jittawit.21

Firm Snapshot

Olin Company (NYSE:OLN) is a Virginia-based chemical firm with long-standing experience within the chlor-alkali area (130 years of expertise and 54% of group gross sales). A number of the firm’s chief merchandise embody caustic soda, chlorine, hydrogen, bleach merchandise, epoxy supplies, aromatics, industrial cartridges, and ammunition (each sporting and army) OLN’s merchandise are utilized primarily by industrial and business entities throughout the globe (39% of group gross sales come from outdoors the US).

We consider there is a time to pursue shares equivalent to OLN, however that point is not now. Listed below are a couple of explanation why we aren’t prepared to leap on the OLIN bandwagon at this juncture.

Cyclical impression and excessive sensitivity to broader markets

At this stage of the enterprise cycle, it’s unwise to get too cozy with commodity chemical performs, given the inherently pronounced sensitivity to international GDP. The IMF was already beforehand anticipating actual international GDP progress to say no from 3.4% in FY22 to 2.9% this 12 months, however this has been scaled down as soon as once more to 2.8% as per its most current forecast in April.

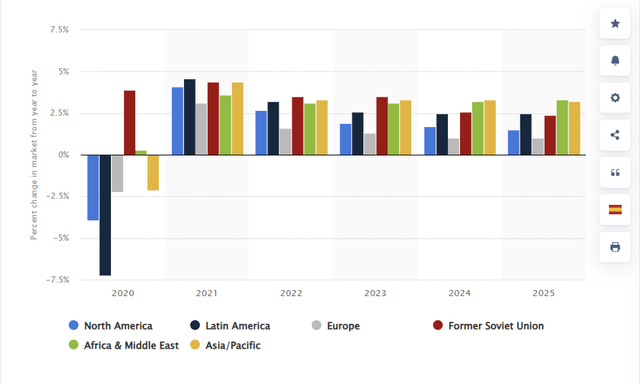

These underwhelming GDP numbers will little doubt go away a mark on chemical volumes. Statista believes that FY23 chemical volumes in necessary areas equivalent to North America (1.9% vs 2.7% in FY22) and Europe (1.6% vs 1.3% in FY23) will fail to maintain tempo with what was seen in FY22 while no area is predicted to see an enchancment in these progress charges.

Statista

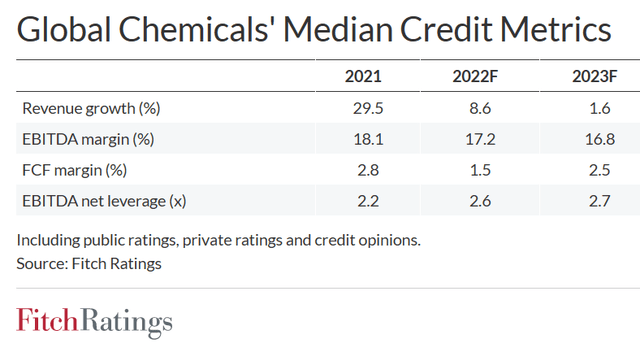

On account of inauspicious industry-related situations count on strain on each the topline and working stage (based on Fitch, income progress shall be subdued at 1.6% whereas margins look poised to contract by 40bps) while monetary leverage pressures will inch up on account of weak working leverage and a decent financial coverage setting. The one factor that will keep resilient is FCF conversion, however as you will see in a while on this piece, Olin is more likely to wrestle right here as nicely.

Fitch

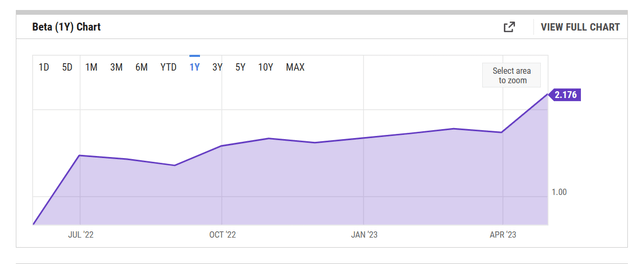

A weakening progress dynamic ought to weigh on the efficiency of broader markets, and it does not assist that Olin’s inventory is hyper-sensitive to the actions of the benchmarks. As you’ll be able to see from the picture under, Olin’s beta has elevated over the previous 12 months, and at present stands at an elevated studying of over 2x!

YCharts

Epoxy division considerations

Olin’s second-largest division – the division which produces epoxy supplies and precursors (~29% of group gross sales) is in a foul manner, and it will be unrealistic to count on a fast turnaround.

Demand within the American and European markets continues to be weak, and administration has additionally acknowledged that they resorted to overpricing in a few of these markets, which impacted their positioning. Notice that Chinese language producers have additionally ramped up the availability place, and since demand within the Asian markets is not resilient sufficient, one is going through an overdose of provide within the export markets.

In the event you’re affected by both of quantity or pricing challenges, Olin might maybe be higher positioned for a speedy bounce again, however once you’re hamstrung by each side of the equation, it turns into even tougher to get well. For context, out of the 54% YoY income decline of this division, 25% was from decrease volumes, and 5% was from weak pricing. FX impacts and the closure of sure models additionally left a mark. Olin is at present within the course of of creating changes to its international epoxy asset footprint and can incur extra restructuring prices linked to the closure of sure models (administration expects one other $30m of contemporary restructuring fees)

Ongoing free money circulate pressures might weigh on buyback momentum

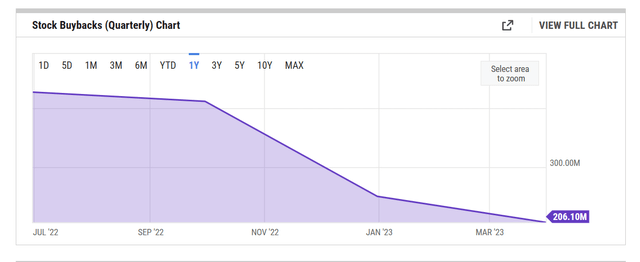

OLN administration takes nice pleasure of their constancy in the direction of shopping for again the inventory, but when current FCF pressures had been to persist, it might put a spanner within the works. Apart from, additionally word that buyback tendencies have already been slowing over time. A 12 months in the past, the corporate was deploying round $400-$450m of money per quarter on shopping for again inventory; as of late it has halved.

YCharts

Coming again to the FCF, we are able to see that the corporate didn’t generate a constructive quantity within the March quarter (-$24m), and while weak profitability performed an element, Olin additionally did not do an important job in managing its working capital nicely sufficient.

YCharts

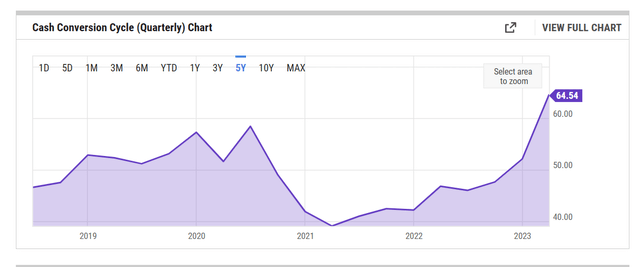

The money conversion cycle offers you a way of how lengthy money is tied up with working capital, and we are able to see that it just lately hit 5-year highs of 65 days within the March quarter (Olin usually retains it at lower than 50 days).

YCharts

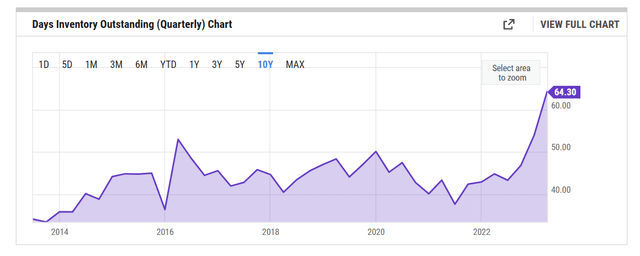

The prime perpetrator right here was the heightened quantity of stock build-up which got here in at 64 days, a 10-year excessive, and ended up sucking out $146m of money!

YCharts

Weak market and demand situations for caustic soda, vinyl intermediates, and epoxy supplies are anticipated to linger for the foreseeable future, so do not count on a speedy decline of these heightened stock ranges. For sure, this could possibly be a drag on money technology. Money gen is also pressurized by upcoming worldwide tax funds of $50m-$100m for the corporate’s energy property within the Gulf Coast.

Underwhelming sell-side estimates for FY23 go away an antagonistic mark on ahead valuations

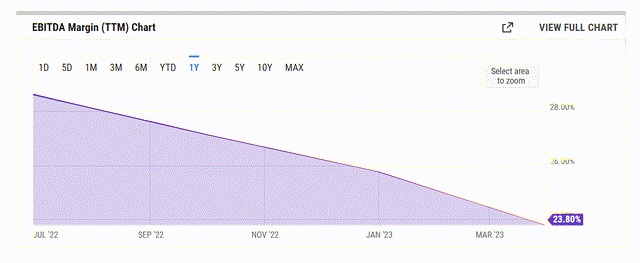

Olin has been incurring heavy margin strain for over a 12 months now (the picture under highlights how the EBITDA margins have been sliding on a trailing twelve-month foundation), and that’s unlikely to abate as we progress by means of this 12 months.

YCharts

As per YCharts estimates (the typical estimates of 12 sell-side analysts) group income in FY23 will hunch by-17% YoY, however the EBITDA impression shall be much more pronounced at -30% YoY (this might suggest that margins drop to 22%, virtually a 400bps YoY impression)!

Within the Q1 presentation, Olin’s administration recommended that EBITDA in FY23 could possibly be within the ballpark of $1.6-$1.9bn. Consensus at present is a bit of decrease than the mid-point of that vary, at $1.71bn. On that EBITDA quantity, the inventory at present trades at a dear ahead EV/EBITDA of 5.6x, which might represent a 20% premium over the 5-year common a number of of 4.68x. Even when we assume a drastic turnaround in H2 (which seems unlikely) with the corporate hitting the higher finish of the vary, that might nonetheless level to a dear EV/EBITDA of 5.1x, which remains to be above the long-term common.

YCharts

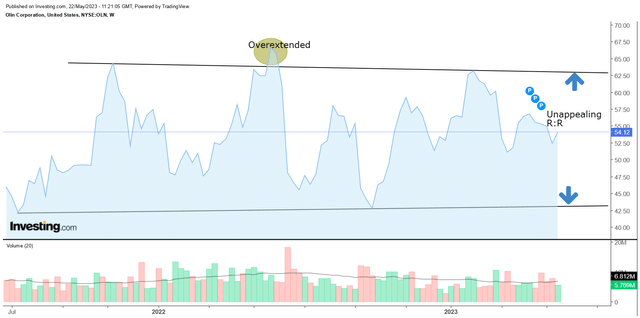

Unappealing technical panorama and restricted assist from establishments

If one considers the weekly value imprints of OLN over the past two years or so, we are able to see that issues have been somewhat uneven, with the inventory making giant swings throughout the $43 to $61 vary. We’re but to see any value vary the place the inventory has managed to stabilize, and thus it turns into much more pertinent to play the 2 boundaries and take positions accordingly. In that regard, if one had been to kick-start a protracted place on the present value level, the risk-reward doesn’t work in your favor. You usually wish to take positions the place the reward-risk equation is over 1x. However on the $54 stage, the equation works out to a sub-par variety of 0.84x

Investing

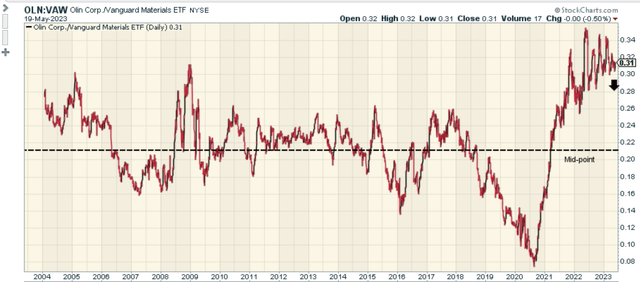

The opposite factor to notice is that Olin is unlikely to profit from any mean-reversion curiosity for these fishing within the supplies sector, as its relative positioning versus the Vanguard Supplies ETF remains to be fairly elevated (~48% larger than the mid-point of the long-term vary).

StockCharts

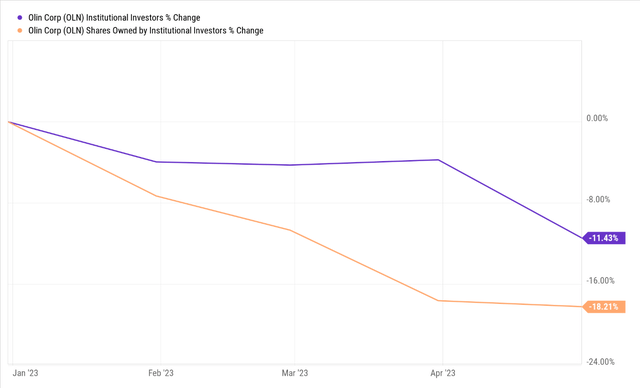

Ideally, you additionally wish to see the fellows with deep pockets, to show extra constructive in your inventory, however that theme is but to be mirrored with Olin. Each the whole variety of establishments that pursue Olin and the web shares owned by them have been sliding each single month for the reason that flip of the 12 months. For context, on a YTD foundation, the previous metric is down by 11% and the latter metric is down by 18%.

YCharts