Galeanu Mihai

This text was coproduced with Wolf Report.

We have re-examined a few actual property funding trusts, or REITs, we reviewed a yr in the past and extra.

Particularly, we’re speaking about Rexford Industrial Realty, Inc. (NYSE:REXR). I final examined this explicit REIT again in September of 2022, when I discovered the valuation to be considerably prohibitive for the type of wonderful upside that we sometimes search for.

Additionally, the yield is not spectacular.

A 2.75% yield on this surroundings, the place I can get 3.65% from a financial savings account, not even a CD?

You will have to actually persuade me of that one, given the variance in risk-reward.

Nevertheless, REXR has grow to be convincing, which is the rationale I made a decision to improve this one to a Sturdy Purchase (My oh My).

We’re now going to share this with you and make clear why this “sharp shooter” is a STRONG BUY!

Rexford: The Fundamentals

The REIT shouldn’t be healthcare or workplace – it is industrial.

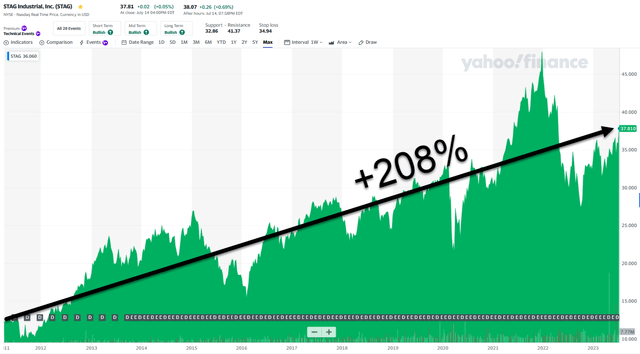

As soon as upon a time, I started investing in STAG Industrial (STAG). Here is my very first article HERE (again in 2011).

Yahoo Finance

Totally different occasions, completely different danger allocations.

I’ve by no means offered one share of STAG…and I do not plan to, despite the fact that its valuation is not low-cost proper now.

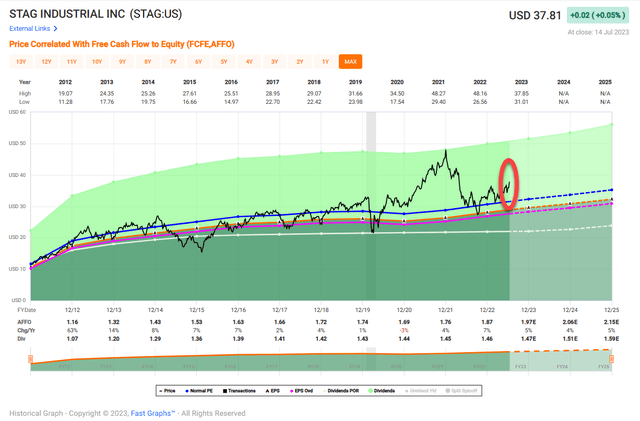

FAST Graphs

My level being, industrial REITs on the proper value are nice investments.

As is REXR.

REXR is a BBB+ rated industrial REIT with a market cap of over $11B. It has over 20 years of historical past, it is a member of the S&P500 (SP500) with 44.2 M sq. toes owned.

Return for the previous 5 years is 112%, which suggests outperformance, and the corporate’s annual dividend progress over the previous 5 years is 19% – outperformance right here as effectively.

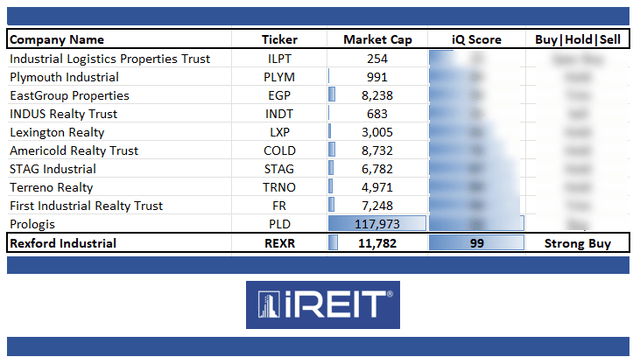

The corporate is the largest pure-play U.S.-focused Industrial REIT on the market. Others are both smaller, not pure-play, or not U.S. Competitors contains companies like STAG, Plymouth Industrial (PLYM) First industrial (FR), and EastGroup Properties (EGP).

The corporate, nevertheless, is a play on a really particular geography, that may not be your cup of tea – particularly, the corporate has a 100% infill in southern California.

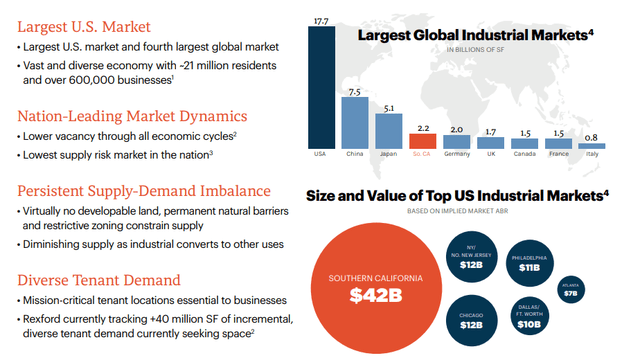

Nevertheless, earlier than you go unfavourable, check out what the corporate really gives when it comes to portfolio and upside – as a result of there’s extra to this story than Southern Cali – although the commercial space of Southern California does deserve highlighting.

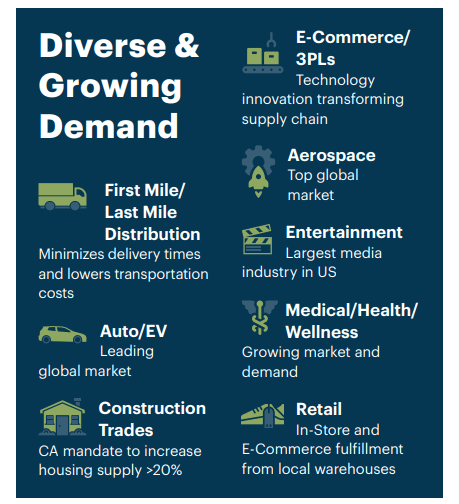

REXR IR

We consider such part of the presentation ought to be seen with a modicum of salt, however on the identical, shouldn’t be discounted.

It is unquestionable that the historic enchantment of this space shouldn’t be the identical factor because the ahead enchantment – however as a result of REXR has such mission-critical tenant places, we do not suppose it may be equated with a number of the issues presently current within the state.

The truth that there’s an excessive shortage of land inside the Infill SoCal implies that there actually are only a few options for the companies that function there – they should flip to REXR.

We have additionally been vocal proponents, by investing in residence REITs like AvalonBay (AVB) and Essex (ESS), that issues will not be as dangerous as they appear on the West Coast.

They’re difficult, and might even be characterised as dangerous in sure areas, like San Francisco, however developments will not be as dangerous throughout your complete state, with cities like San Diego being far much less affected by the downturn.

So why REXR?

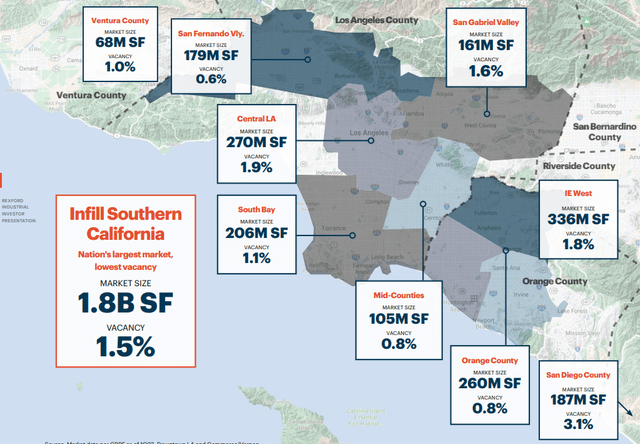

As a result of the corporate’s portfolio is discovered right here.

REXR IR

Check out a few of these emptiness charges – and the 1.5% infill SoCal emptiness.

As a result of shortage and diminishing provide, this creates a persistent supply-demand imbalance that for me is paying homage to a number of the issues happening in sure areas in Sweden.

As a result of nothing is being constructed, and there’s such a shortage, housing costs can not fall past a sure level, whatever the rate of interest.

Wolf Report noticed the identical within the GFC. Sweden was by no means as affected as a number of the different European nations precisely due to what REXR is describing right here, however for a special sector.

However wait, it will get even worse in SoCal – due to native housing mandates that dictate the conversion of business provide to housing, this additional reduces accessible provide. It will increase demand from development for industrial area and will increase each inhabitants and consumption from the SoCal infill portfolio the corporate has.

The corporate “performs” within the highest-demand industrial market within the nation, and already owns the mission-critical tenant places that, whereas not guaranteeing, do make pretty sure that enchantment goes to be there.

REXR IR

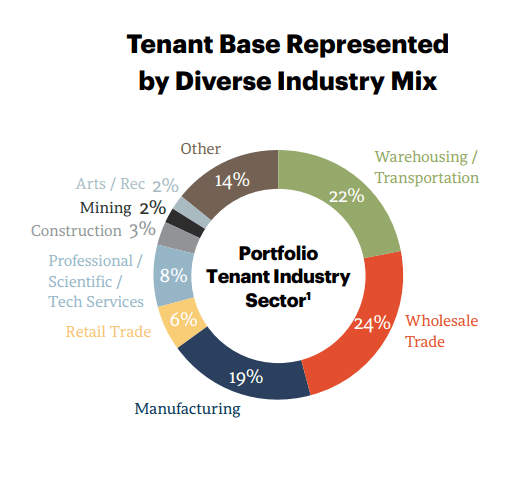

And right here is the tenant-specific diversification of that portfolio, which as you possibly can see is…fairly various. Largely wholesale and warehousing, which is a constructive.

REXR IR

It is unlikely that these are going wherever. Out of 1,600 complete tenants, the dangerous debt as % of income is zero bps. Moreover, REXR’s ABR (annualized base lease) on a per-square foot foundation is nearly twice as excessive as the remainder of the friends, and exceeds them by 75%, reflecting the energy of the precise market.

Spreads are actually wonderful when it comes to renewals, with continued excessive leasing spreads at 80% GAAP and 60% money. The corporate’s leasing expiration schedule is well-filled, although, with about 40% coming due earlier than 2026 – so we’ll wish to keep watch over renewals right here, however at a 13.5% YoY market lease progress with the basics we see, we do not see any challenge or concern right here.

Fundamentals for the corporate are past stable.

$1.85B of liquidity, BBB+, and a 3.6x web debt/Adjusted EBITDA, making it one of many least-leveraged REITs we have checked out – ever. The corporate’s complete debt as a proportion of EVs is lower than 15%. That goes some strategy to lighten the influence of that sub-3% yield.

Expirations are very stable, with a 3.6% weighted common rate of interest, and round 5.Three years common maturity. 100% of the debt is at a hard and fast fee, with no publicity to floating in any respect.

REXR is in some ways the gold commonplace for what an Industrial REIT “ought to” be.

It has a vertically built-in platform with skilled administration – proprietary analysis and origination, M&A’s, good finance/capital market processes, lease and advertising, and development to accounting and finance.

Nobody in administration has lower than 15 years of actual property expertise, and the present chairman has 49 years of RE expertise.

The weaknesses on this explicit thesis or dangers, are easy.

The unfavourable sentiment over California, the place REXR operates – there is no telling how lengthy it’ll final, or how dangerous it’ll get. This uncertainty is basically spilling over not solely to different firms however to REITs and Industrial ones as effectively.

Nevertheless, past its geographical focus, we actually cannot see any danger right here.

The corporate’s leverage is just too low to actually begin speaking about downturns as a result of elevated debt prices. The basics are past stable, and consensus projections are up considerably.

The corporate’s yield shouldn’t be solely conservative, however it’s additionally extraordinarily well-covered.

Leasing spreads are stellar. The general scenario within the firm’s working geography implies that no new vital provide is probably going.

New begins are additionally down, just because the constructing is pricey. The corporate’s dip in occupancy is definitely defined as a result of REXR themselves precipitated it – properties are being put into redevelopment.

In brief, we anticipate the corporate outperformance to proceed, and select to utterly disregard any valuation-related downturn right here, ascribing it to an irrational market.

Now allow us to current the upside for the REIT.

REXR Upside – The valuation

REXR doesn’t “look” low-cost.

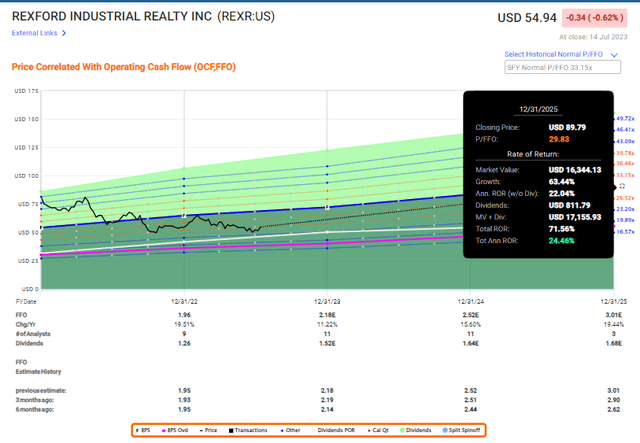

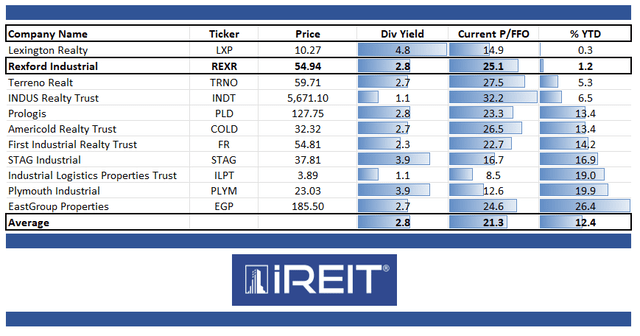

It trades at a combined common P/FFO of 26.5x, which is greater than we normally settle for for a REIT. Nevertheless, the mix of very enticing leverage coupled with fundamentals and a really stable upside in the double digits regardless of macro, spells out why we’re constructive on REXR right here.

REXR sometimes trades at a normalized P/FFO of round 33x.

We might normalize that to round 30x on a ahead foundation at most, however even on a 30x P/FFO, the corporate’s upside right here is well-covered, as the corporate is forecasting between 10-20% FFO progress on an annual foundation for the subsequent few years.

How possible is that this?

Nicely, we stated within the earlier part a number of the qualities as to why we consider this to materialize.

However we will additionally take a look at historic developments – now we have 10+ years of them in any case.

FactSet analysts solely miss forecasts right here negatively round ~10% of the time, with the corporate beating consensus round 11% of the time – the remainder of the time, forecasts and steerage are inside the vary at a 10% margin of error.

This interprets into an above-average conviction and steerage/forecast accuracy, and for that purpose, we are saying that the corporate’s estimates may be “trusted” right here.

In spite of everything, we’re seeing all the suitable indicators from the corporate’s earnings reviews.

The upside even on a conservative forecast of beneath 30x P/FFO is important. Based mostly on high-conviction forecasts, that might end in virtually 25% RoR on an annual foundation, or over 70% RoR in a number of years.

REXR Upside (FAST Graphs)

You may even, as a matter of truth, forecast the corporate as little as 17x P/FFO, and also you’d nonetheless not lose cash (inclusive of dividends).

Your draw back on this funding is extraordinarily protected, as we see it, and there’s upside available in spades.

We would not contact the corporate a couple of yr in the past when it traded above 33-34x P/FFO. The upside at that time was so-so, and there have been much better options on the market.

Options nonetheless exist – many good ones, really – however REXR has gone from being on my radar to being on my “STRONG BUY” record right here.

S&P World analysts give the corporate a median vary of $52 to $77 presently, with a median PT of $65/share. That is down from virtually $85/share a yr in the past.

What has modified?

The notion of California, we would argue – as a result of you possibly can’t actually argue something basically having modified to the unfavourable to actually influence it as a lot.

A yr in the past, the high-point value goal (“PT”) for this firm was above $100/share. We see this as a very good instance of the short-term perspective of a few of these analysts. 10 analysts observe the corporate, 7 of that are “BUY” or equal right here.

We add our voices to this refrain, in addition to to our IREIT score, and provides the corporate a “STRONG BUY” score however going as much as $80/share for the long run.

iREIT®

Thesis

- REXR is maybe one of many highest-quality industrial REITs on the market. It is fundamentals and total security are exceptional, with one of many lowest leverage out of any REIT we have researched. This goes some strategy to make up for the yield that is presently beneath a financial savings account rate of interest.

- The upside right here is coupled reversal, yield, and progress. That upside is very large – and due to this, this funding is much better than any financial savings account. We give the corporate a conservative PT of $80/share, representing a conservatively-adjusted 2025E 29-30x P/FFO degree.

- Based mostly on this, we contemplate this firm a formidable “STRONG BUY” right here, and like with residence REITs reminiscent of AVB or ESS, we’re selecting to take the contrarian view of California right here and go “BUY.”

Bear in mind, we’re all about:

1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly large – firms at a reduction, permitting them to normalize over time and harvesting capital positive factors and dividends within the meantime.

2. If the corporate goes effectively past normalization and goes into overvaluation, we harvest positive factors and rotate my place into different undervalued shares, repeating #1.

3. If the corporate would not go into overvaluation, however hovers inside a good worth, or goes again all the way down to undervaluation, we purchase extra as time permits.

4. We reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Here is our standards and the way the corporate fulfills them (italicized).

- This firm is total qualitative.

- This firm is basically protected/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is presently low-cost.

- This firm has a sensible upside primarily based on earnings progress or a number of enlargement/reversion.

iREIT®