Technological Advancements in Forex Trading

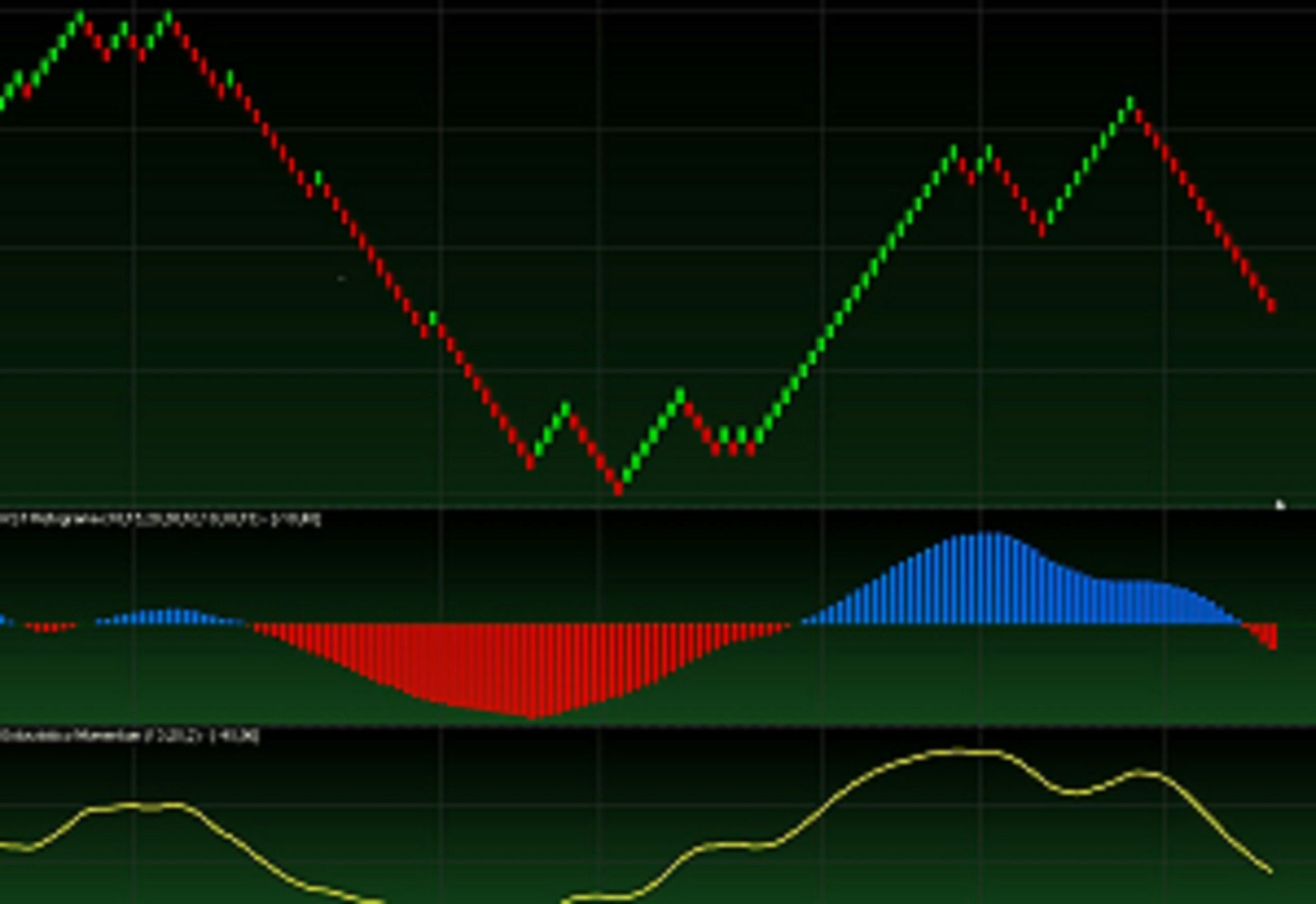

The forex industry in the USA is undergoing significant transformation as a result of technological advancements. One of the most notable innovations is algorithmic trading, which utilizes complex mathematical models to automate trade execution. This method enhances trading efficiency, enabling traders to capitalize on market fluctuations with speed and precision that is unattainable through manual trading. Algorithmic trading not only mitigates human error but also provides the capability to analyze vast amounts of market data in real-time, resulting in better-informed investment decisions.

Furthermore, AI-driven platforms are reshaping the landscape of forex trading. By incorporating machine learning algorithms, these platforms analyze historical data and identify patterns that may not be evident to human traders. Consequently, they offer predictive analytics that can guide investment strategies. These advancements empower traders with enhanced analytical tools that streamline the trading process and improve outcomes. Additionally, AI contributes to risk management by continuously monitoring market conditions and adapting strategies accordingly, thereby protecting investors from potential losses.

Blockchain technology also plays a crucial role in the evolution of the forex market. Its decentralized nature facilitates secure and transparent transactions, addressing issues related to fraud and counterparty risk. By offering an immutable ledger of transactions, blockchain enhances trust among participants in the forex ecosystem. The integration of smart contracts into forex opertions can further automate and secure agreements between parties, reducing the need for intermediaries and lowering transaction costs.

The rise of mobile applications represents yet another trend that is democratizing forex trading for retail investors. These applications enable individuals to access the forex market from anywhere, providing tools for real-time analysis, trade execution, and portfolio management right at their fingertips. As a result, more people can partake in forex trading, leading to a broader participation in the market.

Regulatory Changes Impacting Forex Trading

The forex trading landscape in the United States is undergoing significant transformations, largely driven by evolving regulatory frameworks set forth by key authorities such as the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). In recent years, these organizations have responded to the advent of new market dynamics, including the integration of cryptocurency and advancements in fintech. The challenge lies in balancing consumer protection with the need to foster innovation across the sector.

One of the primary objectives of the CFTC and NFA is to ensure that trading practices within the forex market remain fair and secure. Recent regulatory changes focus on enhancing transparency and accountability among market participants. For instance, the introduction of stricter reporting requirements encourages forex brokers to maintain more rigorous operational standards, thereby reducing the risk of fraud and malpractice. Such measures aim to bolster traders’ trust and confidence in the forex market while ensuring compliance with established laws.

Additionally, the emergence of cryptocurrency trading platforms hasprompted regulatory bodies to reassess their approaches. The potential for greater market volatility associated with cryptocurrencies compels the CFTC and NFA to consider whether existing regulations suffice or if there is a need for tailored directives that address this new realm of investment. These regulatory evaluations are essential for protecting retail investors from undue risk while embracing the technological innovations that cryptocurrencies present.

Moreover, as fintech companies continue to disrupt traditional forex trading models, regulatory agencies are exploring collaborative frameworks with these firms to ensure that innovation aligns with consumer protection standards. By fostering an environment in which new technologies can thrive without compromising regulatory integrity, the U.S. forex industry can build a resilient market that adapts to future challenges. Regulatory changes, therefore, not only serve to protect investors but also pave the way for sustainable growth and development in the realm of forex trading.

Shifts in Trader Demographics and Behavior

The landscape of forex trading in the USA is undergoing a significant transformation as the demographic profile of traders evolves. There has been a marked increase in younger individuals participating in forex markets, driven largely by the pervasive accesibility of technology and online trading platforms. This demographic shift indicates that younger traders, often aged between 18 and 35, are becoming more prominent, embracing forex not only as a form of investment but as a means of financial empowerment.

One notable aspect of this evolution is the changing motivations behind trading. Younger traders are increasingly influenced by social trading, where they can observe and replicate the strategies of more experienced traders through online platforms. This peer-driven approach allows novices to engage in forex trading with a degree of confidence, as they can learn from community-driven insights and shared experiences. Additionally, educational resources proliferating online have made it easier for new traders to gain knowledge about market dynamics, risk management, and trading strategies.

Moreover, the impact of social media and online communities cannot be understated. Platforms such as Twitter, Instagram, and various trading forums have fostered a culture where traders share tips, market analysis, and personal trading experiences with a broad audience. This interaction has not only encouraged greater engagement in forex trading but has also led to the development of new trading strategies that are informed by collective wisdom rather than solely individual research. As yoynger traders capitalize on these networks, they increasingly prioritize community-driven insights, viewing trading as a collaborative effort.

This shift towards a more technologically adept trader base fundamentally alters the dynamics of the forex market in the USA. With increasing access to tools and shared knowledge through digital platforms, the behaviors and strategies of forex traders are continually reshaped, indicating a promising and evolved future for this industry.

The Future of Forex Trading in the USA

The future of forex trading in the USA appears to be both dynamic and multifaceted, influenced by various geopolitical events, economic trends, and technological advancements. As the global economy continues to recover from recent challenges, the forex market is expected to evolve, providing traders and investors with new opportunities and challenges. In particular, changes in trade agreements and international relations may affect currency valuations, leading to increased market volatility. Understanding these geopolitical implications will be vital for participants in the forex market.

Moreover, with the continuous advancements in technology, including artificial intelligence and machine learning, new trading models are likely to emerge. These inovations may facilitate more sophisticated trading strategies, catering to both institutional and retail investors. The rise of automated trading systems and algorithmic strategies could enhance efficiency and provide traders with the ability to make more informed decisions based on real-time data analysis. This technological evolution is expected to support greater access to forex trading, particularly for retail investors who have been increasingly active in this sector.

As sustainable investing principles gain traction globally, the forex industry may also see the integration of these values into trading practices. Investors are becoming more conscious of the environmental and social implications of their investment choices, prompting forex brokers to consider and offer options that align with sustainable investment criteria. This trend could influence the demand for currencies tied to countries with strong sustainability initiatives, thereby impacting forex investment strategies.

Retail trading platforms have experienced significant growth in recent years, and this trend is anticipated to continue. As more individuals seek to engage in forex trading, the indistry will likely see the development of user-friendly interfaces and educational resources that empower new traders. In conclusion, staying informed and adaptable in the evolving landscape of the forex market will be critical for success in future trading endeavors.