Invoice Oxford

American Tower (NYSE:AMT) gives a sustainable dividend yield of three.3% and good dividend progress prospects, plus its valuation can be engaging, making it fairly attention-grabbing for long-term traders.

Firm Overview

American Tower is an actual property funding belief [REIT] that owns and operates telecommunications infrastructure, particularly towers associated to wi-fi and broadcast communications. Its primary enterprise is to lease antenna websites on multi-tenant towers, being one of many primary firms on this trade worldwide. Its present market worth is about $90 billion and trades on the New York Inventory Trade.

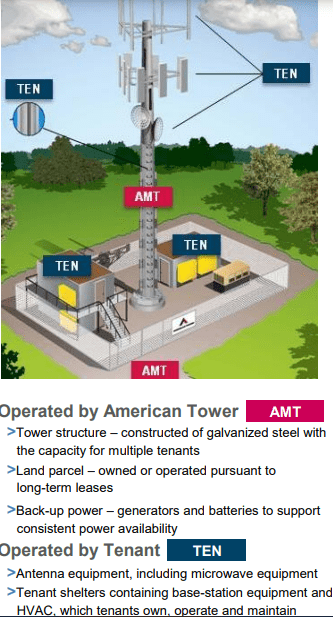

On the finish of final March, it had a portfolio of greater than 226,000 communication websites, together with greater than 43,000 properties within the U.S. and Canada, plus over 182,000 properties in the remainder of the world. Its enterprise mannequin is to personal the actual property and tower construction, whereas its tenants normally personal the remaining tower gear, as illustrated beneath.

Tower (American Tower)

Its enterprise supplies comparatively predictable and rising income, earnings, and money flows over the long run, on account of some particular traits, together with long-term leases with contractual rental escalators, excessive renewal charges, and comparatively low upkeep expenditures.

Certainly, most of its tenant leases with wi-fi carriers have preliminary intervals of 5 to 10 years, with a number of renewal phrases, plus provisions that result in lease will increase on an annual foundation, linked to inflation or fastened escalation. Given the present inflationary surroundings the world over, American Tower’s enterprise is kind of nicely protected on account of a lot of these leases, thus its working efficiency might even enhance on account of inflation, if it will probably keep a superb price management and its working bills improve at a decrease progress charge than rents.

Past having a superb hedge in opposition to inflation, its enterprise additionally enjoys optimistic working leverage, on condition that when the corporate set up a property and a tower, the prices of including further tenants are fairly low and subsequently when it’s in a position so as to add tenants to an current web site, most of incremental income flows on to its working revenue.

Geographically, American Tower has a superb diversification profile on account of its world attain, which additionally offers it good progress prospects over the long run. In the newest quarter, some 55% of its income was generated within the U.S. and Canada, whereas worldwide markets accounted for the remaining. Inside international operations, its most essential area is Latin America (accounting for some 17% of whole income), adopted by Africa (11.7%), Asia-Pacific (9.3%), and Europe (7.1%).

However, from a tenant perspective, it has rather more focus, particularly within the U.S. Certainly, its three largest tenants are T-Cell US (TMUS), AT&T (T), and Verizon (VZ), which collectively account for some 45% of whole income. Different essential tenants are additionally Airtel Africa (OTCPK:AARTY) and Telefonica (TEF), which one accounting for about 10% of whole income, which implies its prime 5 tenants symbolize about 65% of the corporate’s income.

Whereas traditionally tenants have excessive renewal charges and discovering options shouldn’t be straightforward, if a serious tenant decides to maneuver to a different tower supplier, it will probably have a major impression on American Tower’s income, which might not be straightforward to interchange because the variety of giant wi-fi operators is proscribed, particularly within the U.S.

Concerning progress, American Tower has comparatively good progress prospects supported by trade tendencies similar to growing knowledge utilization, which ought to proceed to drive telecom operators’ funding in wi-fi networks and result in extra leasing exercise for tower operators.

Moreover, it additionally has traditionally sought exterior progress via acquisitions, of which crucial previously few years was its $10 billion acquisition of CoreSite Realty, which diversified its enterprise by including knowledge facilities to its enterprise portfolio. Whereas its present technique is to prioritize steadiness sheet deleveraging, American Tower is more likely to pursue acquisitions sooner or later if the chance arises.

Furthermore, its publicity to some creating markets additionally offers it good natural progress prospects within the coming years, as smartphones penetration is decrease than in comparison with its home market and different developed areas, thus it’s anticipated stable wi-fi knowledge demand for years to return.

Monetary Overview

Concerning its monetary efficiency, American Tower has a superb observe file, reporting rising income and powerful enterprise margins over the previous few years. In 2022, because of the acquisition of CoreSite, some 7% of its income was generated by knowledge facilities, whereas the remaining got here nearly all from its tower section.

Its annual revenues within the final 12 months amounted to $10.7 billion, up by 14% YoY, of which 6.9% was associated to tenants billing progress. Its adjusted EBITDA was $6.6 billion, representing an EBITDA margin of 62%. The corporate’s internet revenue was $1.7 billion, and its adjusted funds from operations (AFFO) have been almost $4.7 billion, a rise of seven% YoY.

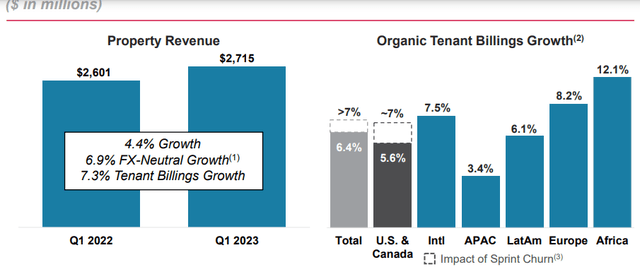

Throughout the first three months of 2023, American Tower maintained a optimistic working momentum, with whole income growing by 4% YoY to $2.77 billion, boosted by natural tenant billing progress of 6.4%, whereas then again foreign exchange was a headwind. Its knowledge middle section reported income progress of 10%, exhibiting that can be having fun with sturdy momentum.

Income (American Tower)

Concerning its profitability, American Tower reported an adjusted EBITDA of $1.7 billion in Q1 (margin of 63.7%), on account of sturdy price management that’s permitting some margin enlargement. Its AFFO was near $1.2 billion, a small improve in comparison with the earlier 12 months.

For the complete 12 months, American Tower’s steering is to attain property income of about $10.7 billion, up by round 3% YoY, supported by rental progress whereas foreign exchange is predicted to impression negatively income progress. Its EBITDA must be above $6.9 billion, or a 62.9% margin, whereas its AFFO is predicted to be some $4.5 billion.

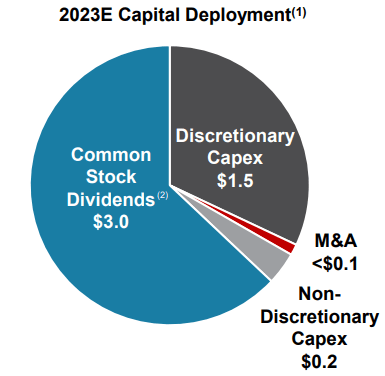

Whereas American Tower has a recurrent and extremely money generative enterprise, its monetary leverage is considerably excessive, as the corporate elevated its debt place following the acquisition of CoreSite. On the finish of final March, its internet debt-to-EBITDA ratio was 5.2x, decrease than 6.1x on the finish of 2021, however nonetheless above its long-term goal of between 3-5x. Subsequently, American Tower’s purpose within the brief time period is to deleveraging its steadiness sheet, which implies most of its natural money movement must be allotted to shareholder remuneration and capex, whereas giant acquisitions aren’t anticipated till it reduces monetary leverage to a suitable stage.

Taking this background into consideration, the corporate’s capital deployment plan for 2023 is to distribute some $Three billion to shareholders via dividends, representing an annual improve of about 10%, allocate some $1.7 billion to capex and a really small quantity to M&A.

Capital plan (American Tower)

Concerning its dividend, American Tower has an excellent historical past, delivering a rising dividend over the previous few years. Its final quarterly dividend was set at $1.56 per share, or $6.24 per share yearly, which at its present share worth results in a dividend yield of about 3.3%.

Provided that its dividend is roofed by AFFO and the corporate’s enterprise mannequin is very recurrent and predictable, plus has a superb money movement era capability, American Tower’s dividend is clearly sustainable and is more likely to keep a rising development within the close to future.

Certainly, in accordance with analysts’ estimates, its dividend is predicted to develop to about $6.45 per share this 12 months, and improve to about $7.82 per share by 2025, exhibiting that American Tower’s dividend progress prospects are fairly good supported by the corporate’s sturdy fundamentals.

Conclusion

American Tower is an organization with a stable profile, on account of its recurring income, earnings and money flows stream, being a powerful help for a sustainable dividend over the long run. Whereas its comparatively excessive monetary leverage is the primary weak issue of its funding case, I don’t see this being a menace to revenue traders as the corporate’s precedence is to cut back steadiness sheet leverage somewhat than looking for additional acquisitions.

Concerning its valuation, it’s at present buying and selling at some 19x FFO, at a reduction to its historic common of about 25x over the previous 5 years. Thus, American Tower has a sustainable dividend and in addition gives a lovely valuation in comparison with its historical past, being subsequently a superb revenue funding proper now.