gilas/iStock through Getty Photos

However the place can we draw the road on what costs matter? Actually costs of products and companies now being produced–our fundamental measure of inflation–matter. However what about futures costs or extra importantly costs of claims on future items and companies, like equities, actual property, or different incomes belongings? Are stability of those costs important to the soundness of the economic system?

Clearly, sustained low inflation implies much less uncertainty concerning the future, and decrease danger premiums suggest increased costs of shares and different incomes belongings. We will see that within the inverse relationship exhibited by value/earnings ratios and the speed of inflation prior to now. However how do we all know when irrational exuberance has unduly escalated asset values, which then develop into topic to surprising and extended contractions as they’ve in Japan over the previous decade?

– Alan Greenspan, The Problem of Central Banking In A Democratic Society

There’s been lots of speak about bubbles just lately because the S&P 500 scales new heights. I’ve by no means preferred that time period since there isn’t any technique to know the longer term, to know that what is going on at present is certainly “irrational” whether or not within the type of extreme exuberance or gloom. We solely understand it was irrational with the advantage of hindsight.

Alan Greenspan’s speech about Central Banking In A Democratic Society wouldn’t be remembered at present apart from that phrase “irrational exuberance”. For most individuals it’s a boring speech concerning the evolution of cash and central banking in America, beginning with a reference to William Jennings Bryan’s well-known speech concerning the gold normal:

In the event that they dare to come back out within the open subject and defend the gold normal as a superb factor, we will battle them to the uttermost, having behind us the manufacturing lots of the nation and the world. Having behind us the industrial pursuits and the laboring pursuits and all of the toiling lots, we will reply their calls for for a gold normal by saying to them, you shall not press down upon the forehead of labor this crown of thorns. You shall not crucify mankind upon a cross of gold.

What Bryan was advocating was an abandonment of the gold normal in favor of bimetallism. He needed to monetize silver at an above-market value to develop the cash provide and permit farmers to extra simply repay their money owed. This got here on the peak of what’s recognized in financial historical past because the lengthy despair, the interval of deflation that adopted the Civil Warfare because the US returned to the gold normal. What Bryan needed was inflation to alleviate the burden of money owed on the “widespread man”.

It isn’t an actual parallel however in a means, one might say that we confronted an analogous scenario after the monetary disaster of 2008. It isn’t coincidence that Bryan was what we all know at present as a populist and that each events at present supply solely barely completely different variations of supposedly populist financial platforms. The last decade after 2008 main as much as COVID in 2020 was one marked by constantly low inflation and near-zero rates of interest. It was additionally a time when inequality grew to become a way more outstanding subject of dialogue as ZIRP and QE had been seen as benefitting the rich, whose stability sheets had been positively impacted by rising asset costs, as Greenspan precisely predicted.

COVID modified the equation as the federal government and central financial institution response modified the composition of family stability sheets. Primarily, debt was shifted from family stability sheets to the federal government’s. Households at present are nonetheless holding way more money – over 15% of GDP – in checking accounts than previous to COVID and family internet value is at an all-time excessive. And that’s not simply true of high-income households; the underside 50% of the revenue distribution continues to be holding much more money too. And whereas inflation has been seen as an issue, particularly by lower-income households, it too had a constructive influence on many American family stability sheets within the type of quickly rising home costs.

If something, I believe the official inflation fee failed to completely seize the rise in costs of latest years. My go to to Miami introduced that into sharp focus this week. For middle-class households that owned a home earlier than COVID, the inflation was a boon. My very own case is illustrative. The value of our modest house within the south Miami-Dade County rose by about 75% within the 18 months after the onset of COVID and it has continued to climb, now double the pre-COVID value. I benefitted from promoting that home at an inflated value and transferring to a state the place actual property was cheaper. I received extra home for much less cash and I wasn’t the one one.

Previous to COVID, lots of child boomers had been going through a retirement that was underfunded and in a really actual sense, COVID bailed them out by elevating the value of their present home and permitting to money out, transfer someplace cheaper, and retire. That’s an enormous purpose why the labor drive participation fee for the over 65 cohort fell from 26% to 23% after COVID – and stayed there – and I think it isn’t going up anytime quickly.

The change in family stability sheets has additionally impacted different asset costs. Extra individuals have been in a position to spend money on shares and different belongings as a result of COVID gave them the wherewithal to take action. The variety of brokerage accounts grew by 10 million in 2020 alone and has continued to develop. Now, a few of what these new “traders” have achieved with their newfound funding capital is likely to be extra correctly categorized as playing – a few of it actually – however lots of it has ended up in index funds and different extra conventional belongings. Costs have responded accordingly.

The query we face at present is, in some ways, the identical one Greenspan posed practically Three a long time in the past:

…How do we all know when irrational exuberance has unduly escalated asset values, which then develop into topic to surprising and extended contractions…

I believe Jerome Powell has answered that query from the perspective of financial coverage. After final week’s FOMC assembly, Powell stated:

We consider that our coverage fee is probably going at its peak for this tightening cycle and that, if the economic system evolves broadly as anticipated, it’ll seemingly be applicable to start dialing again coverage restraint sooner or later this 12 months.

That doesn’t sound like a person nervous about irrational exuberance to me. He additionally sounded so much like Alan Greenspan in speaking about future financial coverage:

We all know that decreasing coverage restraint too quickly or an excessive amount of might lead to a reversal of the progress we now have seen on inflation and finally require even tighter coverage to get inflation again to 2 %. On the similar time, decreasing coverage restraint too late or too little might unduly weaken financial exercise and employment.

That passage might have been straight lifted from Greenspan’s speech 28 years in the past. Discover too that Powell says “if the economic system evolves as anticipated” and that they don’t know if it’ll. So, simply as Greenspan famous, the Fed must be pre-emptive, to alter coverage upfront of adjustments within the economic system which can be arduous to foretell. The conduct of financial coverage has modified some since Greenspan’s speech however not a lot.

So, to get again to the subject we began with, is the inventory market in a bubble? I don’t know after all, however I might level out that the economic system has been so much higher than most have anticipated, and that flows straight by to company earnings and impacts inventory costs. Earnings estimates for the S&P 500 for 2024 are about 12.5% above 2023 which could appear a bit low contemplating the index is buying and selling for over 20 instances these earnings. However markets are forward-looking and never simply by a couple of months; This autumn 2024 earnings are anticipated to rise 20% above This autumn 2023. And full-year estimates for mid-cap (+20%) and small-cap (+30%) are even rosier.

If these estimates are correct, present inventory costs don’t appear outrageous in any respect. Massive caps are the most costly and paying 21 instances earnings for 12.5% earnings progress does appear a bit wealthy. However paying roughly 15 instances earnings for 20% or 30% earnings progress doesn’t sound unreasonable in any respect. In fact, earnings estimates are notoriously inaccurate, particularly at turning factors, so you possibly can’t rely these chickens simply but. Correct earnings estimates are finally a operate of correct financial forecasts.

One factor Alan Greenspan stated in that speech so way back that strikes a chord with me is when he describes how the Fed displays the economic system:

For a few years, the Federal Reserve has maintained what we belief is a extremely refined day-by-day, close to real-time, analysis of the American economic system and, the place related, of international economies as effectively.

There’s, regrettably, no easy mannequin of the American economic system that may successfully clarify the degrees of output, employment, and inflation. In precept, there could also be some unbelievably complicated set of equations that does that. However we now have not been capable of finding them, and don’t consider anybody else has both.

Consequently, we’re led, of necessity, to make use of advert hoc partial fashions and intensive informative evaluation to assist in evaluating financial developments and implementing coverage. There isn’t any different to this, although we constantly search to boost our information to match the ever rising complexity of the world economic system.

I’ve stated for a few years that we can’t predict the longer term economic system, and that the perfect we are able to do is describe its current state. It isn’t as straightforward because it sounds as a result of financial information is topic to revision; it’s not often an correct illustration of the economic system when it’s first launched. Which implies we’re in the identical boat because the Federal Reserve and their 400 PhD economists. We’ve to make funding choices upfront of adjustments within the economic system utilizing forecasts that will or might not be correct.

Sooner or later within the subsequent 12 months, the inventory market will in all probability have a correction, a drawdown of a minimum of 10% however lower than 20%. We get these, on common, about each 18 months. We had one in all final 12 months from July to October that was about 11% peak to trough. The subsequent one, like all those earlier than it, will occur as a result of both the estimate of future inflation or financial progress embedded in inventory costs on the time is deemed sufficiently incorrect to supply that dimension of an adjustment within the outlook for earnings or the speed at which they’re discounted. Smaller errors will produce smaller changes.

To this point this 12 months, the changes to the outlook have all been constructive. Financial progress is stunning – once more – to the upside which bolsters the outlook for earnings and inflation continues to average which ought to permit for a discount within the low cost fee. These are constructive developments and one would count on inventory costs to rise in response. I hesitate to put in writing this however name it….rational exuberance.

Setting

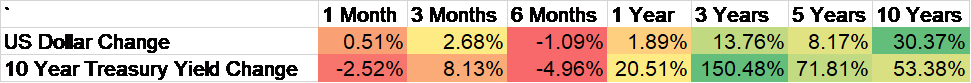

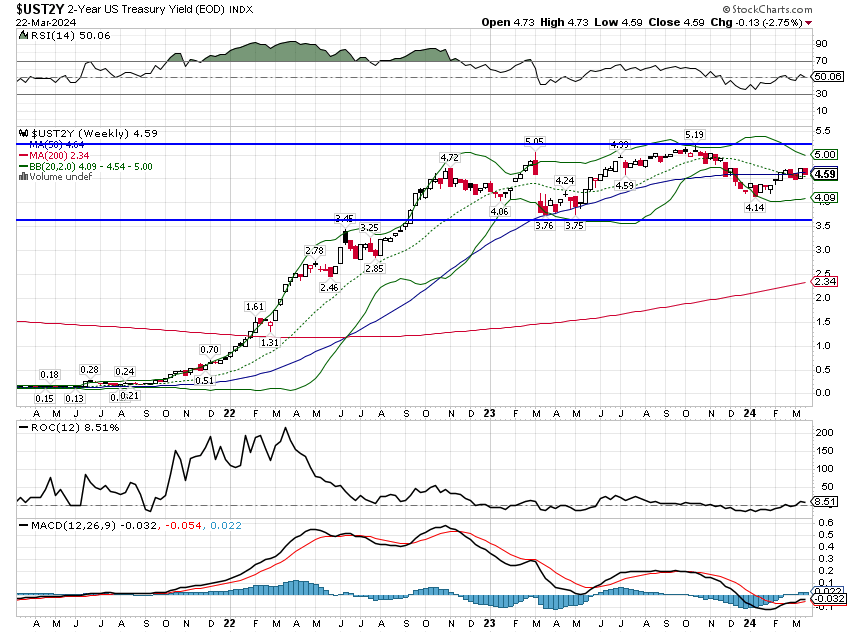

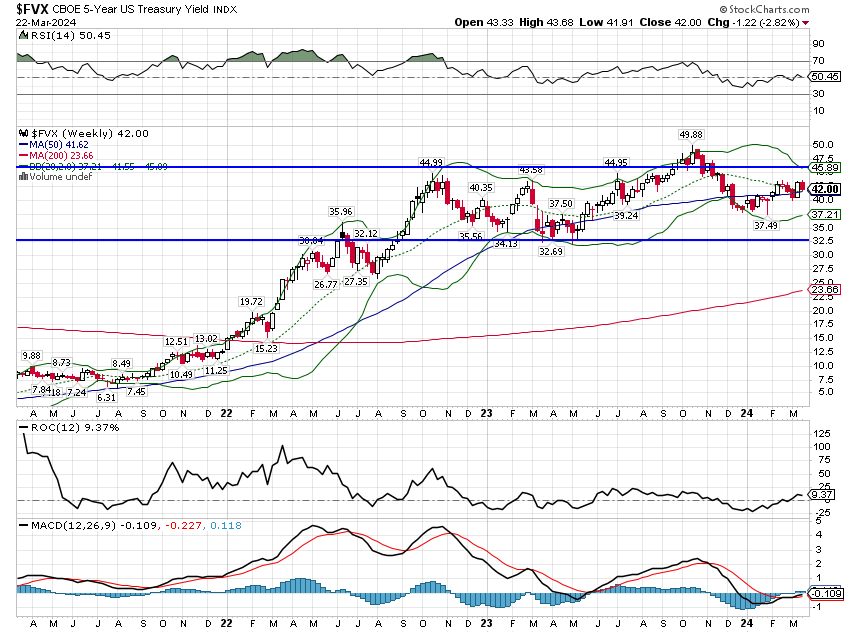

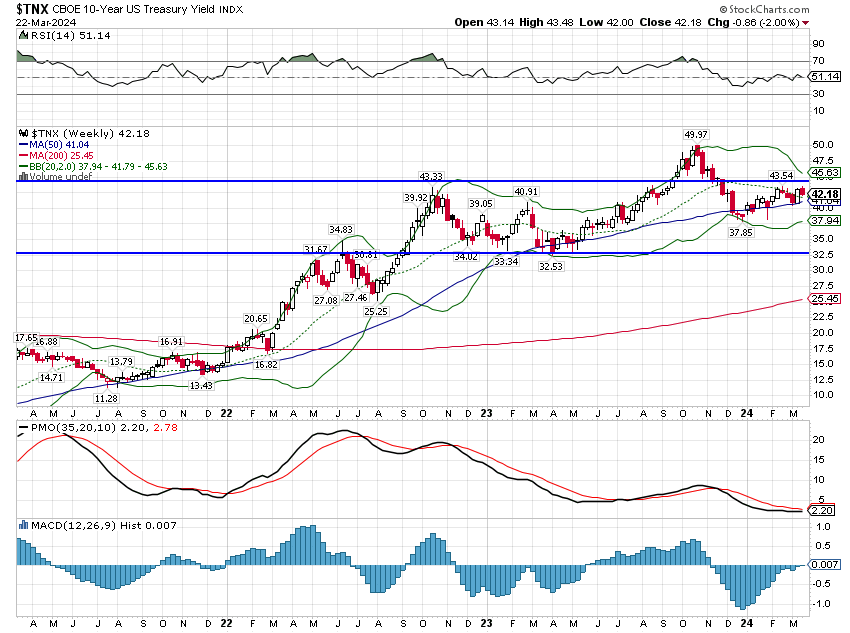

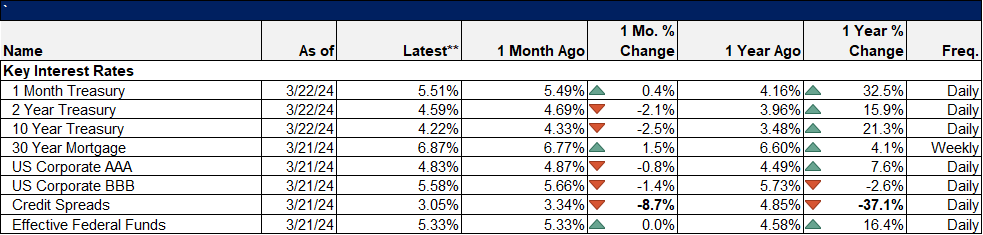

The pattern of rates of interest hasn’t modified with the 2-year, 5-year, and 10-year Treasury yields persevering with to commerce in a variety that has endured for many of the final 18 months.

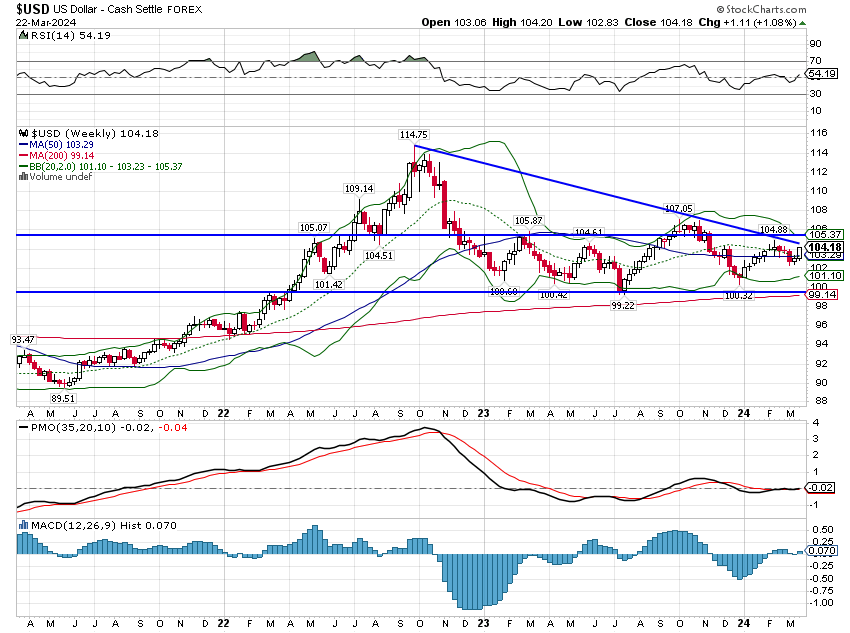

The greenback was up a little bit greater than 1% final week and the short-term pattern is on the cusp of fixing. I wrote a couple of weeks in the past concerning the DXY resuming its downtrend however that will have been untimely. Like everybody else, I’ve my very own biases and a weak greenback is what I count on so I’ve to protect in opposition to seeing what I wish to see. The short-term pattern continues to be down in my view, however one might additionally see it like rates of interest – in a buying and selling vary for over a 12 months. Having stated that, US financial information continues to point out power so we shouldn’t be shocked if the greenback breaks increased. Sarcastically, if it does, that will are inclined to suppress inflation and would make fee cuts extra seemingly.

Markets

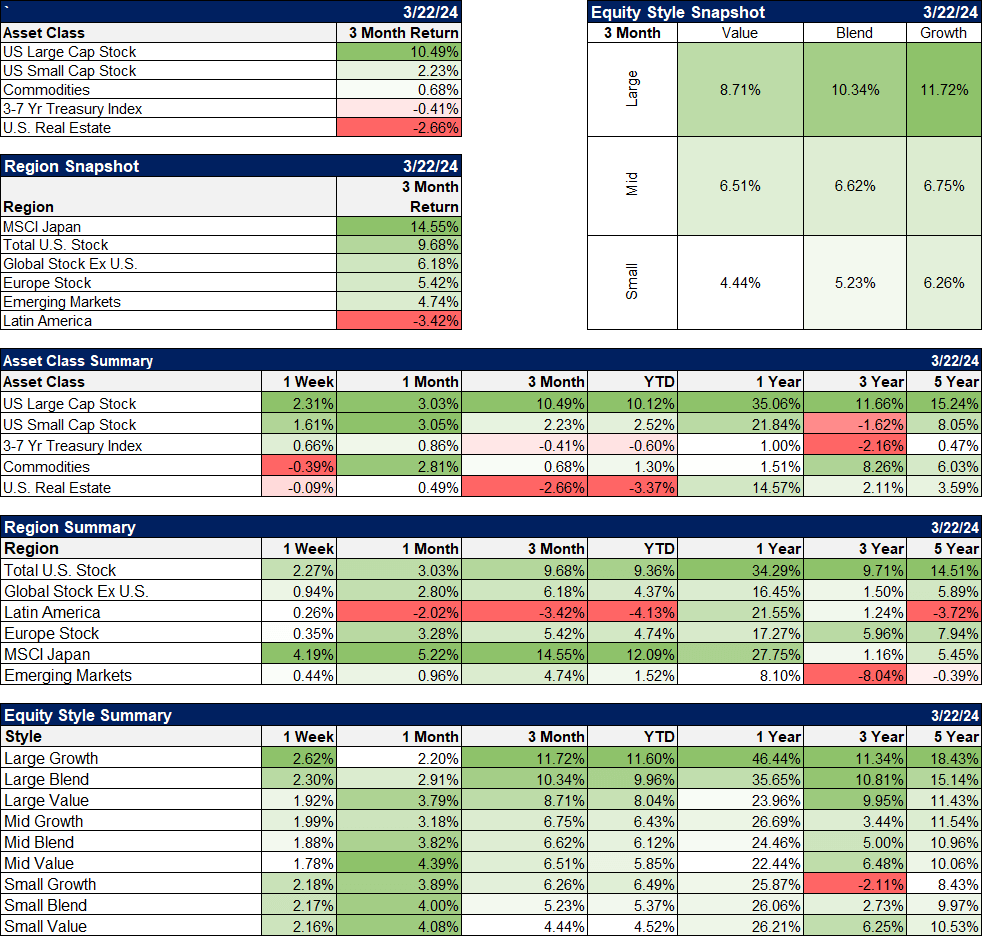

Shares, massive and small, had a superb week as bonds rallied within the wake of the FOMC assembly. Commodities had been principally flat as crude oil was flat and nat gasoline rose practically 10% (however from a really weak degree). Economically delicate metals (copper, platinum, and so on.) had been decrease however modestly.

Japan led international markets even because the BOJ ended adverse charges and yield curve management. There was widespread anticipation of the transfer and an expectation that the yen would rally on the information however something that anticipated is unlikely to maneuver markets; it was already priced in.

Sectors

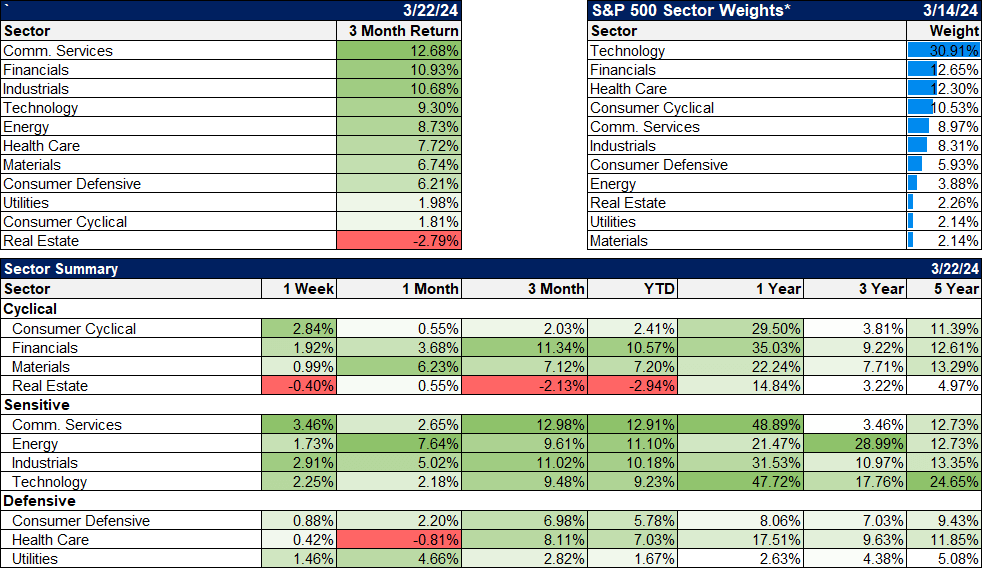

The rally final week was broad-based with 10 of 11 financial sectors increased. Actual property was the lone loser, down simply 0.4%. Actual property can also be the lone sector down YTD; it’s nonetheless broadly hated regardless of being up over 14% within the final 12 months. Actual property isn’t going to steer till charges get in a extra pronounced downtrend however that doesn’t imply it might’t present good returns. Even in years when charges rise, REITs do fairly effectively.

Financial/Market Indicators

The financial information final week was all higher than anticipated:

- Housing market index at 51 vs expectations of 48. This sentiment index is again in enlargement for the primary time since final July

- Housing begins 1.52 million vs 1.425 million expectations

- Constructing permits 1.52 million vs 1.495 million anticipated

- Jobless claims 210okay vs 215okay anticipated

- Philly Fed 3.2 vs -2.Three anticipated. Additionally an enormous rise in Enterprise Situations (38.6 vs 7.2 final month), CAPEX (23.6 vs 12.7), new orders (5.Four vs -5.2) and costs paid (3.7 vs 16.6)

- Current house gross sales 4.Four million vs 3.9 million anticipated

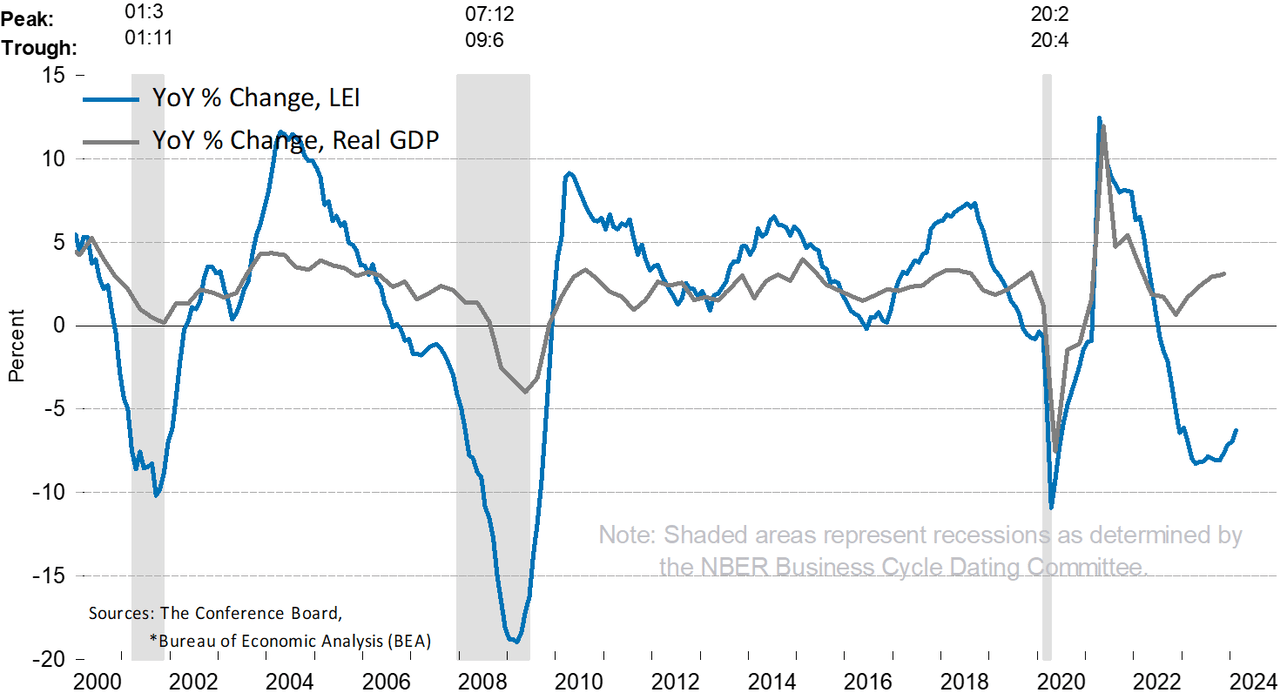

- Main financial indicators +0.1% vs -0.2% anticipated and the primary constructive studying since February 2022. It appears to be like like the products manufacturing aspect of the economic system is recovering.

Credit score spreads fell once more, to inside 2 foundation factors of the low for this cycle set in late 2021. Previous to that one has to return to the summer season of 2007 to discover a decrease studying and that’s considerably discomfiting as that was not a time to be complacent. Nonetheless, we now have seen decrease readings prior to now so the unfold can get tighter nonetheless. All we are able to actually say is that there isn’t any stress in credit score proper now.

You may keep in mind final 12 months the worry was that lower-rated corporations had been going through a “wall of maturity” with a lot of low-rated debt and loans coming due over the subsequent few years. Properly, narrowing spreads has allowed lots of corporations to refinance already and the pick-up in debt price has been pretty modest at lower than 200 foundation factors (that was practically 500 foundation factors as just lately as 2022). The wall of maturity isn’t trying practically so tall now.

Authentic Put up

Editor’s Notice: The abstract bullets for this text had been chosen by Looking for Alpha editors.