damedeeso

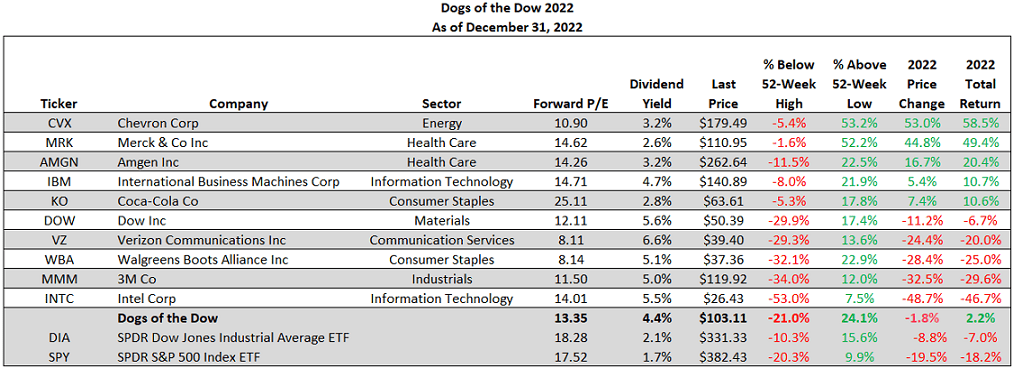

With the market’s shut on Friday, buyers fortunately stated goodbye to 2022. Only a few funding classes generated a constructive return in 2022. One space inside equities that outperformed the broader market was shares that had dividends related to them. I’ve highlighted one particular technique over time, The Canine of the Dow, that’s centered solely on dividend yield. Over time, the Canine of the Dow technique has generated blended outcomes, however in a 12 months like 2022, dividends mattered. In 2022, the overall return for the Dow Canine equaled a constructive 2.2% versus the Dow Jones Industrial Common return of -7.0% and the S&P 500 Index return, down -18.2%.

The Canine of the Dow technique is one the place buyers choose the ten shares which have the very best dividend yield from the shares within the Dow Jones Industrial Index after the shut of enterprise on the final buying and selling day of the 12 months. As soon as the ten shares are decided, an investor invests an equal greenback quantity in every of the ten shares and holds them for your complete subsequent 12 months. For 2023, two of the 2022 Dow Canine might be changed, Coca-Cola (KO) and Merck (MRK). The 2 Dow Jones shares that qualify for the Dow Canine in 2023 are Cisco (CSCO) and JPMorgan Chase (JPM). The dividend yields for CSCO and JPM at 2022 year-end are 3.20% and three.00%, respectively.

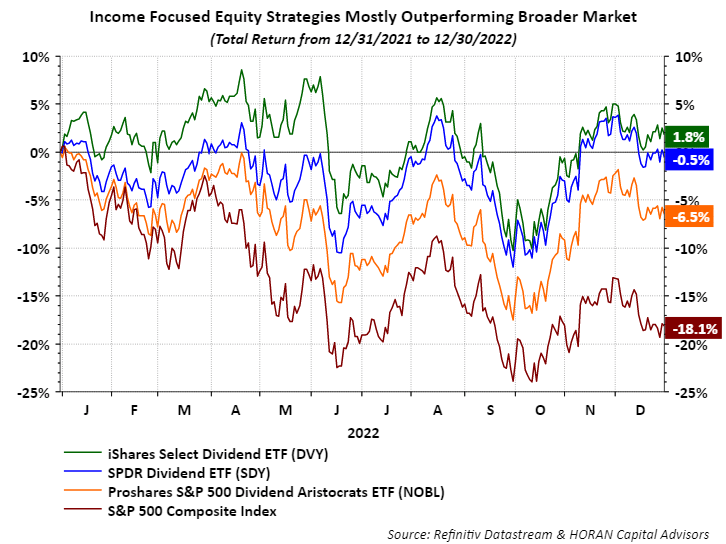

Investing in shares that pay a dividend doesn’t guarantee constructive fairness returns. One profit although is the actual fact high-quality dividend-paying shares do have a tendency to carry up higher in unstable down markets like buyers skilled in 2022. Under is a chart that shows the overall return efficiency of three frequent ETFs that concentrate on dividend-paying methods together with the S&P 500 Index return for 2022. All three of the dividend methods considerably outperformed the S&P 500 Index. The dividend payers and dividend growers don’t outperform yearly; nevertheless, incorporating shares with favorable dividend traits into one’s portfolio can scale back the portfolio’s general volatility.

Disclosure: Agency/Household lengthy DOW, MRK, VZ, INTC, MMM, JPM, CSCO

Unique Put up

Editor’s Notice: The abstract bullets for this text had been chosen by Searching for Alpha editors.