MicroStockHub

Wanting on the weekly shut of the 10-year US Treasury yield, the ultimate yield print this week at 4.30% is the very best weekly closing yield because the 4.47% shut in late November ’23.

Final Friday, March 8, ’24, the 10-year Treasury yield closed at 4.09%, so if the S&P 500 will get just a little wobbly in right here, you perceive why.

Thanks partially to yields, the greenback had a powerful week as measured by the UUP, up 0.75% within the final 5 buying and selling days.

Fascinating that the Nasdaq Composite has but to take out its November ’21 all-time-high of 16,212, and stay above that key degree. It’s closed above that key degree in March ’24 a number of occasions, however has since fallen again beneath the November ’21 excessive.

First, just a little on credit score spreads:

![]()

The above spreadsheet reveals the credit score unfold development because the S&P 500 backside in early November ’23.

What stunned me this previous week, is that top yield credit score spreads tightened one other 12 bps within the final 5 days alone.

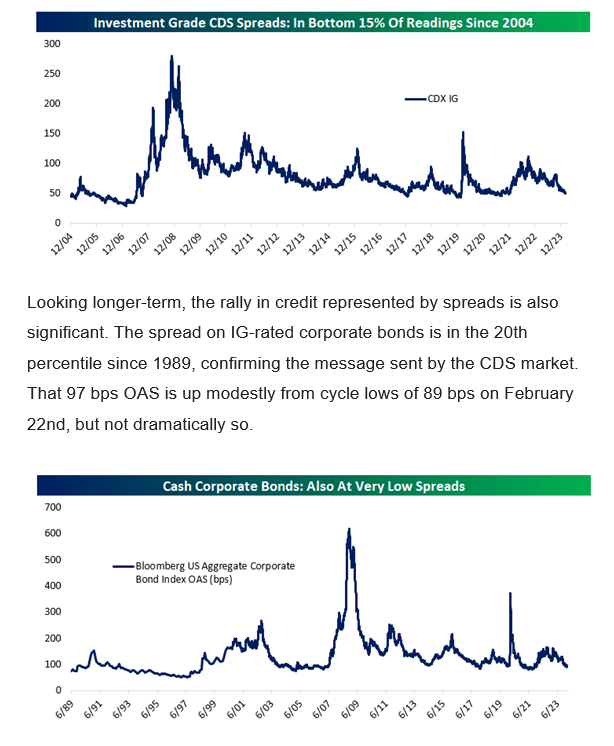

This Bespoke word from March seventh, ’24 with the graphical assist, notes the development in credit score spreads.

Whereas not all the time correlating to larger inventory costs instantly, tighter credit score spreads are all the time good to see, versus the alternative.

This weblog offered just a little company excessive yield this previous week, disposing of the PIMCO Excessive Yield Fund, which is often larger high quality of the assorted excessive yield mutual funds within the junk bond universe, and swapping into the LQD or the iShares Funding Grade ETF.

The swap sacrifices just a little yield whereas including just a little length or complete return (ought to the Fed cut back the fed funds charges) and defending consumer accounts from a credit score high quality perspective.

Purchasers stay lengthy the SHYG, the HYG and Pimco’s HYS, so shoppers are nonetheless lengthy about 95% of their high-yield publicity that they’ve owned the final three years.

S&P 500 knowledge:

- The ahead 4-quarter estimate (FFQE) this week improved to $243.31 from final week’s $243.29 and is the fifth week in a row of sequential enchancment within the FFQE.

- The P/E ratio on the ahead estimate this week is 21x vs. 21x final week.

- The S&P 500 earnings yield improved to 4.76% vs. 4.75% final week, the primary sequential enchancment since mid-February ’24.

- The three corporations reporting subsequent week that this weblog may have an curiosity in are Micron Know-how (MU), Nike (NKE) and FedEx (FDX). Micron studies Wednesday, March 20th, after the shut, whereas Nike and FedEx report after the market shut on Thursday, March 21 ’24.

With simply two weeks left in This fall ’23 S&P 500 earnings, there may be actually little anticipated change within the outcomes over the subsequent two weeks, thus S&P 500 earnings have entered the quiet interval or lifeless zone, except the above firm studies.

The constructive as famous final week is that 2024 S&P 500 EPS estimates have modified little during the last 12-14 weeks which is a constructive provided that traders and analysts have seen 2024 steering with January and February ’24 earnings releases.

Company steering continues to be cautious and that’s normally a plus.

Abstract/conclusion: S&P 500 earnings stay in good condition, and the upward drift within the ahead estimate and a few of the annual S&P 500 EPS estimates is a constructive, given that is normally the time of the quarter the place analysts get nervous and are slowly decreasing numbers.

Nike and FedEx are each US manufacturers with a substantial world attain. Will probably be attention-grabbing to see if FedEx is impacted by Boeing’s (BA) points because the Wall Avenue Journal famous this week.

None of that is recommendation or a suggestion. Previous efficiency is not any assure of future outcomes. Investing can contain lack of principal even over quick durations of time. Readers ought to gauge their very own consolation with portfolio volatility, and alter accordingly. All S&P 500 EPS and income estimates are sourced from LSEG or the London Inventory Trade Group.

Thanks for studying.

Unique Publish

Editor’s Observe: The abstract bullets for this text had been chosen by In search of Alpha editors.