Andreus

There’ll come a time when it is not ‘They’re spying on me by way of my cellphone’ anymore. Ultimately, it will likely be ‘My cellphone is spying on me‘.”― Philip Okay. Dick.

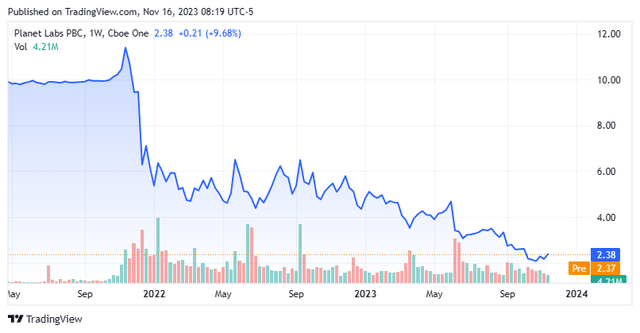

At this time, we put Planet Labs PBC (NYSE:PL) within the highlight. This satellite-related concern is aiming at a rising market and losses ought to drop considerably in coming years. That mentioned, the corporate has disenchanted traders with its final couple of quarterly studies even whereas delivering respectable gross sales progress. What’s forward for Planet Labs? An evaluation follows under.

Looking for Alpha

Firm Overview:

Planet Labs PBC is headquartered in San Francisco. The corporate designs, constructs, and launches constellations of satellites. These are used to supply excessive cadence geospatial information delivered to clients by way of a web-based platform. Planet Labs presents its purchasers planet monitoring, base maps, tasking, apps, variables, hyperspectral, analytic feeds, and platform in addition to assorted different companies. The inventory trades slightly below $2.50 a share and sports activities an approximate market capitalization of $680 million. The corporate’s fiscal 12 months begins on October 1st.

September Firm Presentation

The corporate’s low-cost community of easy-to-launch satellites photos all the Earth each day, archives it and offers real-time entry to purchasers by way of its cloud-native proprietary know-how and platform. Clients pay for these companies on a subscription foundation. Roughly 55% of the corporate’s general income comes from North America.

Second Quarter Outcomes:

September Firm Presentation

The corporate reported its second quarter numbers on September seventh. Planet Labs delivered a non-GAAP lack of seven cents a share within the quarter, largely in step with expectations. Revenues rose slightly below 11% on a year-over-year foundation to $53.eight million, just below the consensus forecast. Income progress was in step with a 10% improve in whole buyer depend, to 944 from the identical interval a 12 months in the past.

September Firm Presentation

The corporate’s main consumer base is within the agriculture, mapping, forestry, and finance and insurance coverage sectors. It additionally serves federal, state, and native governmental our bodies. Gross margins improved to 49% from 48% from the prior interval a 12 months in the past. Administration supplied the next ahead steerage.

September Firm Presentation

FY2024 steerage was about $10 million under the analyst agency consensus inflicting the inventory to drop within the mid-teens through the day second quarter numbers had been posted. The same steerage disappointment after first quarter numbers brought about an identical fall within the inventory it ought to be famous. In late September, Planet Labs re-upped an settlement with NASA that may present it a bit over $18 million in funding by way of 12 months finish 2024.

Analyst Commentary & Steadiness Sheet:

Since second quarter outcomes had been posted in September, eight analyst companies together with Goldman Sachs and Needham have reissued Purchase/Outperform scores on Planet Labs. Value targets proffered vary from $4.90 to $7.00 a share. Three of they purchase reiterations had minor downward value goal revisions, it ought to be famous.

Just below 4 p.c of the excellent float within the shares is presently held brief. The corporate had no insider gross sales of inventory as a public firm till April of this 12 months. Since then, a number of insiders have bought slightly below $300,000 value of fairness collectively. The corporate ended the primary half of this 12 months with simply over $365 million value of money and marketable securities on its steadiness sheet. Planet Labs additionally carries no long-term debt. The corporate had an adjusted EBITDA lack of $14.5 million within the second quarter.

Verdict:

Planet Labs had a lack of 61 cents a share in FY2023 on simply over $190 million in revenues. The present analyst agency consensus has losses being lower in half in FY2024 as gross sales rise to some $220 million. In FY2025, they see 21 cents of losses per share on 20% income progress.

September Firm Presentation

Planet Labs is aiming at an increasing market. The corporate has constantly grown its buyer base and has a excessive renewal charge for its subscription companies. Planet Labs additionally has a rock-solid steadiness sheet. The corporate introduced a layoff of 10% of its worker depend in August to assist scale back prices it ought to be famous. Management expects to take a $7 million to $eight million non-recurring restructuring price when it studies Q3 outcomes. Administration additionally expects whole operational prices to be lowered by $35 million in FY2025 in comparison with the place they had been projected initially of FY2024. AI can be a possible new business alternative for the agency as nicely.

General, I like Planet Labs PBC’s enterprise mannequin and longer-term potential. Nevertheless, the inventory has destroyed chunk of shareholder worth in the previous couple of years, and Planet Labs has disenchanted traders in every of its final two quarterly studies and steerage. A recent set of knowledge factors will likely be obtainable in early December when the corporate posts third quarter outcomes. Whereas it is a story value watching, I wish to see extra progress on the profitability entrance earlier than I make an funding in Planet Labs.

In a complete surveillance state, complicity is more likely than ignorance.”― Cliff Jones Jr.