urbancow/E+ by way of Getty Photographs

We beforehand lined C3.ai (NYSE:NYSE:AI) in September 2023, discussing its blended prospects at a time of generative AI increase, with the administration electing to pivot to a decrease margin consumption-based pricing mannequin to seize market share and client base.

Mixed with its sustained money burn and deteriorating stability sheet, we had most well-liked to price the inventory as a Maintain then.

On this article, we can be highlighting C3.ai’s improved near-term prospects, attributed to the diminished gross sales friction with decrease common contract worth (lower cost factors) and shorter gross sales cycle.

Mixed with the rising ratio of subscription income and better projected conversion price, it seems that the administration’s new enterprise mannequin is working as supposed.

Regardless of so, we keep our Maintain ranking, since we consider that there’s a minimal margin of security at these inflated ranges, with the inventory overly buoyed by the generative AI hype.

The Generative AI Funding Thesis Stays Overly Inflated Right here

For now, C3.ai has reported a backside line beat within the FQ2’24 earnings name, with revenues of $73.23M (+1.2% QoQ/ +17.3% YoY) and adj EPS of -$0.13 (+44.4% QoQ/ +18.1% YoY).

On the one hand, the transition to a consumption-based pricing mannequin has instantly impacted its path in the direction of profitability, attributed to its declining adj gross margins of 69% (inline QoQ/ -Eight factors YoY).

The identical has been noticed in C3.ai’s revised FY2024 steering, with revenues of $307.5M (+15.2% YoY) and adj loss from operations of -$125M on the midpoint (-83.6% YoY), as its losses speed up from the earlier provided steering of -$62.5M on the midpoint (+8.1% YoY).

Then again, the SaaS firm stories rising subscription revenues of $66.4M (+8.1% QoQ/ +11.5% YoY) and 404 in buyer engagements (+81% YoY), additional underscoring its profitable buyer wins up to now because of the diminished gross sales friction.

The rising ratio of subscription revenues at 91% (+6 factors QoQ/ -4.Three YoY) is very encouraging as properly, attributed to the improved predictability of its gross sales and expanded client base, more likely to additional contribute to its long-term high/ backside line fly wheel.

Nevertheless, with nice demand, additionally comes nice competitors.

It stays to be seen how aggressive C3.ai’s choices can be in opposition to properly funded Large Tech firms whom are providing related generative-AI primarily based analytic SaaS, corresponding to Microsoft (MSFT) by way of OpenAI, Nvidia (NVDA), Palantir (PLTR), and Alphabet (GOOG).

Maybe this explains the brand new enterprise mannequin’s decrease common contract worth of $0.8M (-20% QoQ/ -94.7% YoY) within the newest quarter. That is on high of the shorter gross sales cycle of roughly 24 hours, with the appliance anticipated to go reside inside 4 to eight weeks.

Primarily based on C3.ai’s accomplished contracts up to now, the administration has additionally confidently guided a slightly aggressive “pilot to manufacturing conversion price of about 70%,” implying its rising alternative to monetize its AI choices at a a lot quicker price.

That is on high of the deepened partnership with Amazon’s (AMZN) AWS, with the brand new C3 Generative AI utility permitting “customers of all technical ranges to start utilizing generative AI inside minutes of signing up,” obtainable with a 14-day free trial.

C3.ai Valuations

Searching for Alpha

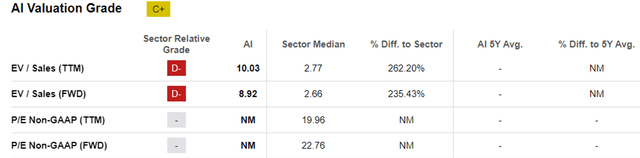

Maybe because of this Mr. Market has awarded the C3.ai inventory with the premium FWD EV/ Gross sales of 8.92x, nonetheless comparatively larger than its 1Y imply of seven.16x and the sector median of two.71x.

The identical premium has additionally been noticed in its SaaS supplier friends, corresponding to CrowdStrike (CRWD) at 18.05x, MSFT at 11.24x, NVDA at 19.42x, and PLTR at 16.60x, implying their comparatively stretched valuations at a time of Generative AI hype.

The Consensus Ahead Estimates

Searching for Alpha

Then once more, herein lies the dillemma.

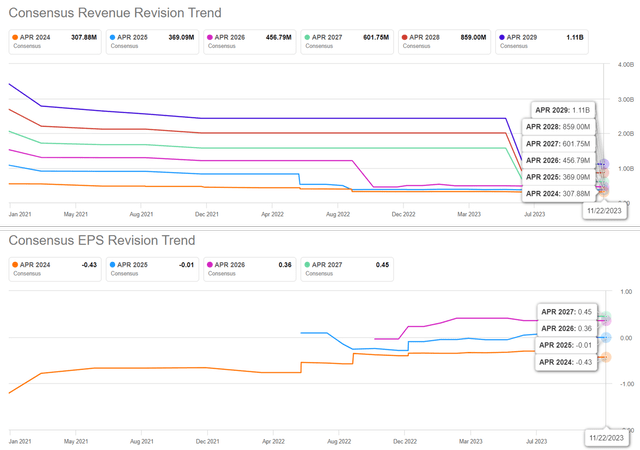

C3.ai’s top-line prospects have been notably downgraded to a CAGR of +19.6% by way of FY2026, with a protracted adj EPS/ FCF profitability. That is in comparison with the earlier estimates of +22.1% and FY2025 adj EPS/ FCF profitability, respectively.

Given their efforts to restructure its international gross sales group largely composed of technical area specialists, it’s obvious that the administration has elected to seize market share and client base first, earlier than specializing in its backside line.

For now, the downgraded high line estimates and extended profitability indicate that the C3.ai inventory might have pulled ahead most of its upside potential, with the premium valuations providing a minimal margin of security at present ranges.

This additionally implies that the SaaS firm’s reliance on stock-based compensation might stay elevated over the subsequent few years, additional accelerating its share dilution from the 118.65M reported within the newest quarter (+2.97M QoQ/ +9.77M YoY).

Regardless of the supposedly massive generative AI TAM of as much as $1.3T by 2032, it additionally stays to be seen how a lot of it might fall on C3.ai’s lap, with its FQ4’23 income steering of $76M on the midpoint (+3.7% QoQ/ +13.9% YoY) showing to be underwhelming.

That is in comparison with PLTR’s accelerating QoQ/ YoY progress, with FQ3’23 revenues of $558.16M (+4.6% QoQ/ +16.8% YoY) and FQ4’23 steering of $601M (+7.6% QoQ/ +18.1% YoY).

Solely time might inform.

So, Is C3.ai Inventory A Purchase, Promote, or Maintain?

C3.ai 1Y Inventory Value

Buying and selling View

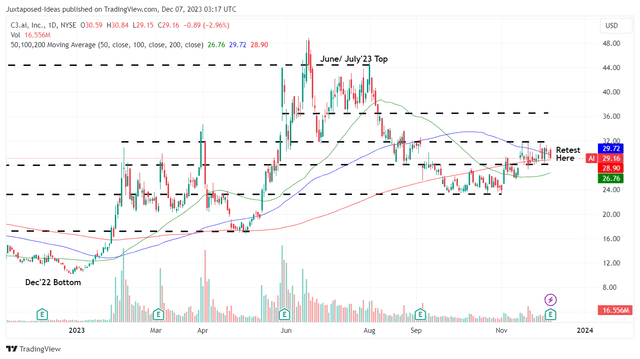

For now, C3.ai has already rallied over optimistically by +21.6% from the November 2023 backside, with the inventory showing to be properly supported at $28s whereas assembly immense resistance on the $30s.

Nevertheless, we aren’t satisfied about its long-term upside potential, with the inventory buying and selling means above its e-book worth per share of $7.91 and the minimal reversal in its adj EPS profitability of $0.36/ FCF of $39.22M by FY2026.

Whereas C3.ai has reported accelerating pilot/ adoption, we consider that the continued consumption-based pricing mannequin might pose near-to-intermediate-term headwinds to its stability sheet, with a internet money place of $762.3M (+1.5% QoQ/ -9.2% YoY), with it remaining to be seen if the earlier money burn might proceed.

Mixed with the potential volatility related to its immense quick curiosity of 34.35% on the time of writing, we choose to proceed ranking the C3.ai inventory as a Maintain (Impartial) right here.