djgunner/E+ through Getty Pictures

By Mike Larson

Now, that’s what I name rotation!

After languishing for ages, smaller-capitalization shares got here roaring again over the previous couple weeks. In the meantime, the “Huge Tech” shares that had been main markets tumbled throughout the board.

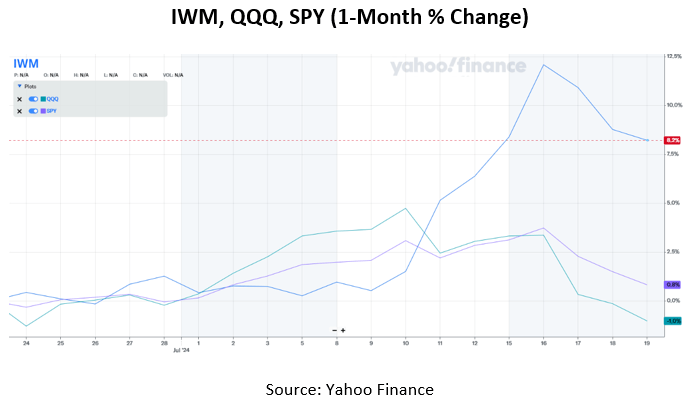

Simply take a look at the MoneyShow Chart of the Week for July 22, 2024. It exhibits the 1-month proportion change within the iShares Russell 2000 ETF (IWM), the Invesco QQQ Belief (QQQ), and the S&P 500 ETF Belief (SPY). You possibly can see the IWM has risen greater than 8% throughout that timeframe, whereas the QQQs have shed 1% and the SPY is barely within the black.

On a shorter-term timeframe, the motion is even starker. In a current seven-day stretch of buying and selling, the Russell 2000 outperformed the S&P 500 by the widest margin since knowledge was first collected in 1986. And it’s not only a capitalization difficulty. Worth shares additionally outperformed development shares by probably the most since 2001.

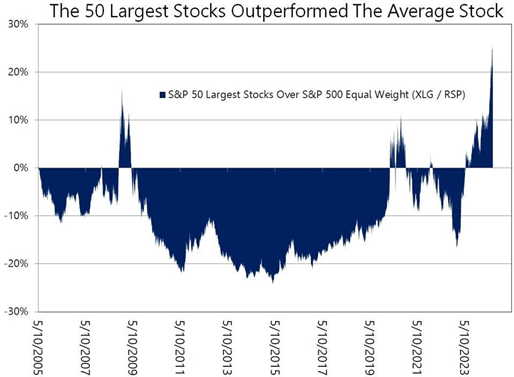

This comes after a dramatic stretch of underperformance for smaller, less-expensive shares. Solely final month, I confirmed you ways even throughout the Russell Index this 12 months, larger-cap shares had been outperforming mid-cap shares, which in flip had been outperforming micro-cap names. The identical factor has been true within the S&P 500, as you possibly can see on this chart from Forbes.com.

Supply: Path Monetary, through Forbes.com

Supply: Path Monetary, through Forbes.com

The burning query for traders now could be easy: Will the rotation proceed? Or in different phrases, is that this a big-picture development shift… or simply short-term buying and selling motion that’ll reverse quickly?

Affordable folks can disagree. A lot are on-line and on tv. However you possibly can put me within the “big-picture shift” camp.

I believe traders are on the lookout for new winners, new sectors, and new investments in a brand new rate of interest and financial regime. That doesn’t imply tech will tank. But it surely does possible imply smaller-cap, value-style names in sectors like financials, power, industrials, and supplies will outperform. Gold and gold miners, too.

So, my recommendation is: “Don’t combat it. Embrace it.”

Unique Publish

Editor’s Be aware: The abstract bullets for this text had been chosen by In search of Alpha editors.