenditures during the last twelve months.

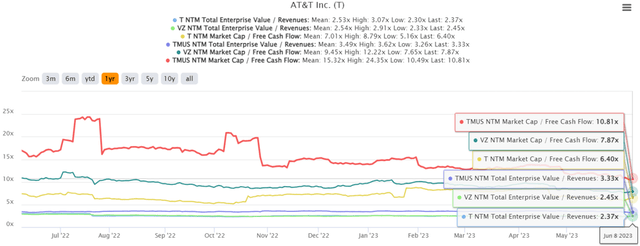

T, VZ, & TMUS 5Y EV/Income and NTM Market Cap/FCF

S&P Capital IQ

This cadence could also be why their shares’ valuations have been moderated up to now, with T buying and selling at NTM Market Cap/ Free Money Stream of 6.40x, VZ at 7.87x, and TMUS at 10.81x, in comparison with their 5Y imply of 8.44x, 11.87x, and 23.29x, respectively. Their NTM EV/ Revenues stays stagnant over the previous 5 years as properly, suggesting their sluggish top-line progress forward.

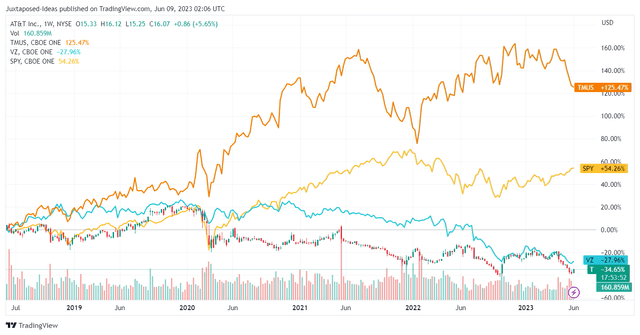

T, VZ, & TMUS 5Y Inventory Worth

Buying and selling View

Nonetheless, if traders are searching for high-growth telecom inventory, they might have a look at TMUS as a substitute, because of the spectacular 5Y returns at +125.47%. Whereas previous efficiency might not be indicative of ahead returns, the T and VZ inventory has additionally underperformed towards the broader market, even when we’re to incorporate their dividends.

Then once more, we proceed to fee each T and VZ shares as buys right here, as a consequence of their oversold ranges, with T buying and selling at its 2008 lows and VZ equally at its 2011 lows.

The market rumor has triggered far more engaging entry factors for income-seeking traders, in our view, with T now providing a wonderful ahead dividend yield of 6.89% and VZ at 7.40%, in comparison with their 4Y common yields of 6.94% and 4.94%, respectively.

Naturally, traders should additionally modify their expectations accordingly, since these two shares could proceed their underperformance for the foreseeable future, with their solely advantage being the wealthy dividend yields. Even then, assuming that AMZN actually enters the foray, we might even see the legacy telecoms’ EBITDA negatively impacted, probably triggering a dividend reduce then.

Solely time could inform.