BlackJack3D

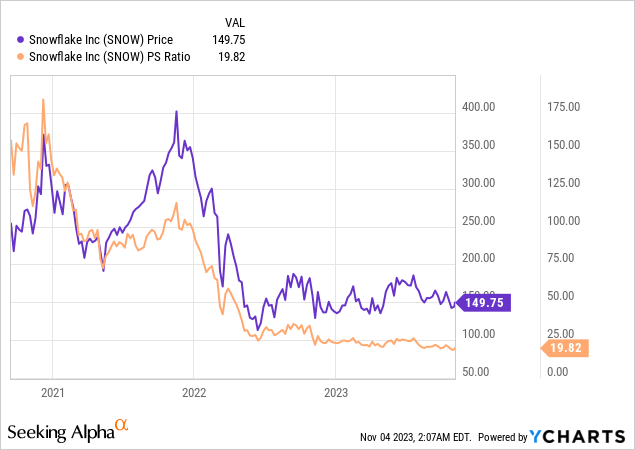

Snowflake’s (NYSE:SNOW) inventory has fallen like a rock from a worth near $400 within the bull market of 2021 / 2022 to a considerably extra affordable valuation. I consider that the inventory has began from what could be thought-about a backside on the worth of $110 -$140. Given the long-term outlook of the corporate, this text discusses why now may very well be entry level for SNOW inventory.

Snowflake as a Play on AI

Snowflake stays among the best massive information and AI performs out there. A simplified description of the corporate is that it’s a information cloud vendor that brings collectively varied information from completely different, and infrequently siloed, programs right into a single platform. Inside the platform customers can question and analyze the information in addition to carry out advanced evaluation.

A easy instance is that an organization may have Salesforce (CRM) as its buyer relationship administration software, NetSuite (ORCL) as its finance software, and Zendesk (ZEN) as its Assist administration platform. Though every system has its personal native reporting, they do not essentially work together with one another making cross-department reporting and evaluation tough. It’s these obstacles that Snowflake goals to interrupt.

The massive story in latest weeks is generative AI / Machine Studying and the enhancements it may make to data work and employee productiveness. In accordance with information from ARK Make investments, AI instruments equivalent to ChatGPT can enhance employee productiveness by greater than 100%.

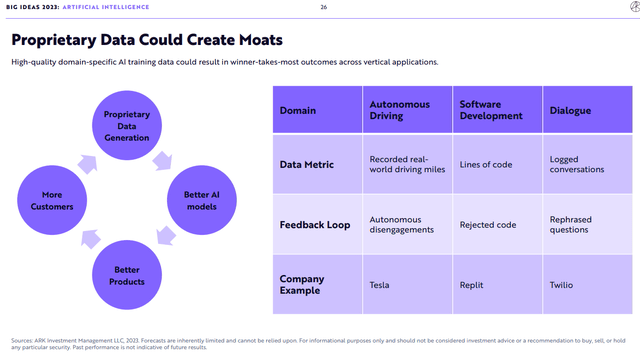

As chances are you’ll know, the effectiveness of AI /ML fashions is primarily pushed by their information units. Having good information is vital to “coaching” these fashions with the intention to correctly do its duties. In accordance with ARK Make investments, these proprietary information units may develop into key aggressive benefits for firms. In any case, proprietary information nearly creates a virtuous cycle because it results in higher AI fashions, higher services, extra clients, and finally extra proprietary information. Snowflake matches into the “AI theme” by granting these capabilities to its clients.

Massive Concepts 2023 (ARK Make investments)

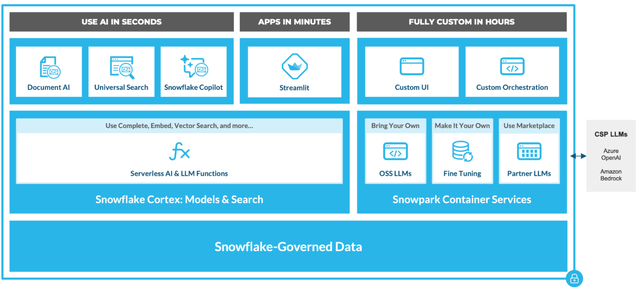

Snowflake Cortex Brings the AI Promise to Actuality

Provided that all the firm’s information could be queried on the Snowflake platform, the subsequent logical step can be to use AI instruments to this massive information. It is because of this the corporate developed Snowflake Cortex – a brand new service that allows even non-tech customers to rapidly analyze information and construct AI purposes. The Snowflake Cortex permits customers of all ability units to make use of industry-leading AI fashions, LLMs, and vector search performance thus tapping into the potential of generative AI.

Snowflake Cortex (Snowflake Web site)

The instruments obtainable in Snowflake Cortex embrace;

- Giant Language Fashions-based fashions help with unstructured information equivalent to Reply Extraction, Sentiment Detection, Translation and Textual content Summarization

- Machine Studying fashions that analyze information to carry out duties like Forecasting and Anomaly Detection

- Different normal use case AI instruments equivalent to Textual content Completion and Textual content to SQL

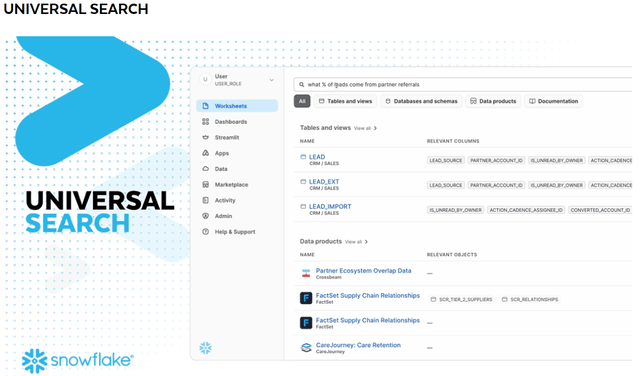

Probably the most fascinating characteristic although of Snowflake Cortex is its “Common Search” perform. Utilizing this characteristic, clients can simply discover tables, views, databases, schemas, and different info throughout the information lake. Anybody who has labored at a significant company can inform you that discovering the right information is a significant ache level. This software can reply enterprise questions simply utilizing a ChatGPT-style bot. Snowflake constructed this characteristic on know-how from Neeva – an AI search start-up acquired by the corporate final Might.

Snowflake Cortex (Snowflake Web site)

I consider these new merchandise carry large worth to the corporate’s enterprise clients and that is simply the tip of the iceberg. Snowflake has an entire suite of partnerships and merchandise within the pipeline. This explains why the corporate has such excessive buyer satisfaction metrics. Snowflakes has a very excessive internet income retention charge of 142% indicating that over time clients are shopping for increasingly of the corporate’s providers.

In accordance with its Q2 fiscal 2024 quarterly press launch, the corporate has 402 clients with trailing 12-month product income larger than $1 million. This buyer cohort grew 62% year-over-year. The corporate additionally has 639 clients out of the Forbes World 2000 indicating enough space to develop. General revenues for Q2 2024 skilled a 36% year-over-year progress, from $497.2 million to $674 million. Progress slowed from Q2 final 12 months which was 83% year-over-year. Nonetheless, it must be famous that the corporate is attaining stable progress numbers within the context of a troublesome macroeconomic setting.

Alternative and Valuation

Snowflake is reporting its fiscal Q3 2024 earnings on the finish of November. With the Fed just lately pausing rate of interest hikes, the market general is having a second have a look at beaten-down progress shares. The corporate has guided Revenues on the vary of $670 – $675 million which represents a 28 -29% progress charge.

Over the long run, the corporate is poised to trip huge long-term developments. Generative AI and different instruments are forecasted to be a large market. In accordance with analysis by Bloomberg Intelligence the TAM for AI may develop to as massive as $1.three trillion over the subsequent 10 years. This represents a CAGR of 42%.

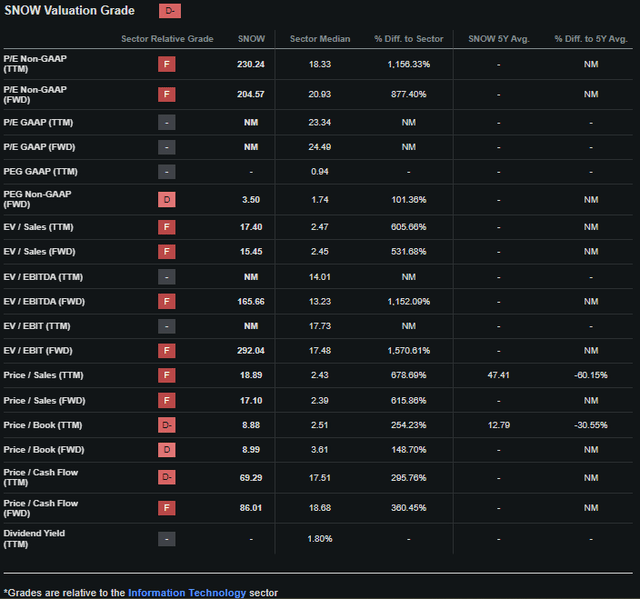

The principle knock in opposition to Snowflake has all the time been its valuation. Taking a look at Looking for Alpha’s Valuation Quant grade, Snowflake has a valuation of D-. This is not actually stunning as the corporate is not actually “worthwhile” regardless of producing respectable money stream. On a Worth to Non-GAAP earnings and Worth to Cashflow foundation, SNOW inventory is buying and selling at 230.2 instances and 69.29 instances. That is excess of the sector median of 18.33x and 17.5x.

Valuation Quant (Looking for Alpha)

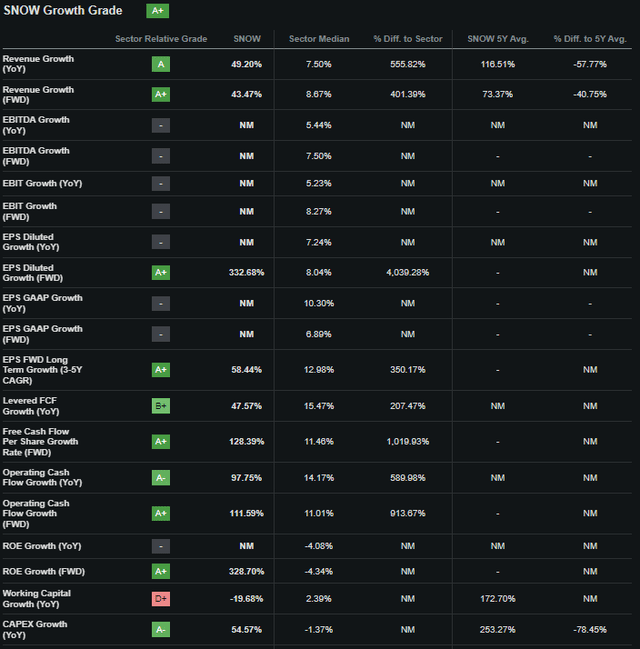

Regardless of being “costly” relative to different shares on this sector, Snowflake is the most cost effective it has been. The 18-19x Worth-to-sales ratio is far decrease than the above 50x it has been buying and selling in 2021 – 2022. The actual fact of the matter is, Snowflake is an excellent firm that can all the time be buying and selling at a premium. The identical Quant rankings give Snowflake an A+ in its progress grade with ahead Income progress of 43.5% and ahead free money stream per share progress of 128%.

Valuation Quant (Looking for Alpha)

It is totally affordable to attend till SNOW inventory’s worth falls additional. Nonetheless, a fall to “low-cost” valuations might by no means occur. Corporations which are world-class usually develop into their valuations and stay costly for lengthy stretches of time. Consider Amazon (AMZN) or Tesla (TSLA) and lots of extra examples. So until you might be Warren Buffett chances are you’ll by no means get a greater deal on SNOW inventory than what you see as we speak.

Key Dangers And Conclusion

Be aware: Whereas I’ve been extremely optimistic about SNOW inventory for this text, I do need to level out a couple of key dangers to my bullish thesis. First is that Snowflake is buying and selling at costly valuations of 18-19x Worth-to-sales ratio. This has been a 12 months the place progress shares have been decimated for lacking earnings. Anticipate a drop in SNOW inventory ought to earnings disappoint on the finish of the month.

Moreover, there may be all the time the danger of the US falling right into a “hard-landing” sort recession. This may occasionally trigger Snowflake’s enterprise shoppers to chop down on spending as they try and preserve their budgets. Progress shares like SNOW will decline way more than the broader index on this state of affairs.

Lastly, in the long run, Snowflake faces a couple of aggressive threats. Privately-owned Databricks is gaining momentum. The corporate additionally has a bizarre “frenemy” sort relationship with main cloud distributors Amazon and Google (GOOG). These cloud distributors may vertically combine and begin providing their very own in-house service to displace Snowflake. Because of this it’s so essential that Snowflake stays forward of the curve with regards to know-how and why I’ve mentioned at size what it’s doing to adapt to the brand new AI/ML world.