Klaus Vedfelt/DigitalVision through Getty Photos

By Samuel Rines

Ignoring knowledge might be helpful. As a result of not all knowledge is, in truth, helpful. Because the variety of datasets has proliferated, so too has the noise created by them. However there may also be indicators buried within the noise, notably in relation to survey-based gentle knowledge.

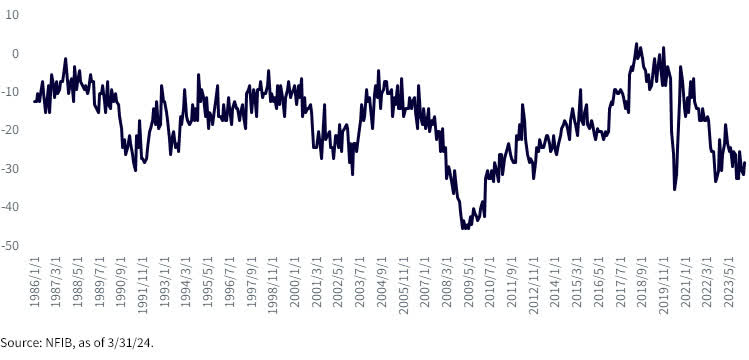

Enter the NFIB Small Enterprise Survey.1 It may simply be argued that it ought to be ignored, given the rampant, near-permanent pessimism embedded within the survey. Will the financial system enhance? In all probability not. Anticipate gross sales to enhance? A stable, perhaps. That has been the overall story for the previous decade-excepting the 2016 to early 2020 interval.

NFIB Expectations for Actual Gross sales and Economic system

The NFIB financial outlook has been and stays dismal. There isn’t any means round it. However the U.S. financial system has not succumbed to the gloom. As an alternative, it has powered by means of an on-again, off-again inflation cycle, with unemployment sitting at lower than 4% and resilient GDP progress. All with a Federal Reserve bent on breaking inflation with elevated rates of interest.

There are some oddities to the information, one being the query about “actual” gross sales. In any case, revenues are nominal, not adjusted for inflation. That injects two sources of error into the dataset: the outlook for gross sales and inflation. With earnings season starting to choose up steam, mentions of “inflation-adjusted revenues” are more likely to proceed their long-term development of round zero.

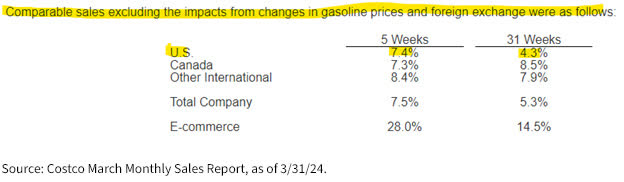

Costco (COST) adjusting gross sales for fluctuations in overseas change and gasoline costs? After all. Adjusting for inflation? No. As a result of adjusting revenues or gross sales to inflation is nonsensical. To not point out, Costco noticed its same-store gross sales speed up in March even when stripping out the roughly half share level increase from a shift within the timing of Easter.

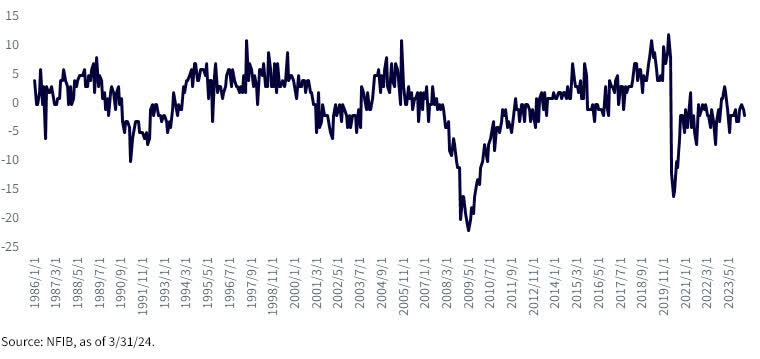

NFIB “Earnings Tendencies”

After which there may be the query about earnings. Based on the survey, there has solely been a quick window of positivity previously 38 years. In truth, current readings are solely marginally higher than the figures seen within the rapid aftermath of the COVID-19 lockdowns. And-apparently-hiring has by no means bounced again.

Precise Employment Modifications

Why does any of this matter?

Partly, it reinforces the “handoff to regular.” If the financial system has carried out this nicely with this a lot pessimism, what occurs if and when the pessimism begins to fade? If-as the NFIB Survey suggests-small companies haven’t participated within the post-COVID-19 restoration, what does the financial system appear to be after they do?

In different phrases, pervasive skepticism might be seen in a few methods. Superficially, it seems as a headwind to the U.S. financial system. However that’s already within the system. It’s not “new information” for the U.S. financial outlook. As an alternative, it ought to be seen as a potential financial catalyst. The handoff to regular may very well be a stunning revelation to these not paying consideration.

1 NFIB gross sales and financial system expectations are based mostly on a query in regards to the “subsequent 6 months” and are reported on a web of “higher” or “worse” solutions.

NFIB earnings are based mostly on a query relating to the final three months being “higher” or “worse” than the earlier three months.

NFIB precise employment based mostly on a query relating to precise employment adjustments within the final three months.

Samuel Rines, Macro Strategist, Mannequin Portfolios

Sam Rines serves as a Macro Strategist, Mannequin Portfolios at WisdomTree extending the agency’s customized mannequin portfolio administration capabilities. Previous to WisdomTree, Samuel was a Managing Director of CORBU, a analysis agency we struck up a relationship with to ship mannequin portfolios. Samuel is a world macro knowledgeable targeted on the funding implications of politics and coverage. His PolyMacro analysis has been extensively adopted by massive household places of work, institutional traders and the media. Previous to becoming a member of CORBU, Samuel was the Chief Economist and Funding Strategist at Avalon Advisors. Earlier than becoming a member of Avalon, Samuel was a portfolio supervisor at Chilton Capital Administration, the place he launched the Chilton ESG Fairness Technique and a protracted/quick expertise portfolio. Samuel began his profession because the cross-asset analyst for a small hedge fund. He’s the creator of the guide “After Regular: Making Sense of the World Economic system “.

Authentic Put up