Darren415

I final wrote in regards to the SPDR Portfolio S&P 500 Excessive Dividend ETF (NYSEARCA:SPYD) again in July 2021, arguing that whereas the ETF was set to outperform the SPX, the excessive diploma of volatility meant that the returns have been not well worth the threat. Since then, valuations have fallen considerably, however so has the chance value when it comes to the risk-free charge. Whereas the SPYD will outperform US Treasuries over the long run, the fairness threat premium is at report lows. Buyers within the SPYD are accepting a really low premium over USTs to compensate for the upper threat when it comes to draw back volatility and I due to this fact favor USTs over the approaching months.

The SPYD ETF

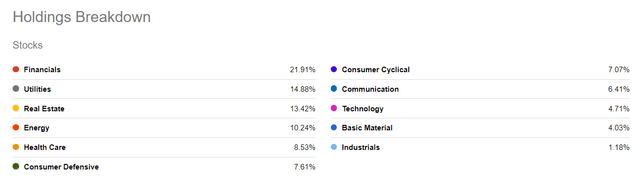

The SPYD ranks all dividend payers within the S&P 500 by indicated yield (the newest dividend, multiplied by dividend frequency, divided by share worth) and selects the highest 80. SPYD doesn’t embody any of the dividend sustainability or high quality screens which are baked into some peer ETFs. SPYD equally weights its portfolio whereas some related, income-focused funds weight by yield. Because of this, the ETF has a a lot increased weighting of financials, actual property, and vitality relative to the S&P 500. Know-how, in the meantime, represents lower than 5% of the index, as one would anticipate given the low dividend funds within the sector. The ETF has a minimal expense ratio of 0.07% and a distribution yield of 4.7%. Nonetheless, this yield will nearly actually fall, absent a decline in fairness costs, because the ahead dividend yield on the underlying S&P 500 excessive dividend yield index is simply 4.0%.

Seekingalpha.com

Actual Return Outlook Is Respectable…

The S&P 500 excessive dividend yield index has risen to 4.2% from 3.9% in mid-2021, because of rising dividend funds. This rise in dividend funds has truly underperformed different fundamentals akin to gross sales and earnings. Because of this, the dividend payout ratio sits simply above 50%, which is the bottom it has been within the knowledge accessible which is from 2016. Notably, this low payout ratio doesn’t replicate outsized revenue margins, because the rise in earnings has come from an increase in gross sales over the previous 18 months.

SPYD PE, DY, and Dividend Payout Ratio (Bloomberg)

This has led to a sizeable rise in long-term anticipated returns. The SPX has returned roughly 8% in actual phrases per yr over the long run when valuations have been on the stage of the S&P 500 excessive dividend yield index at the moment. It might be argued then that these are the returns one ought to anticipate on the SPYD. Nonetheless, these sturdy historic returns partly replicate sturdy development seen over this era, the place actual GDP averaged over 3%. The actual GDP development outlook now sits at lower than 1% based mostly on pattern charges of productiveness and labor pressure development. As excessive dividend paying shares are likely to develop extra slowly as they’re typically mature firms, dividend development is prone to be even decrease than this for the SPYD. Moreover, the long-term SPX returns have been supported by rising valuations, which has added one other 1% to annual returns. Taking these elements into consideration, actual returns look prone to be round 4% over the long run.

However The Fairness Threat Premium Is Too Low

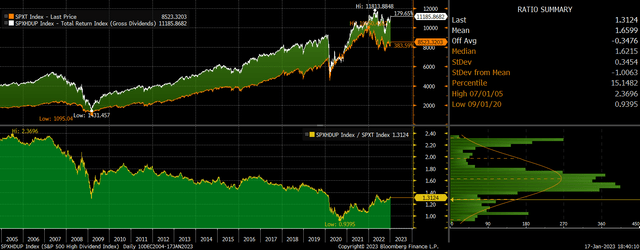

In contrast with the true return outlook for the SPX, which I estimate to be round zero, that is fairly sturdy, however within the context of present elevated bond yields this can be very low. The chart under exhibits the dividend yield on the S&P 500 excessive dividend yield index versus the 10-year US Treasury bond yield. The present unfold of 0.6% is the bottom on report and compares to a median of 1.9% since 2016.

SPYD Dividend Yield Vs UST Yield (Bloomberg)

It’s the identical story once we evaluate the dividend yield to 10-year inflation-linked bond yields, which present long-term returns after inflation. As shares are actual belongings, they need to be anticipated to rise with the rising worth stage over time, and so any comparability with bonds is healthier to be made with inflation-linked bonds quite than common Treasuries. The present unfold of two.9% might be regarded as the return of extra return on the SPYD over the subsequent decade assuming no change in valuations and assuming that dividends develop on the charge of inflation. Whereas 2.9% per yr could seem to be ample compensation for the added threat of investing in shares, it compares with a 7-year common of 4.4% and a excessive of 8.7% seen on the top of the Covid crash.

SPYD Dividend Yield Vs US Inflation-Linked Bond Yield (Bloomberg)

A Observe Document Of Underperformance In Bear Markets

This 2.9% fairness threat premium isn’t so engaging once we take into account the efficiency of the SPYD throughout bear markets. Within the Covid crash the ETF misplaced 47% of its worth, and losses in the course of the international monetary disaster have been a staggering 73%. The excessive weighting of economic and actual property shares, which have a 35% weighting, makes the ETF extremely vulnerable to financial weak point and credit score stress. As we noticed over the last two main downturns, US Treasury bonds truly carried out nicely as expectations of decrease rates of interest noticed yields plummet. I see a rising chance of one other rotation into bonds and away from shares because the financial development outlook continues to deteriorate.

SPYD Vs SPX (Bloomberg)

Abstract

The outlook for the SPYD has improved over the previous 18 months, and actual long-term return expectations now sit at round 4%. Whereas that is engaging relative to the SPX and is increased than the returns anticipated on US Treasuries, bonds characterize a greater risk-reward commerce within the present local weather because of the threat of sharp losses within the SPYD within the occasion of a recession.