M. Suhail

In terms of the Energy of Compounding, there aren’t many higher examples of there than The House Depot (NYSE:HD). HD has been a compounding darling for years, and what I imply by that’s the truth that they have offered not solely stable dividend development through the years, however separate from the dividend, they’ve offered nice share worth appreciation.

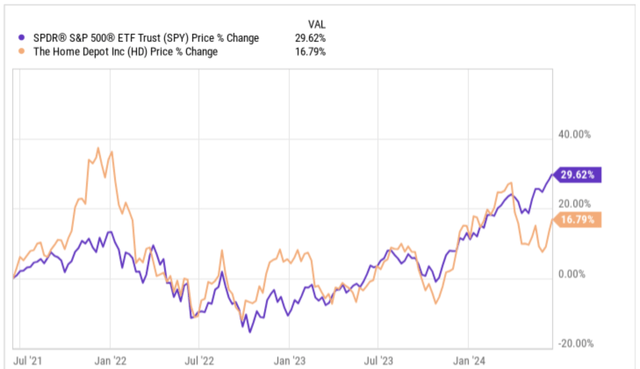

Nonetheless, over the previous few years, HD shares have effectively underperformed the S&P 500 (SPY) by a good margin.

yCharts

Trying on the efficiency chart above, you may see that HD has truly outperformed the S&P 500 for a lot of that previous three yr interval, however not till not too long ago has the roles switched, which may point out that shares of the house enchancment big could also be buying and selling at a reduction, which is one thing we’ll have a look at extra intently right now.

HD In The Eye of a Weakening Shopper

It has been no secret that the US shopper has been weakening as inflation and better rates of interest have lastly taken their toll. Sufficient is sufficient and the buyer greenback, particularly the discretionary greenback is drying up.

We now have seen a push again from customers at corporations equivalent to Starbucks (SBUX) and McDonald’s (MCD), which have indicated customers are being extra choosy, lastly, with how they spend cash after years of extraordinarily excessive inflation.

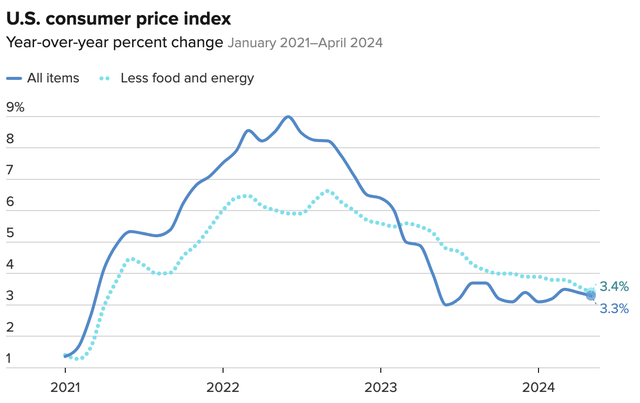

Within the newest CPI report, though rates of interest have remained excessive, inflation has remained sticky. The Might 2024 CPI report confirmed a rise of three.3% yr over yr and core-CPI, which excludes unstable meals and power costs, rose 3.4% over final yr. The Federal Reserve has a aim of bringing these figures down nearer to 2%, which means they nonetheless have a whole lot of room for enchancment.

cnbc.com

By way of retail gross sales, the Might report simply got here out displaying retail gross sales elevated 0.1%, which was under estimates on the lookout for 0.2% development yr over yr. If you exclude auto gross sales, retail gross sales truly declined.

Given all this, with US customers clearly being extra thoughtful with how they spend their cash, residence enchancment initiatives have taken a backseat, particularly after the growth we noticed in 2020 and 2021 throughout the pandemic with many individuals working from residence for a protracted time period, one thing that has develop into regular right now.

So given all this, is HD shares a BUY, SELL or HOLD?

Time to Purchase Shares of HD?

In terms of residence enchancment shops like HD and its closest competitor Lowe’s Firms (LOW), each of those corporations rely closely on the spring promoting season as customers are inclined to shore up the landscaping at their present properties or they could have simply bought a brand new residence and need to add landscaping. No matter it might be, the backyard class is vital throughout this time of the yr.

Nonetheless, once we breakdown the retail gross sales report for the month of Might, the constructing supplies and backyard sector of the report confirmed a yr over yr decline of 4.3%, one of many weakest classes inside the report.

Trying from one other angle, U.S. homebuilder sentiment weakened in Might for the primary time in six months displaying that greater rates of interest are weighing on residence gross sales.

The NAHB Housing Market Index fell unexpectedly to 45 in Might, the bottom since January. The studying was under each single analyst estimate that was printed.

House Depot caters much less to the DIY shopper and extra to the Professional shopper, however a mix of a weaker US shopper and builders displaying a insecurity doesn’t bode effectively for this residence enchancment big for the time being.

Within the firm’s newest earnings report, HD reported a decline of two.8% in comparable retailer gross sales and a decline of three.2% in US comp retailer gross sales. Revenues got here in under analyst expectations at $36.Four billion, declining 2.4% yr over yr.

Administration reaffirmed their steering, which referred to as for whole gross sales development of only one% and comp gross sales decline of 1% for the total yr, telling us administration just isn’t very optimistic on the US shopper both in 2024.

As such, there may be not lots to love from a macro standpoint in the case of investing in shares of HD. Nonetheless, as a long-term investor, if shares are priced extraordinarily low, it may level to an incredible entry level for these prepared to attend it out. Let’s take a more in-depth have a look at a few of these valuations now.

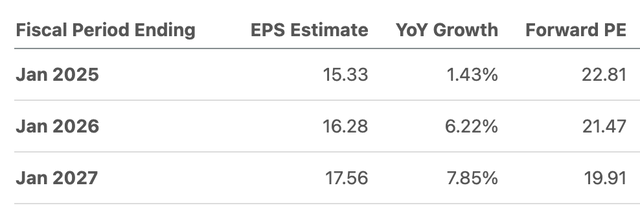

Analysts aren’t anticipating a lot by way of EPS development this yr, however the next two years EPS is predicted to leap between 6-7% per yr.

In search of Alpha

Utilizing this yr’s steering, shares at present commerce at 22.8x they usually commerce at 21.5x subsequent years earnings. For comparable functions, shares have traded at a median P/E a number of of 22.7x over the previous 5 years. Provided that, there may be not a lot of a reduction in any respect in the case of shares of HD.

From an Enterprise Worth to EBITDA standpoint, shares commerce at 16.1x, which is effectively above their 5-year common of 14.9x.

I like HD, however the valuation and the weak shopper doesn’t have me all that excited for the time being.

A Dividend Compounder

As I discussed in the beginning, HD has been a compounding darling and a portion of that has to do with not solely the corporate paying a stable dividend, but it surely has been the corporate’s skill to extend the dividend at a stable clip.

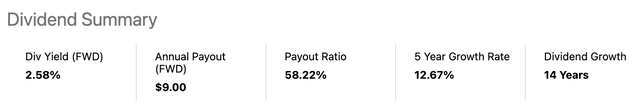

In search of Alpha

Shares of HD at present yield a dividend of two.6% they usually have a 5-year dividend development fee of almost 13%. The corporate has elevated the dividend for 14 consecutive years and counting.

The Energy of Compounding lets you take this dividend revenue yearly, and reinvest that so as to add extra shares to your funding. With an organization that constantly will increase its dividend, not solely do you now have extra shares, however since they pay a better payout annually, your dividend revenue will rise at a sooner clip yearly as effectively. It’s a highly effective course of over the long term.

Investor Takeaway

The House Depot is a unbelievable firm and intensely effectively run, however the present atmosphere doesn’t bode effectively for this residence enchancment juggernaut.

Though they proceed to pay a rising dividend, valuation doesn’t look all that low cost in any respect contemplating we’re seeing a weakening shopper and a slowing economic system. Discretionary spending is essential for HD and that has soured in current months.

As such, I’m going to take a PASS on shares of HD proper now, as their isn’t any intrigue on the present valuation, and I’ll wait to see if I can enter at a a lot lower cost.