“Market-timers can’t get far more bullish, which is bearish from a contrarian stance.”

The inventory market’s rally has misplaced nearly all help from contrarian evaluation. That’s as a result of a lot of the money in fairness portfolios that was sitting on the sidelines is now again available in the market, leaving little further sideline money obtainable to speculate and propel costs a lot increased in coming months.

Certainly, lots of the short-term inventory market timers my auditing agency screens are extra bullish at present than at nearly another time since information started being collected in 2000.

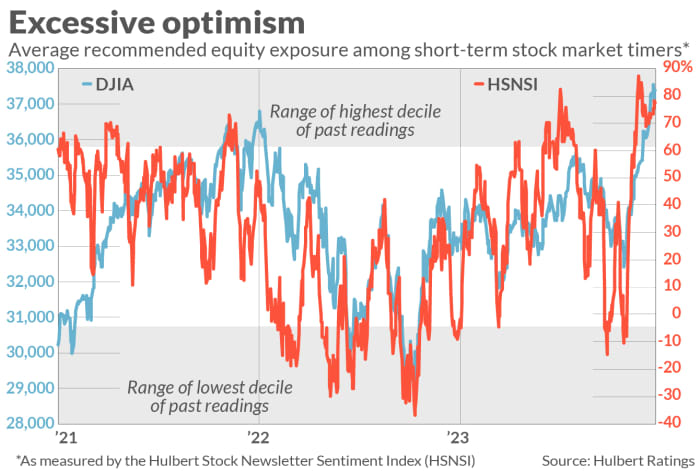

Take into account these timers that target timing the broad market, as represented by market averages such because the Dow Jones Industrial Common DJIA and the S&P 500 SPX. Their common really helpful fairness publicity degree presently is increased than in simply 0.7% of the buying and selling days since 2000. The timers can’t get far more bullish than that, which is bearish in keeping with contrarian evaluation.

The timers’ bullishness is illustrated within the chart under, during which the timers’ common really helpful fairness publicity degree is represented by the Hulbert Inventory E-newsletter Sentiment Index (HSNSI). The shaded zone on the high of the chart displays the vary of HSNSI readings which might be within the high 10% of their distribution since 2000; in earlier columns I’ve used that zone to point extreme optimism.

You’ll discover that the HSNSI entered this high decile zone greater than a month in the past and, opposite to contrarians’ expectations, the inventory market continued to rise. One potential clarification for this stunning energy is that sure different market timers — those that give attention to the Nasdaq market particularly — remained a lot much less optimistic. On reflection, these timers’ relative warning might have been sufficient to present the rally room to run.

As lately as mid-December, for instance, my agency’s Hulbert Nasdaq E-newsletter Sentiment Index (HNNSI), which displays these Nasdaq-focused timers’ common really helpful fairness publicity, was solidly in the midst of its historic distribution. That not is the case: The HNNSI now stands on the 92nd percentile of its historic distribution, becoming a member of the HSNSI of their respective zones of extreme optimism. (The HNNSI shouldn’t be plotted within the accompanying chart.)

This deteriorating sentiment image doesn’t assure that the market will instantly stumble, in fact. Contrarian evaluation shouldn’t be the one issue that propels the market, and even when contrarian evaluation is on track, the market doesn’t all the time reply instantly. For instance, shares simply may rally in coming days — over the Santa Claus rally interval by way of early January, as I indicated final week — earlier than finally succumbing to the gravitational pull exerted by extreme optimism.

Nonetheless, if the long run is just like the previous, the U.S. market’s rally is more and more residing on borrowed time.

Mark Hulbert is an everyday contributor to MarketWatch. His Hulbert Rankings tracks funding newsletters that pay a flat charge to be audited. He may be reached at mark@hulbertratings.com

Extra: The 10 days that moved the inventory market probably the most in 2023

Additionally learn: Ed Yardeni: 12 causes inventory traders will see the S&P 500 hit 5,400 in 2024